ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

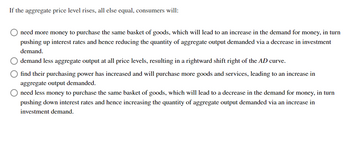

Transcribed Image Text:If the aggregate price level rises, all else equal, consumers will:

need more money to purchase the same basket of goods, which will lead to an increase in the demand for money, in turn

pushing up interest rates and hence reducing the quantity of aggregate output demanded via a decrease in investment

demand.

demand less aggregate output at all price levels, resulting in a rightward shift right of the AD curve.

find their purchasing power has increased and will purchase more goods and services, leading to an increase in

aggregate output demanded.

need less money to purchase the same basket of goods, which will lead to a decrease in the demand for money, in turn

pushing down interest rates and hence increasing the quantity of aggregate output demanded via an increase in

investment demand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a fictional economy that is operating at its long-run equilibrium. The following graph shows the aggregate demand (AD) curve and short-run aggregate supply (AS) curve for the economy. The long-run aggregate supply curve is represented by a vertical line at the potential GDP level of $6 trillion. The economy is initially producing at potential GDP. Suppose that fiscal authorities decide to decrease marginal tax rates. Assume that this change in marginal tax rates is perceived as a long-term change. Shift the appropriate curves to illustrate the supply-side view of the fiscal policy effect on output and the price level. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther. 120 Potential GDP AS 100 PRICE LEVEL 60 80 60 40 40 20 20 0 0 2 4 6 8 AD 10 12 QUANTITY OF OUTPUT (Trillions of dollars) AD 1 AS Potential GDP True or…arrow_forwardThe following graph represents the short-run aggregate supply curve (SRAS) based on an expected price level of 120. The economy's full- employment output level is $9 trillion. Major unions across the country have recently negotiated three-year wage contracts with employers. The wage contracts are based on an expected price level of 120, but the actual price level turns out to be 160. Show the short-run effect of the unexpectedly high price level by dragging the curve or moving the point to the appropriate position. PRICE LEVEL (CPI) 240 200 160 40 0 0 3 SRAS[120] 6 9 12 REAL GDP (Trillions of dollars) 15 18 SRAS[120] 0 (?) Interpret the change you drew on the previous graph by filling in the blanks in the following paragraph:arrow_forwardWhat does the intersection of the AD and AS curves signify? Contrast the shor-turn aggregate supply (SRAS) curve from the long-run aggregate supply (LRAS) curve. (11.2)arrow_forward

- The following graph shows the economy in long-run equilibrium at the expected price level of 120 and the natural level of output of $600 billion. Suppose a stock market boom increases household wealth and causes consumers to spend more. Shift the short-run aggregate supply (AS) curve or the aggregate demand (AD) curve to show the short-run impact of the stock market boom. 240 AS 200 AD 160 AS 120 80 AD 40 200 400 600 800 1000 1200 OUTPUT (Billions of dollars) In the short run, the increase in consumption spending associated with the stock market expansion causes the price level to the price level people expected and the quantity of output to the natural level of output. The stock market boom will cause the unemployment rate to the natural rate of unemployment in the short run. Again, the following graph shows the economy in long-run equilibrium at the expected price level of 120 and the natural level of output of $600 billion, before the increase in consumption spending associated with…arrow_forwardWhich of the following could shift the DAD (dynamic AD) curve to the right, all else equal? an increase in imports a higher real interest rate the Fed raising its target inflation rate a decrease in home purchasesarrow_forwardIf the intersection of AD and SRAS occurs at $21 trillion GDP but full employment GDP (LRAS) is at $22 trillion GDP, which of the following policy choices would help move the economy toward full employment? a) Lowering income taxes and payroll taxes for all employees. b) All of the choices would help increase AD and bring the economy closer to full employment. c) increasing the money supply to lower interest rates. d) Increases government spending on infrastructure. e) Sending out stimulus checks to everyone earning less than $100,000 per year.arrow_forward

