SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

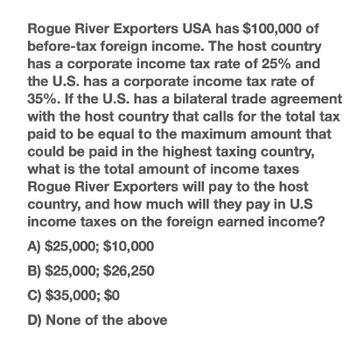

Transcribed Image Text:Rogue River Exporters USA has $100,000 of

before-tax foreign income. The host country

has a corporate income tax rate of 25% and

the U.S. has a corporate income tax rate of

35%. If the U.S. has a bilateral trade agreement

with the host country that calls for the total tax

paid to be equal to the maximum amount that

could be paid in the highest taxing country,

what is the total amount of income taxes

Rogue River Exporters will pay to the host

country, and how much will they pay in U.S

income taxes on the foreign earned income?

A) $25,000; $10,000

B) $25,000; $26,250

C) $35,000; $0

D) None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Midnight Motors is a US multinational firm. The manager of Midnight Motors is evaluating its international tax situation. In the US, Midnight Motors’ corporate tax rate is currently 26%. Midnight Motors has major operations in Argentina, Brazil, and China, and the tax rate is 13%, 41%, and 31%, respectively. Assume Midnight Motors' profits are fully and immediately repatriated. The foreign taxes paid for the current year are listed as follows: Argentina Brazil China Earnings before interest and taxes (EBIT) ($million) $490 $560 $630 Host country taxes paid $63.7 $229.6 $195.3 Earnings before interest after taxes $426.3 $330.4 $434.7 Midnight Motors' net US tax liability on its foreign earnings is closest to: $437 million $-52 million $0 million $489 millionarrow_forwardBrandy, a U.S. corporation, operates a manufacturing branch in Chad, which does not have an income tax treaty with the United States. Brandy’s world- wide Federal taxable income is $30,000,000; it is subject to a 21% marginal tax rate. Profits and taxes in Chad for the current year are summarized as follows. Compute Brandy’s foreign tax credit associated with its operations in Chad.arrow_forward7arrow_forward

- A US firm does business in Australia. In attempting to assess its economic exposure, it compiled the following information: Its U.S. sales are somewhat affected by the value of the Australian dollar (AU$), because it faces competition from Australian exporters. It forecasts the U.S. sales based on the following three exchange rate scenarios: Revenue from U.S. Business Exchange Rate of AU$ (in millions) AU$ = $.70 $100 AU$ = $.75 105 AU$ = $.80 110 Its Australian dollar revenues from sales in Australia invoiced in Australia dollars are expected to be AU$600 million Its anticipated cost of materials is estimated at $200 million from the purchase of U.S. materials and AU$100 million from the purchase of Australia materials Fixed operating expenses are estimated at $30 million Variable operating expenses are estimated at 20% of total sales (after including Australian sales, translated to a dollar amount) Interest expense is estimated at $20 million on existing U.S. loans, and the…arrow_forwardBaltimore, Inc., is a U.S.‑based MNC that obtains 10 percent of its supplies from European manufacturers. Sixty percent of its revenues are due to exports to Europe, where its products are invoiced in euros. Explain how Baltimore can attempt to reduce its economic exposure to exchange rate fluctuations in the euro.arrow_forward9. HiramCo, a U.S. entity, wholly owns corporations that operate manufacturing businesses in both Mexico and Costa Rica, and it holds its investment portfolio in Sweden. How many foreign tax credit computations must HiramCo make? Be specific, and use the term basket in your answer.arrow_forward

- Paper is a resident foreign corporation with branches nationwide, including the Philippines. Its Philippine branch had an income of P10,000,000 in 2020 and it earmarked P8,000,000 for remittance. It actually remitted P7,000,000. How much is the branch profit remittance tax due of the Philippine branch?arrow_forwardWhich statement is wrong? * A resident citizen and a resident alien have a final tax of 15% on interest on foreign currency deposit. A non-resident citizen is exempt from income tax on interest on foreign currency deposit. A non-resident alien engaged in business in the Philippines is subject to a final tax of 25% on gross income from within the Philippines from cinematographic films. A non-resident alien engaged in business in the Philippines has a final tax of 20% only if the interest is on a bank depositarrow_forwardBoston Beanery, a U.S.-based company, establishes a branch in Great Britain in January of Year 1, when the exchange rate is US$1.30 per British pound (£). During Year 1, the British branch generates £5,000,000 of pretax income. On October 15, Year 1, £2,000,000 is repatriated to Boston Beanery and converted into U.S. dollars. Assume the effective income tax rate in Great Britain is 19 percent. Taxes were paid in Great Britain on December 31, Year 1. Relevant exchange rates for Year 1 are provided here (US$ per £): January 1 1.30 Average 1.40 October 15 1.45 December 31 1.50 Assume a U.S. tax rate of 21 percent. Required: Determine the amount of U.S. taxable income, U.S. foreign tax credit, and net U.S. tax liability related to the British branch (all in U.S. dollars).arrow_forward

- A product sells for $1,000 in the U.S. If the exchange rate between $ and euro is $1 = 0.90 euro, and if ppp holds, what would be the price of the same product in europe?arrow_forwardSuppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$1.90 million (Fijian dollars, F$) worth of imports from Fiji in 90 days. Currently, the spot rate for the Fijian dollar is $0.56 per F$. (U.S. dollars). If If Retrojo were to exchange U.S. dollars for the required F$1,900,000.00 Fijian dollars, it would need $ Retrojo waits 90 days to make this exchange (perhaps due to insufficient funds on hand), and the Fijian dollar appreciates to $0.70 during those 90- days, then Retrojo would need $ (U.S. dollars). Thus, if Retrojo believes that the Fijian dollar will appreciate, it can its exposure to such exchange rate risk by locking in the original exchange rate through the use of a forward contract. reduce increase RE: 0/2 step)arrow_forwardGodoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning