ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:If Bean Bruuer advertises, Hatte Latte makes a higher profit if it chooses

If Bean Bruuer doesn't advertise, Hatte Latte makes a higher profit if it chooses

Suppose that both firms start off by deciding not to advertise. If the firms act independently, what strategies will they end up choosing?

Hatte Latte will choose not to advertise and Bean Bruuer will choose to advertise.

Both firms will choose not to advertise.

Both firms

choose to advertise.

Hatte Latte will choose to advertise and Bean Bruuer will choose not to advertise.

Again, suppose that both firms start off not advertising. If the firms decide to collude, what strategies will they end up choosing?

Hatte Latte will choose to advertise and Bean Bruuer will choose not to advertise.

Hatte Latte will choose not to advertise and Bean Bruuer will choose to advertise.

Both firms will choose to advertise.

Both firms will choose not to advertise.

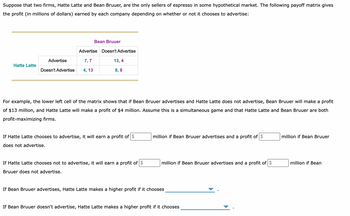

Transcribed Image Text:Suppose that two firms, Hatte Latte and Bean Bruuer, are the only sellers of espresso in some hypothetical market. The following payoff matrix gives

the profit (in millions of dollars) earned by each company depending on whether or not it chooses to advertise:

Hatte Latte

Bean Bruuer

Advertise

7,7

Doesn't Advertise 4, 13

Advertise

Doesn't Advertise

13, 4

8,8

For example, the lower left cell of the matrix shows that if Bean Bruuer advertises and Hatte Latte does not advertise, Bean Bruuer will make a profit

of $13 million, and Hatte Latte will make a profit of $4 million. Assume this is a simultaneous game and that Hatte Latte and Bean Bruuer are both

profit-maximizing firms.

If Hatte Latte chooses to advertise, it will earn a profit of $

does not advertise.

If Hatte Latte chooses not to advertise, it will earn a profit of $

Bruuer does not advertise.

million if Bean Bruuer advertises and a profit of $

million if Bean Bruuer advertises and a profit of $

If Bean Bruuer advertises, Hatte Latte makes a higher profit if it chooses

If Bean Bruuer doesn't advertise, Hatte Latte makes a higher profit if it chooses

million if Bean Bruuer

million if Bean

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Apple and Samsung control the majority of the Smart Phones. Suppose the diagram above represents their strategic options, either to offer an expensive or a cheap phone in the market. If both firms offer an expensive phone, they will each earn 4 billion dollars. If Samsung offers a cheap phone, while Apple offers only an expensive phone, Samsung will earn $6 billion and Apple will earn $2 billion, and vice versa. If they both offer a cheap phone, they will each earn $3 billion. What are the profits in the Nash Equilibrium? a. Samsung earns $2 billion and Apple earns $6 billion. b. Both firms earn $3 billion. c. Both firms earn $4 billion. d. Samsung earns $6 billion and Apple earns $2 billion.arrow_forwardArcher Daniels Midland (ADM) and Cargill are the biggest makers of high-fructose corn syrup (HFCS), used to sweeten Coke, Pepsi, and other non-diet soft drinks. Each firm is currently choosing between increasing or decreasing their price for HFCS. The table below gives each firm's profits in each possible situation. A is Archer Daniels Midland and C is Cargill. For purposes of this question, ignore the existence of other HFCS makers. Cargill P increase P decrease P increase A: $500 million A: $200 million C: $400 million C: $500 million ADM P decrease A: $600 million A: $350 million C: $200 million C: $300 million a. Assuming the two firms do not cooperate, does either have a dominant strategy? If so, what is it? b. If ADM and Cargill decide to cooperate, how, if at all, will the outcome differ from part a? Would this case be an evample of a repeated or a pon-reneated game?arrow_forwardthe question is in the image attached.arrow_forward

- Consider two firms in the Australia market. The table below depicts each firm’s profits, depending on what price both firms charge. a. Find (if any) each firm's dominant strategy. b. Which strategy does each firm choose in equilibrium when collusion (joint agreement) is not allowed? c. Suppose that collusion is allowed between the two firms. Could these firms benefit from collusion? Why or why not?arrow_forwardconsider the market for oil. Suppose for simplicity that there are only two oil roducing countries-Saudi Arabia and Kuwait. Both countries must choose hether to produce a low output or a high output. These output strategies with corresponding profits are depicted in the ayoff matrix to the right. Kuwait's profits are in red and Saudi Arabia's are in blue. Kuwait Suppose the two countries form a cartel. What is the cooperative equilibrium? Low Output High Output O A. The cooperative equilibrium is for Saudi Arabia to produce a high output and Kuwait to produce a high output. $125 $75 Low Output $8 $13 O B. A cooperative equilibrium does not exist for this game. O C. The cooperative equilibrium is for Saudi Arabia to produce a low output and Kuwait to produce a high output. Saudi Arabia $98 $70 O D. The cooperative equilibrium is for Saudi Arabia to produce a high output and Kuwait to produce a low output. High Output $5 $8 O E. The cooperative equilibrium is for Saudi Arabia to produce…arrow_forwardSuppose that Creamland and Dairy King are the only two firms that sell ice cream. The following payoff matrix shows the profit (in millions of dollars) each company will earn depending on whether or not it advertises: Dairy King Advertise Doesn'tAdvertise Advertise 10, 10 18, 2 Creamland Doesn'tAdvertise 2, 18 11, 11 For example, the upper right cell shows that if Creamland advertises and Dairy King doesn't advertise, Creamland will make a profit of $18 million, and Dairy King will make a profit of $2 million. Assume this is a simultaneous game and that Creamland and Dairy King are both profit-maximizing firms. If Creamland decides to advertise, it will earn a profit of $ million if Dairy King advertises and a profit of $ million if Dairy King does not advertise. If Creamland decides not to advertise, it will earn a profit of S million if Dairy King advertises and a profit of $ million if Dairy King does not advertise.arrow_forward

- Two duopolists are sharing a market in which they are contemplating whether to compete or to cooperate. If they cooperate and behave like a monopolist they will share the monopolist profit of $1800. If they compete each will get a profit of $800 but if one them cooperates while the other chooses to compete the one who cooperates gets $700 while the one who competes will end up with $1000. Set-up the game, explain the process and show the Nash-equilibrium reached when the game is played.arrow_forwardPictech Pricing High Low High 8, 8 4, 13 Flashfone Pricing Low 13, 4 7,7 For example, the lower-left cell shows that if Flashfone prices low and Pictech prices high, Flashfone will earn a profit of $13 million, and Pictech will earn a profit of $4 million. Assume this is a simultaneous game and that Flashfone and Pictech are both profit-maximizing firms. If Flashfone prices high, Pictech will make more profit if it chooses a v price, and if Flashfone prices low, Pictech will make more profit if it chooses price. price, and if Pictech prices low, Flashfone will make more profit if it chooses If Pictech prices high, Flashfone will make more profit if it chooses a price. a dominant strategy for both Flashfone and Pictech. Considering all of the information given, pricing low If the firms do not collude, what strategies will they end up choosing? O Flashfone will choose a high price, and Pictech will choose a low price. O Both Flashfone and Pictech will choose a high price. O Both…arrow_forwardLet ci be the constant marginal and average cost for firm i (so that firms may have different marginal costs). Suppose demand is given by P=1-Q. Calculate the Nash equilibrium quantities assuming there are two firms in a Cournot market. Also compute market output, market price, firm profits, industry prof- its, consumer surplus, and total welfare. Represent the Nash equilibrium on a best-response function diagram. Show how a reduction in firm 1’s cost would change the equilibrium. Draw a representative isoprofit for firm 1.arrow_forward

- What is meant by dominant strategy?arrow_forward8. Two firms, the only firms in the market, sell the same product and have the same marginal cost. They realise they would be better off if they didn't compete with each other. They enter an alternating offers bargaining game to decide how they will divide the monopoly profit, n. They have three periods to come to an agreement. If no agreement is reached after three periods, the firms will compete simultaneously in prices. The firms toss a coin to decide who makes the first offer in the bargaining game. Firm 1 wins and decides to go first. Each firm has a discount factor o. a) Draw the game tree. b) What is the subgame perfect equilibrium when 8 = 0.5? c) What is the equilibrium payoff for each firm? d) Was Firm 1 wise to opt to make the first offer? Explain your answer. %3Darrow_forwardThe payoff matrix in the figure to the right shows the payoffs for a pricing game. If you were firm A, which strategy would you choose? Firm A should A. price high because this is their maximin strategy. B. price low because this is their tit-for-tat strategy. C. price high because this is their dominant strategy. D. price low because this is their dominant strategy. E. price low because this maximizes profits of both firms. Firm B's dominant strategy is to price If this game were repeated a large number of times and you were firm A and you could change your strategy, what might you do? Firm A should O A. use a tit-for-tat strategy by responding in kind to firm B's play. B. use a maximin strategy by maximizing the minimum gain that can be earned. C. use a tit-for-tat strategy by selecting a price that minimizes firm B's profits. D. use a maximin strategy by by responding in kind to firm B's play. E. use a tit-for-tat strategy by maximizing the minimum gain that can be earned. C Price…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education