FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

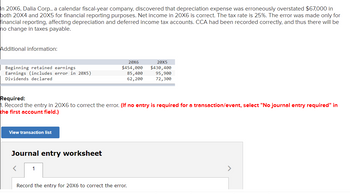

Transcribed Image Text:In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $67,000 in

both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 25%. The error was made only for

financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be

ho change in taxes payable.

Additional information:

20X6

20X5

Beginning retained earnings

$454,000

Earnings (includes error in 20X5)

Dividends declared

85,400

62,200

$430,400

95,900

72,300

Required:

1. Record the entry in 20X6 to correct the error. (If no entry is required for a transaction/event, select "No journal entry required" in

the first account field.)

View transaction list

Journal entry worksheet

1

Record the entry for 20X6 to correct the error.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A company acquired a new machine and immediately deducted the entire cost on its current income tax return because of favorable tax depreciation rules. The company uses straight-line depreciation for financial statement purposes. Which outcome will result from this decision? O A decrease in taxes payable in future years as a result of temporary differences O An increase in taxes payable in future years as a result of temporary differences A decrease in taxes saved in future years as a result of permanent differences O An increase in taxes saved in future years as a result of permanent differencesarrow_forwardFor its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 300,000 Permanent difference (15,000 ) 285,000 Temporary difference-depreciation (20,000 ) Taxable income $ 265,000 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?arrow_forwardPretax accounting income is $206,000. Depreciation for tax is $111,000; depreciation for accounting is $29,000. Bad debt expense for tax is $12,000; bad debt expense for accounting is $9000. A fine for pollution of a river was imposed by the state of Kentucky for $7000. The tax rate is 20%. Which of the following is true? Income tax expense is 206,000 x .2 The current portion is 206,000 x .20 Income tax expense is less than the current portion. Income tax expense is more than the current portion.arrow_forward

- Required information [The following information applies to the questions displayed below.] Hafnaoui Company reported pretax net income from continuing operations of $903,500 and taxable income of $712,500. The book-tax difference of $191,000 was due to a $242,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $117,000 due to an increase in the reserve for bad debts, and a $66,000 favorable permanent difference from the receipt of life insurance proceeds. b. Compute Hafnaoui Company's deferred income tax expense or (benefit). Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit. X Answer is complete but not entirely correct. Deferred income tax expense $ 712,500arrow_forwardSunland Services Ltd. follows ASPE and had earned accounting income before taxes of $520,000 for the year ended December 31, 2023. During 2023, Sunland paid $77,000 for meals and entertainment expenses. In 2020, Sunland's tax accountant made a mistake when preparing the company's income tax return. In 2023, Sunland paid $10,500 in penalties related to this error. These penalties were not deductible for tax purposes. Sunland owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At the beginning of 2023, Sunland rented the building to Trung Inc. for two years at $64,500 per year. Trung paid the entire two years' rent in advance. Sunland used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $286,200. For tax purposes, Sunland claimed the maximum capital cost allowance of $431,400. This asset had been purchased at the beginning of the year for $3,004,400. In 2023, Sunland…arrow_forwardvt,1arrow_forward

- Altima Corporation discovered an error in its 2020 financial statements. The firm recorded $4,200,000 in depreciation expense instead of record $4,500,000. Altima has a constant tax rate of 40% and reports 3 years of comparative income statements and 2 years of comparative balance sh- in its annual report. Ignoring the income tax effect, what is the correct journal entry to record the prior-period adjustment? O Depreciation expense Accumulated Depreciation O Retained Earnings 300,000 Income Tax Payable Accumulated Depreciation Retained Earnings O Accumulated Depreciation 300,000 Retained Earnings Accumulated Depreciation 300.000 estion 22 300,000 300,000 120.000 180,000 300,000 300,000arrow_forwardDon't give answer in imagearrow_forwardIn 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $67,000 in both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 25%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional Information: 20X6 20X5 Beginning retained earnings $454,000 $430,400 Earnings (includes error in 20X5) Dividends declared 85,400 95,900 62,200 72,300arrow_forward

- 1.) XQP corporation expensed $50,000 of bad debts during the year. The activity in the allowance for doubtful accounts was $70,000 Beginning Balance Bad Debt Accrued for the Year Bad Debts Written Off Ending Balance $50,000 $35,000 $85,000 What is the BOOK-TO-TAX difference of XQP Corp for bad debts? O A.SO O B.$15,000 Unfavorable OC. $35,000 Unfavorable O D. $50,000 Unfavorable O E. $85,000 Unfavorablearrow_forwardDuring an audit of Madison Company’s December 31, 2020 records it was discovered that the company did not accurately accrue for $12,500 of depreciation expense. The accrual of interest expense of $4,500 was also omitted. These errors occurred in 2019 and have a material impact on Madison’s financial records. Madison’s net income for the year was $123,000. The company is subject to a 35% tax rate. The company had a retained earnings balance of $557,500 on January 1, 2020. No dividends were paid. Required: 1. Prepare the necessary journal entries to correct the accounting records of Madison Company’s books. 2. Prepare the statement of retained earnings for 2020. 1. Prepare the necessary journal entries to correct the accounting records of Madison Company’s books. For grading purposes, prepare four separate entries dated December 31. General Journal Instructions PAGE 1 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 2…arrow_forwardIn 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $58,000 in both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 30%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional information: 20X6 S Beginning retained earnings $446,000 20X5 $424,100 Earnings (includes error in 20x5) Dividends declared 83,800 61,300 94,200 2,300 Required: 1. Record the entry in 20X6 to correct the error. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education