FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

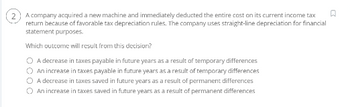

Transcribed Image Text:A company acquired a new machine and immediately deducted the entire cost on its current income tax

return because of favorable tax depreciation rules. The company uses straight-line depreciation for financial

statement purposes.

Which outcome will result from this decision?

O A decrease in taxes payable in future years as a result of temporary differences

O An increase in taxes payable in future years as a result of temporary differences

A decrease in taxes saved in future years as a result of permanent differences

O An increase in taxes saved in future years as a result of permanent differences

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In Able Company’s efforts to estimate a value for Baker Company's goodwill, Able is estimating Baker Company's expected future earnings. Able is using Baker's past earnings to project the future earnings. Which of the following items should be eliminated from Baker's past earnings in order to project future earnings? Extraordinary items Amortization expense for identifiable intangibles a. Yes Nob. Yes Yesc. No Yesd. No Noarrow_forwardA new accountant, Costa Goodsold, put together a preliminary version of Medina Co.'s financial statements. Medina's Net Income was $500, its Depreciation Expense was $100, and its Cash Flow from Operations was $70. The CEO found an error that Costa made in computing straight-line Depreciation Expense, which should have been $50. What is Medina's Cash Flow from Operations after fixing this mistake? (you can ignore taxes). a) $70 b) $170 c) $450 d) $120 e) $20arrow_forwardAssume that Congress recently passed a provision that will enable Barton's Rare Books (BRB) to double its depreciation expense for the upcoming year but will have no effect on its sales revenue or tax rate. Prior to the new provision, BRB's net income after taxes was forecasted to be $4 million. Which of the following best describes the impact of the new provision on BRB's financial statements versus the statements without the provision? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes. Question 10 options: a) Net fixed assets on the balance sheet will increase. b) The provision will reduce the company's free cash flow. c) The provision will increase the company's net income. d) Net fixed assets on the balance sheet will decrease. e) The provision will increase the company's tax…arrow_forward

- Short-lived goods and services that are treated as a business expense as they are used rather than depreciated over several years are called Multiple Choice O capital items. expense items. derived items. durables. nontaxable items. H ‒‒ Nextarrow_forwardou are working with an accounting firm. Sussie, who is representing Suss Co, needs advice about depreciating assets. She asks; what are depreciating assets? What are the different ways to calculate the declining value of depreciating assets? Furthermore, Suss Co has aggregated turnover of $ 2 billion. In December 2021, Suss Co purchased a machine for $4m, which was commenced immediately for an income-producing purpose. What tax does the Suss Co claim?arrow_forwardIf a company is seeking to minimize its income tax expense, the depreciation method it would most likely select would be the: units of production method straight-line method single-and-a-half depreciation method double-declining balance methodarrow_forward

- In relation to evaluating non-current assets, indicate which of the following statements is TRUE? 1. The higher the asset turnover, the more effective a company is in using its resources to generate sales. 2. Too high a depreciation rate will result in increased reported profits for the period. 3. All non-current assets must be depreciated. 4. The older the assets are, the better the company is performing.arrow_forward3) ( Below table shows the calculations for an after-tax analysis of a machine purchase alternative. EOY ВТСР Depreciation Deduction Тахable Income АТCF Income Таxes - 20,000 16,000 16,000 16,000 16,000 16,000 18,000 3,000 3,000 3,000 3,000 3,000 3,000 13,000 13,000 13,000 13,000 13,000 15,000 - 6,500 - 6,500 - 6,500 - 6,500 - 6,500 - 7,500 - 20,000 9,500 9,500 9,500 9,500 9,500 1 3 4 6. 10,500 a) Find answers to the below questions What are the cost basis (price) and "annual revenues less expenses"? What is the terminal market value (or salvage value)? What is the income tax rate? i. ii. iii. iv. What is the method used for depreciation deduction? What is the book value at the end of useful life? V. b) Calculate the equivalent present worth (PW) and the equivalent annual worth (AW) at an after-tax MARR of 11%.arrow_forwardSuppose a firm switches from straight-line depreciation to an accelerated depreciation methods (such as sum of the years digits depreciation) in the later years of some equipment's life. (a) Explain how this move would impact the firm's net income in the year of the switch? (b) Also explain which item(s) on the balance sheet would be impacted in the year of the switch and why they would be impacted this way.arrow_forward

- The fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can make it difficult for a financial analyst to compare periodic performance from firm to firm. Suppose you were a financial analyst trying to compare the performance of two companies. Company A uses the double-declining-balance depreciation method. Company B uses the straight-line method. You have the following information taken from the 12/31/2024 year-end financial statements for Company B: Income Statement Depreciation expense $ 11,500 Balance Sheet Assets: Plant and equipment, at cost Less: Accumulated depreciation (46,000) $ 69,000 Net $ 115,000 You also determine that all of the assets constituting the plant and equipment of Company B were acquired at the same time, and that all of the $115,000 represents depreciable assets. Also, all of the depreciable assets have the same useful life and residual values are zero. Required: 1. In order to compare…arrow_forwardThis depreciation method was brought about by the Tax Reform Act of 1986. a. Straight-Line O b. Modified Accelerated Cost Recovery System (MACRS) O c. Declining Balance O d. Accelerated Cost Recovery System (ACRS)arrow_forwardAs a company, to minimize the present worth of taxes paid to the federal government, use longest MACRS recovery period. true or false?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education