Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Subject financial accounting

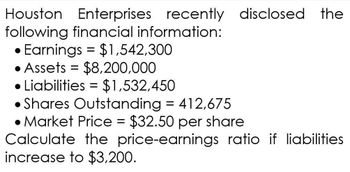

Transcribed Image Text:Houston Enterprises recently disclosed the

following financial information:

•Earnings = $1,542,300

•Assets = $8,200,000

Liabilities = $1,532,450

•Shares Outstanding = 412,675

•Market Price = $32.50 per share

Calculate the price-earnings ratio if liabilities

increase to $3,200.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardThe Kretovich Company had a quick ratio of 1.4, a current ratio of 3.0, a days’ sales outstanding of 36.5 days (based on a 365-day year), total current assets of $810,000, and cash and marketable securities of $120,000. What were Kretovich’s annual sales?arrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forward

- What is the price-earnings (P/E) ratio?arrow_forwardCalculate The Market Price with General Accounting methodarrow_forwardOn the balance sheet of Bearcat Inc., you notice "Common Stock ($0.10 par)" of $248,655, "Capital Surplus" of $282,621, and "Retained Earnings" of $210,534. If Bearcat Inc. has Sales of $292,6836 and a profit margin of 30.52%, what is the price/earnings (P/E) ratio of the firm if their stock is currently selling for $21.94 per share? O None of these options are correct 67.18 54.97 240.97 61.07 DISCLarrow_forward

- You have the following information about Trisha Company: total asset =P350,000; common stock equity = P175,000; Return on Equity (ROE) =12.5%. What is Trisha’s earnings available for common stockholders? A. P21,875B. P43,750C. P50,000D. P47,632arrow_forwardAnswer? ? Financial accountingarrow_forwardCompute the following ratios for both companies for the current year, and decide which company’s stock better fits your investment strategy. Debt Ratio Earning per share of common stocks Price/earning ration Dividend payoutarrow_forward

- (Market value analysis) Lei Materials' balance sheet lists total assets of $1.17 billion, $197 million in current liabilities, $435 million in long-term debt, $538 million in common equity, and 50 million shares of common stock. If Lei's current stock price is $54.48, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forwardLei Materials' balance sheet lists total assets of $1.05 billion, $127 million in current liabilities, $435 million in long-term debt, $488 million in common equity, and 54 million shares of common stock. If Lei's current stock price is $51.38, what is the firm's market-to-book ratio?arrow_forwardFranklin Co. reported the following year-end data: net income of $220,000; annual cash dividends per share of $3; market price per (common) share of $150; and earnings per share of $10. Compute the (a) price-earnings ratio and (b) dividend yield.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning