FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Sunland Services Ltd. follows ASPE and had earned accounting income before taxes of $520,000 for the year ended December 31,

2023.

During 2023, Sunland paid $77,000 for meals and entertainment expenses.

In 2020, Sunland's tax accountant made a mistake when preparing the company's income tax return. In 2023, Sunland paid $10,500 in

penalties related to this error. These penalties were not deductible for tax purposes.

Sunland owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At

the beginning of 2023, Sunland rented the building to Trung Inc. for two years at $64,500 per year. Trung paid the entire two years'

rent in advance.

Sunland used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $286,200. For tax

purposes, Sunland claimed the maximum capital cost allowance of $431,400. This asset had been purchased at the beginning of the

year for $3,004,400.

In 2023, Sunland began selling its products with a two-year warranty against manufacturing defects. In 2023, Sunland accrued

$306,100 of warranty expenses: actual expenditures for 2023 were $88,200 with the remaining $217.900 anticipated in 2024.

In 2023, Sunland was subject to a 25% income tax rate. During the year, the federal government announced that tax rates would be

decreased to 23% for all future years beginning January 1, 2024.

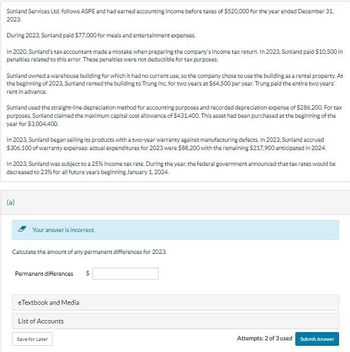

Your answer is incorrect.

Calculate the amount of any permanent differences for 2023.

Permanent differences

eTextbook and Media

List of Accounts

Save for Later

Attempts: 2 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of 2021, a company has a deferred tax asset with a balance of $480,000.The company has a valuation allowance account related to the deferred tax asset. The valuation account has a balance of $205,000 at the beginning of 2021. If it is more likely than not that all of the deferred tax asset will be realized, then (enter the number that represents the correct answer): income tax expense will be debited by $205,000. income tax expense will be credited by $205,000. deferred tax asset will be debited by $275,000 the valuation account will be credited by $205,000.arrow_forwardSunland Services Ltd. follows ASPE and had earned accounting income before taxes of $520,000 for the year ended December 31, 2023. During 2023, Sunland paid $77,000 for meals and entertainment expenses. In 2020, Sunland's tax accountant made a mistake when preparing the company's income tax return. In 2023, Sunland paid $10,500 in penalties related to this error. These penalties were not deductible for tax purposes. Sunland owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At the beginning of 2023, Sunland rented the building to Trung Inc. for two years at $64,500 per year. Trung paid the entire two years' rent in advance. Sunland used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $286,200. For tax purposes, Sunland claimed the maximum capital cost allowance of $431,400. This asset had been purchased at the beginning of the year for $3,004,400. In 2023, Sunland…arrow_forwardPearl Inc. incurred a net operating loss of $455,000 in 2020. The tax rate for all years is 20%. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

- During 2024, its first year of operations, Baginski Steel Corporation reported a net operating loss of $360,000 for financial reporting and tax purposes. During 2025, Baginski reported income of $200,000 for financial reporting and tax purposes. The enacted tax rate is 25%. Required: - Prepare the journal entry to recognize Baginski's 2025 tax expense or tax benefit. Show the lower portion of the 2025 income statement that reports income tax expense or benefit.arrow_forwardIn December of 2019, a company received consulting services of $100,000. No entry was recorded for these service in 2019. The invoice for the services was received in January 2020 and recorded by debiting consulting expense and crediting accounts payable. This error was discovered in 2020 and was determined to be a material error. What is the impact of the error on the net income of 2019 and 2020? Provide the proper correcting journal enntry assuming a 30% tax rate.arrow_forwardRoth Inc. has a deferred tax liability of $68,000 at the beginning of 2021. At the end of 2021, it reports accounts receivable on the books at $90,000 and the tax basis at zero (its only temporary difference). If the enacted tax rate is 17% for all periods, and income taxes payable for the period is $230,000, determine the amount of total income tax expense to report for 2021.arrow_forward

- In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $68,000 in both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 35%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional information: Z0X6 Beginning retained earnings $456,000 zexs $432,500 Earnings (includes error in 20x5) Dividends declared 85,800 62,500 96,400 72,900 Required: 1. Record the entry in 20X6 to correct the error. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field.) Answer is not complete. General Journal Debit Credit 136,000 23,800x 112,200x No 1 Date 20X6 Deferred income tax liability Retained earnings, error correction 2. Prepare the comparative retained earnings section of the statement of changes…arrow_forwardEgolf Corporation failed to include $380,000 of taxable interest income on its 2022 calendar year Form 1120. The gross income reported on the return was $6.0 million, and the return was filed on February 20, 2023. Required: a. What is the last day on which the IRS may assess additional tax for Egolf's 2022 taxable year? b. Assume Egolf only reported $1.3 million in gross income on its 2022 calendar year return. What is the last date on which the IRS may assess additional tax for 2022? Complete this question by entering your answers in the tabs below. Required A Required B What is the last day on which the IRS may assess additional tax for Egolf's 2022 taxable year? Due date for assessment of additional tax is Required A Required Barrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education