FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

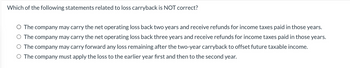

Transcribed Image Text:Which of the following statements related to loss carryback is NOT correct?

O The company may carry the net operating loss back two years and receive refunds for income taxes paid in those years.

O The company may carry the net operating loss back three years and receive refunds for income taxes paid in those years.

O The company may carry forward any loss remaining after the two-year carryback to offset future taxable income.

O The company must apply the loss to the earlier year first and then to the second year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 18arrow_forwardA company experiences a net operating loss of $80,000 in year 1. In year 2, the company reports taxable income of $60,000. How much of the taxable income will the company offset in year 2 by applying the net operating loss from year 1? O $60,000 O $48,000 O $80,000 O Cannot be determined because the tax rate is not given.arrow_forwardWhich statement is true about a Business Loss Limitation in 2020? A. The CARES Act suspended the excess loss limitation provisions through the end of 2020. B. Business losses are never deductible C. Only losses up to $518,000 could be deducted in 2020. D. Only losses up to $259,000 could be deducted in 2020.arrow_forward

- In 2020, Compton Ltd (Compton) incurred a loss of $1,260,000 for tax purposes, when the tax rate was 30%. Because the company had no prior taxable profit, it carried the entire loss forward. Considering the size of the tax loss, Compton management expected to recover only three-quarters of the tax loss by applying the tax loss to future taxable profit. On 1 January 2021, the income tax rate increased from 30% to 32%. In 2022, it expects that the reminder of the tax loss created in 2020 can fully recover by future taxable profits. Compton has a year end of 31 December. Required: Which of the following statement is considered not true in accordance with HKAS 12 ‘Income Taxes’? A. Deferred tax assets should be adjusted upward to $94,500 in 2022 B. Deferred tax assets and liabilities as at start of 2021 should be adjusted upward C. Deferred tax assets in January 2021 should be increased by $18,900 D. 75% of the tax loss in 2020 will be recognized as deferred…arrow_forwardam. 134.arrow_forwardA company has accounts receivable of $300 000 and an associated doubtful debts allowance of $60 000. The revenue associated with the accounts receivable of $300 000 has already been included in taxable profit. The doubtful debts will be deductible when the amount is actually written off as bad with a related deduction to accounts receivable. REQUIRED a) Assuming that the tax rate is 30 percent, what is the amount of the temporary difference? b) Does this give rise to a deferred tax asset or a deferred tax liability, and what is the amount of the deferred tax asset/liability Please donot provide solution in image format provide solution in step by step format and asaparrow_forward

- Ivanhoe Corporation has a deferred tax asset at December 31, 2026 of $210000 due to the recognition of potential tax benefits of an operating loss carryforward. The enacted tax rates are as follows: 30% for 2023-2025; 25% for 2026; and 20% for 2027 and thereafter. Assuming that management expects that only 50% of the related benefits will be realized, a valuation account should be established in the amount of O $36750. O $31500. O $105000. O $42000. ofarrow_forwardvt,1arrow_forwardTrey, Inc. reports a taxable loss of 5210.000 for 2022. Its taxable income for the last two years was as föllows: 2020 2021 $60,000 80,000 Trey expects tavable income in future years and has a tax rate of 30% for all periods affected. The amount that Trey, Inc. reports as a net loss for Inardal reporting purposes in 2022 is: Seet one 74 ST00000 loss 0 S108000 loss OL 147000 loss 04 ST0000 loss O210000 lossarrow_forward

- Pearl Inc. incurred a net operating loss of $455,000 in 2020. The tax rate for all years is 20%. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardOn December 31, 2022, Big Bear Corporation reports liabilities with a tax basis of $1,200,000 and a book basis of $1,700,000. There was no difference in the asset basis. The difference in liability basis arose from temporary differences that would reverse in the following years: 2023 $120,000 2024 $110,000 2025 $112,000 2026 $80,000 2027 $78,000 Assuming a tax rate of 40% for 2022 - 2025 and a rate of 45% for 2026 - 2027, what should Big Bear report on its balance sheet on December 31, 2022? Group of answer choices deferred tax liability of $200,000 deferred tax asset of $207,900 deferred tax liability of $207,900 deferred tax asset of $200,000arrow_forwardPronghorn Inc. incurred a net operating loss of $583,900 in 2023. Combined income for 2020, 2021, and 2022 was $464,400. The tax rate for all years is 30%. Assume that it is more likely than not that the entire tax loss carryforward will not be realized in future years. Assume that Pronghorn earns taxable income of $20,300 in 2024 and that at the end of 2024 there is still too much uncertainty to recognize a deferred tax asset. (a) Prepare the journal entries that are necessary at the end of 2024 assuming that Pronghorn does not use a valuation allowance account. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Year Account Titles and Explanation 2024 2024 (To record current tax expense) (To record current tax benefit) Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education