ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

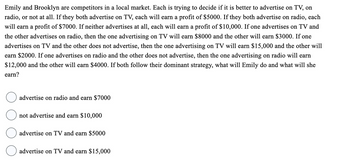

Transcribed Image Text:Emily and Brooklyn are competitors in a local market. Each is trying to decide if it is better to advertise on TV, on

radio, or not at all. If they both advertise on TV, each will earn a profit of $5000. If they both advertise on radio, each

will earn a profit of $7000. If neither advertises at all, each will earn a profit of $10,000. If one advertises on TV and

the other advertises on radio, then the one advertising on TV will earn $8000 and the other will earn $3000. If one

advertises on TV and the other does not advertise, then the one advertising on TV will earn $15,000 and the other will

earn $2000. If one advertises on radio and the other does not advertise, then the one advertising on radio will earn

$12,000 and the other will earn $4000. If both follow their dominant strategy, what will Emily do and what will she

earn?

advertise on radio and earn $7000

not advertise and earn $10,000

advertise on TV and earn $5000

advertise on TV and earn $15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Solve the attahment.arrow_forwardHand written solutions are strictly prohibitedarrow_forwardTwo firms X and Y compete with each other. Firm X can produce one of three products X1, X2, or X3. Similarly, firm Y can produce one of three products Y1, Y1, and Y3. Each firm's profit depends on its own and its competitor's decision about which product to produce. These profits are given in the table below where each cell presents profits corresponding to a pair of chosen strategies with the first number being the profit of firm X and the second being the profit of firm Y. For example, if X chooses to produce X3 and Y chooses to produce Y1, the profit of X will be $15 and the profit of Y will be $20. The firms make their product choice decisions simultaneously and independently of each other. Y1 Y2 Y3 X1 0, 0 12, 8 16, 16 15, 20 18, 9 20, 15 8, 12 18, 18 9, 18 X2 X3 11) Does this game have any equilibrium in dominant strategies? If yes, find all of them. 12) In addition to the equilibria (if any) you found in the previous question, does this game have any other equilibria? If yes,…arrow_forward

- Two duopolists are sharing a market in which they are contemplating whether to compete or to cooperate. If they cooperate and behave like a monopolist they will share the monopolist profit of $1800. If they compete each will get a profit of $800 but if one them cooperates while the other chooses to compete the one who cooperates gets $700 while the one who competes will end up with $1000. Set-up the game, explain the process and show the Nash-equilibrium reached when the game is played.arrow_forwardTwo men’s clothing stores that compete for most of the market in a small town in Ohio and will choose their weekly advertising levels sequentially. The newspaper advertising department calls the clothing stores in alphabetical order to find out how much advertising each firm wishes to buy. Somehow — and nobody at the newspaper knows exactly how this happens — Arbuckle’s advertising decision “leaks out” to Mr. B’s, which then knows Arbuckle’s advertising decision when it makes its advertising decision for the week. The following payoff table facing the two firms, Arbuckle & Son and Mr. B’s, shows the weekly profit outcomes for the various advertising decision combinations. The payoff table is common knowledge. Use this payoff table to construct the appropriate sequential decision on the blank game tree provided below. If the manager at Arbuckle and Son employs the roll-back method to make the advertising decision for Arbuckle, the likely outcome will be: Multiple Choice $5,000 of…arrow_forwardCompany A and Company B are competing oligopolists. Both companies are considering increasing or maintaining their prices. The payoff matrix shows the profits of the companies in millions based on their possible actions.. Company A Increase Price Company B Increase Price Maintain Price $50, $40 Maintain Price $55, $45 $35, $30 $60, $35 The government offers a $5 million subsidy to maintain current pricing. What is the expected outcome of the new payoff matrix, given the subsidy? The Nash equilibrium changes, and both companies will maintain their prices The Nash equilibrium changes, and both companies will increase their prices. The Nash equilibrium remains the same, and both companies will increase their prices Company A will increase its price, while Company B maintains its price. Company A will maintain its price, while Company B increases its pricearrow_forward

- O Cell A O Cell C O Cell E O Cell I None of the abovearrow_forwardFirms 1 and 2 compete in a Cournot duopoly. If firm 2 adopts a strategy that raises firm 1's marginal cost: firm 2's reaction function will shift up. firm 1's reaction function will shift down. firm 2's reaction function will shift down. firm 1's reaction function will shift up.arrow_forwardTwo gas stations in a rural town can engage in collusion over pricing. Because drivers often just stop at the first station they see as they go through town, price competition is not that severe in the first place. Assume either station can price gas at $0.30 above average total cost or $0.50 above average total cost. If they have equal prices, they split the market. If they have unequal prices, the lower price station gets 75% of the market (assume for simplicity no change in the size of the market; price elasticity of demand is very low for short term changes in the price of oil).a. Draw the normal form representation of this game. Identify the key aspects of the game.b. Identify the dominant strategy, if any, for each player.c. Identify any Nash equilibria.arrow_forward

- Synergy and Dynaco are the only two firms in a specific high-tech industry. They face the following payoff matrix as they decide upon the size of their research budget: Dynaco's Decision Synergy's Decision Large Budget Large Budget $30 million, $20 million Small Budget $0, $30 million If Synergy believes Dynaco will go with a large budget, it will choose a budget. If Synergy believes Dynaco will go with a small budget, it will choose a budget. Therefore, Synergy a dominant strategy. O True Small Budget $70 million, $0 $50 million, $40 million If Dynaco believes Synergy will go with a large budget, it will choose a budget. If Dynaco believes Synergy will go with a small budget, it will choose a budget. Therefore, Dynaco a dominant strategy. O False True or False: There is a Nash equilibrium for this scenario. (Hint: Look closely at the definition of Nash equilibrium.)arrow_forwardGame Theoryarrow_forward4. Using a payoff matrix to determine the equilibrium outcome Suppose that Flashfry and Warmbreeze are the only two firms in a hypothetical market that produce and sell air fryers. The following payoff matrix gives profit scenarios for each company (in millions of dollars), depending on whether it chooses to set a high or low price for fryers. Flashfry Pricing High Low Warmbreeze Pricing High Low 11, 11 2,13 13, 2 10, 10 For example, the lower-left cell shows that if Flashfry prices low and Warmbreeze prices high, Flashfry will earn a profit of $13 million, and Warmbreeze will earn a profit of $2 million. Assume this is a simultaneous game and that Flashfry and Warmbreeze are both profit-maximizing firms. price, and if Flashfry prices low, Warmbreeze will make more profit if it If Flashfry prices high, Warmbreeze will make more profit if it chooses a chooses a price. If Warmbreeze prices high, Flashfry will make more profit if it chooses a chooses a price. Considering all of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education