- The following graph shows the economy in long-run equilibrium at the expected price level of 120 and the natural level of output of $300 billion. Suppose households suddenly begin to spend less and save more in order to increase saving for retirement. Shift the short-run aggregate supply (AS) curve or the aggregate demand (AD) curve to show the short-run impact of the sharp increase in saving. PRICE LEVEL 240 200 160 120 8 40 0 0 100 200 300 400 OUTPUT (Billions of dollars) AS AD 500 600 AD AS A In the short run, the decrease in consumption spending associated with the increase in saving causes the price level to price level people expected and the quantity of output to the unemployment rate to the the natural level of output. The sharp increase in saving will cause the natural rate of unemployment in the short run.arrow_forwardSuppose that the production function for the economy is given by: Y = AL/3K/3 Suppose that this economy has 1,000 units of Labour, and 125 units of capital, and TFP (A) is equal to 10. The Short-Run Aggregate Supply Curve (AS) here is given by: Y = 5p And when we consider the AEF at a price level of $1,400, the main components of it (C, I, & G) are given by (we are assuming a closed economy NX = 0): C = 300 + 0.8Y I = 300 G = 200 1. What is potential GDP in this question (Y*)? Show your work. Suppose also that for any $10 decrease in price, desired consumption will increase by $5. 2. Write down the equation for the Aggregate Demand Curve (AD) in the form of Y = a + bp. Show your work. 3. What is the current Short-Run Equilibrium value for Real GDP (Y) and the price level (p)? Show your work. 4. Draw the AD, AS, and LRAS curves. Label all x-intercepts and y-intercepts. Are we currently in an Inflationary Gap, Recessionary Gap, or in Long-Run Equilibrium? How do you know?arrow_forwardQuestion #4. Individual income taxes directly affect personal disposable incomes which in turn affect the domestic demand for goods and services. Production costs depend substantially on oil prices. Market expectations are: (1) income taxes in the U.S. will decline and (2) oil prices will remain relatively unchanged. Using market expectations, what do you expect the U.S. output and prices next year? Assume we are moving from the old equilibrium to a new equilibrium. Please state clearly your assumptions and include a graph to support your answer.arrow_forward

- Consider a closed economy, where wages are sticky in the short run. The consumption function is C = co+c₁(Y-T), where the marginal propensity to consume c₁ is equal to 0.8. Initially the economy is in equilibrium at Y = Y* and P = Pº, where Pe is the price level that was expected when agents agreed their fixed nominal wage contracts. The short-run aggregate supply curve (SRAS) is horizontal. Suddenly the government increases government spending G by $200. For the following questions, if you think a variable goes up by (say) $50, just enter 50 as your answer. If you think a variable goes down by $50, enter -50 as your answer. If you think a variable doesn't change at all, enter 0 as your answer. 10. By how much will output Y change in the short run? 11. By how much will consumption C change in the short run? 12. By how much will investment I change in the short run? 13. By how much will output Y change (compared to its initial level before the change in G) in the long run, after wage…arrow_forwardIf membership falls in labor unions and unions become less popular, then: production costs will increase, SRAS will shift to the left, decreasing equilibrium GDP and increasing the aggregate price level. production costs will fall, SRAS will shift to the right, increasing equilibrium GDP and lowering the aggregate price level. production costs will not change, AD will shift to the right, increasing equilibrium GDP and aggregate price level. production costs will fall, there will be a downward movement along SRAS, equilibrium GDP will increase and aggregate price level will fall.arrow_forwardThe graph in Figure I presents the annual GDP growth rate of the United States economy since the first quarter of 2004, while the graphs in Figure II represent three different scenarios of the relationship. between aggregate demand and supply that reflect different situations of economic growth. Answer the following questions in detail. Using the shifts in the aggregate demand curve in each of the three graphs in Figure II, explain the function of aggregate consumption and investment. Explain in detail what is happening in Graph A in Figure II and, after examining the data in the graph in Figure I, identify in what period of time said situation is occurring.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education