FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

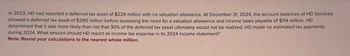

Transcribed Image Text:In 2023, HD had reported a deferred tax asset of $226 million with no valuation allowance. At December 31, 2024, the account balances of HD Services

showed a deferred tax asset of $290 million before assessing the need for a valuation allowance and income taxes payable of $114 million. HD

determined that it was more likely than not that 30% of the deferred tax asset ultimately would not be realized. HD made no estimated tax payments

during 2024. What amount should HD report as income tax expense in its 2024 income statement?

Note: Round your calculations to the nearest whole million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sunland Services Ltd. follows ASPE and had earned accounting income before taxes of $520,000 for the year ended December 31, 2023. During 2023, Sunland paid $77,000 for meals and entertainment expenses. In 2020, Sunland's tax accountant made a mistake when preparing the company's income tax return. In 2023, Sunland paid $10,500 in penalties related to this error. These penalties were not deductible for tax purposes. Sunland owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At the beginning of 2023, Sunland rented the building to Trung Inc. for two years at $64,500 per year. Trung paid the entire two years' rent in advance. Sunland used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $286,200. For tax purposes, Sunland claimed the maximum capital cost allowance of $431,400. This asset had been purchased at the beginning of the year for $3,004,400. In 2023, Sunland…arrow_forwardViolet Corporation reported a loss in 2022 of $610,000 and carried back the loss to the extent allowed. The company reported taxable income of $215,000 in 2020 and $245,000 in 2021. It has no permanent or temporary differences and its tax rate is 30%.Violet reported taxable income of $345,000 in 2023. What is the necessary journal entry for 2023? Group of answer choices Income Tax Expense 183,000 Income Tax Payable 138,000 Deferred Tax Asset 45,000 Income Tax Expense 103,500 Income Tax Payable 58,500 Deferred Tax Asset 45,000 Income Tax Refund Receivable 138,000 Deferred Tax Asset 45,000 Income Tax Benefit 183,000 Income Tax Refund Receivable 58,500 Deferred Tax Asset 45,000 Income Tax Benefit 103,500arrow_forward4.arrow_forward

- Caesar Corporation reported income before taxes of $220,000 for the years 2020, 2021, and 2022. In 2023 they experienced a loss of $220,000. The company had a tax rate of 35% in 2020 and 2021, and a rate of 45% in 2022 and 2023. Assuming Caesar uses the carryback provisions for the net operating loss, by what amount will the income tax benefit reduce the net loss in 2023? Group of answer choices $88,000 $77,000 $99,000 $220,000arrow_forwardi have completed this in excel but would like to compare my answersarrow_forwardDuring the preparation of financial statement for Master Ltd for 2023 it was discovered thatan amount of $22,000, incurred in September 2021 and payable to an overseas supplier, wasoverlooked and not paid or provided for in the financial statement ending 30 June 2022. Theamount is considered to be material and will be permitted as a deduction for tax purposes(tax rate 30%).Required:i) Prepare the necessary journal entry to correct this error.arrow_forward

- At the end of 2020, Payne Industries had a deferred tax asset account with a balance of $80 million attributable to a temporary book-tax difference of $320 million in a liability for estimated expenses. At the end of 2021, the temporary difference is $240 million. Payne has no other temporary differences. Taxable income for 2021 is $576 million and the tax rate is 25%. Payne has a valuation allowance of $32 million for the deferred tax asset at the beginning of 2021. Required: 1. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that the deferred tax asset will be realized in full. 2. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized.At the end of 2020, Payne Industries had a deferred tax asset account with a balance of $80 million attributable to a temporary book-tax difference of $320 million in a…arrow_forwardOn December 31, 2021, Winston Inc. has determined that it is more likely than not that $258000 of a $611000 deferred tax asset will not be realized. The journal entry to record this reduction in asset value will include a O debit to Income Tax Payable of $258000. O credit to the Allowance to Reduce Deferred Tax Asset to Expected Realizable Value of $258000. O credit to Income Tax Expense for $353000. Odebit to Income Tax Expense for $353000arrow_forwardB Co. reported a deferred tax liability of $26.0 million for the year ended December 31, 2017, related to a temporary difference of $65 million. The tax rate was 40%. The temporary difference is expected to reverse in 2019 at which time the deferred tax liability will become payable. There are no other temporary differences in 2017–2019. Assume a new tax law is enacted in 2018 that causes the tax rate to change from 40% to 30% beginning in 2019. (The rate remains 40% for 2018 taxes.) Taxable income in 2018 is $95 million. Required:Determine the effect of the change and prepare the appropriate journal entry to record B’s income tax expense in 2018.arrow_forward

- At December 31, 2020, Sheridan Corporation has a deferred tax asset of $180,000. After a careful review of all available evidence, it is determined that it is more likely than not that $54,000 of this deferred tax asset will not be realized.Prepare the necessary journal entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardIvanhoe Corporation has a deferred tax asset at December 31, 2026 of $210000 due to the recognition of potential tax benefits of an operating loss carryforward. The enacted tax rates are as follows: 30% for 2023-2025; 25% for 2026; and 20% for 2027 and thereafter. Assuming that management expects that only 50% of the related benefits will be realized, a valuation account should be established in the amount of O $36750. O $31500. O $105000. O $42000. ofarrow_forwardGiada Foods reported $970 million in income before income taxes for 2021, its first year of operations. Tax depreciation exceeded depreciation for financial reporting purposes by $130 million. The company also had non-tax-deductible expenses of $92 million relating to permanent differences. The income tax rate for 2021 was 25%, but the enacted rate for years after 2021 is 30%. The balance in the deferred tax liability in the December 31, 2021, balance sheet is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education