Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

provide correct and short answer. General Account

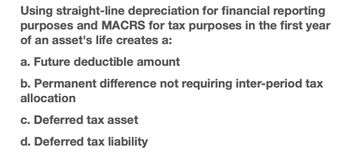

Transcribed Image Text:Using straight-line depreciation for financial reporting

purposes and MACRS for tax purposes in the first year

of an asset's life creates a:

a. Future deductible amount

b. Permanent difference not requiring inter-period tax

allocation

c. Deferred tax asset

d. Deferred tax liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please see attached image for question thank youarrow_forwardWhich of the following is deducted from the financial income in computing for the taxable income? Excess of accounting depreciation from the allowed tax deduction Donations received during the year Penalties paid for late filing of tax returns Unrealized losses from FA@FVTOCIarrow_forward1. The amount of income taxes that relate to financial income subject to tax is reported on the income statement as A. long-term deferred income taxes (credit) C. income tax expense B. current deferred income taxes (debit) D. income tax payable 2. An item that would create a permanent difference in pretax financial and taxable income would be A. using accelerated depreciation for tax purposes & straight line depreciation for book purposes. B. using the percentage of completion method on long-term construction contracts. C. purchasing equipment previously leased with an operating lease in prior years. D. paying fines for violation of laws. 3. Which of the following is the most likely item to result in a deferred tax asset? A. using completed contract method of recognizing construction revenue tax purposes, but using percentage of completion method for financial reporting purposes. B. using accelerated depreciation for tax purposes but straight-line depreciation for accounting purposes.…arrow_forward

- A valuation allowance for deferred tax assets Select one: a. Is required when future deductible amounts are expected to be applied against future taxable income. b. Requires evidence that it is more likely than not that none of the deferred tax asset will be realized. c. Is a contra asset account shown on the tax return. d. Is likely to be recognized if a company expects losses in early future years.arrow_forwardSubject: acountingarrow_forwardUsing the straight-line method of depreciation for reporting purposes and accelerateddepreciation for tax purposes would most likely result in a:A . valuation allowance.B . deferred tax asset.C . temporary diff erence.arrow_forward

- Recognition of tax benefits in the loss year due to a NOL carry back involves: O The establishment of an income tax refund receivable. Only a note to the financial statements. The establishment of a deferred tax liability. O The establishment of a deferred tax asset.arrow_forwardAccounting profit is O A. The The profit or loss is for a period determined before deducting in accordance tax expense O B. The profit or loss is for a period determined in accordance with tax law C. The profit or loss after for a period after deducting tax expense O D. The profit or loss after current tax expense determined accordance with tax lawarrow_forwardA net operating loss (NOL) carryforward creates: A-a deferred tax liability that should be classified as current liability B- a deferred tax asset that represents future tax benefit that can offset future taxable income O A O B Drouinunarrow_forward

- Which of the following is an example of a temporary difference which would result in a deferred tax asset? a. Rent revenue collected in advance included in taxable income before it is included in accounting income b. Investment gains recognized earlier for accounting purposes than for tax purposes c. Use of straight-line method for accounting purposes and an accelerated rate for tax purposes d. Use of a longer depreciation period for accounting purposes than is used for tax purposearrow_forward1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent difference. (a) ______ For some assets, straight-line depreciation is used for tax purposes while double-declining balance method is used for financial reporting purposes.(b) ______ Warranty expenses are accrued when the sale is made, but cannot be deducted until the work is actually performed.(c) ______ The company uses the percentage of completion method to record revenue on long-term contracts for financial reporting purposes, but the completed contract method is used for tax purposes.(d) ______ Accelerated depreciation is used for tax purposes, and the straight-line depreciation method is used for financial reporting purposes, for some equipment.(e) ______ A landlord collects some…arrow_forwardFor each item below, indicate whether it involves: 1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent differerence Use the appropriate number to indicate your answer for each. A. For some assets, straight-line depreciation is used for tax purposes while double-declining balance method is used for financial reporting purposes. B. Warranty expenses are accrued when the sale is made, but cannot be deducted until the work is actually C. The company uses the percentage of completion method to record revenue on long-term contracts for financial reporting purposes, but the completed contract method is used for tax purposes. D. Accelerated depreciation is used for tax purposes, and the straight-line depreciation method is used for financial…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT