Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please given answer accounting question

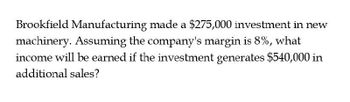

Transcribed Image Text:Brookfield Manufacturing made a $275,000 investment in new

machinery. Assuming the company's margin is 8%, what

income will be earned if the investment generates $540,000 in

additional sales?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sunrise Company sells 3, 650 frying pans per year. The owner has invested $80, 000 in the business and desires an 8% return on his investment (ROI = Net Income Investments). Product Costs VC $4.5 per pan FC $78,000 per year Selling and Administrative Costs VC $3.00 per pan FC $15,000 per year If Sunrise uses the income statement bottom-up forecasting to estimate revenue and absorption cost-based pricing, what is its selling price and markup percentage? A. 5.32% and $34.73 B. 34.25% and $34.73 C. 27.48% and $32.98 D. 363% and $34.73arrow_forwardThe Boron Company will produce 2,500 boxes of batteries next year. Variable costs is 60% of sales, while fixed costs will total P80,000 on which half is attributable to manufacturing and the rest to financing cost. What is the sales price of the per box of batteries if Boron Company wants to achieve a degree of operating leverage of 1.67 and an earnings before taxes equal to half the amount of interest expense? 100 250 150 200arrow_forwardPrice Corporation is considering selling to a group of new customers and creating new annual sales of $240,000. 3% will be uncollectible. The collection cost on all accounts is 6% of new sales, the cost of producing and selling is 83% of sales, and the firm is in the 22% tax bracket. What is the profit on new sales?arrow_forward

- ABC Corporation sells its product for $12 per unit. Next year, fixed expenses are expected to be $400,000 and variable expenses are expected to be $8 per unit. How many units must the company sell to generate a target profit (net operating income) of $80,000?arrow_forwardThe investment generates 560000 in additional sales?arrow_forwardA project currently generates sales of $11.6 million, variable costs equal to 50% of sales, and fixed costs of $3.8 million. The firm's tax rate is 30%. a. What are the effects on the after-tax profits and cash flow, if sales increase from $11.6 million to $13.8 million. (Input all amounts as positive values. Do not round intermediate calculations. Enter your answers in millions rounded to 3 decimal places.) After-tax profit (Click to select) million, million. by $ Cash flow (Click to select) v by $ b. What are the effects on the after-tax profits and cash flow, if variable costs increase to 55% of sales. (Input all amounts as positive values. Do not round intermediate calculations. Enter your answers in millions rounded to 3 decimal places.) After-tax profit| (Click to select) v by $ Cash flow (Click to select) million. v by $ million. %24arrow_forward

- Dinshaw Company is considering the purchase of a new machine. The invoice price of the machine is $87,306, freight charges are estimated to be $2,620, and installation costs are expected to be $7,370. The annual cost savings are expected to be $14,980 for 11 years. The firm requires a 20% rate of return. Ignore income taxes. What is the internal rate of return on this investment? Internal rate of return % Round to 0 decimal placesearrow_forwardStark Industries reports that its average operating assets are $511,000,000 and its net operating income is $147,000,000 on sales of $1,645,000,000 What is the residual income if the required rate of return is 0.11? Round your answer to the nearest dollar.arrow_forwardThe Warren Watch Company sells watches for $26, fixed costs are $150,000, and variable costs are $15 per watch. What is the firm's gain or loss at sales of 8,000 watches? Loss, if any, should be indicated by a minus sign. Round your answer to the nearest cent.$ What is the firm's gain or loss at sales of 16,000 watches? Loss, if any, should be indicated by a minus sign. Round your answer to the nearest cent.$ What is the break-even point (unit sales)? Round your answer to the nearest whole number.units What would happen to the break-even point if the selling price was raised to $31? What would happen to the break-even point if the selling price was raised to $31 but variable costs rose to $21 a unit? Round your answer to the nearest whole number.arrow_forward

- Your corporation sells a product for $10 per unit. The variable expenses are $6 per unit, and the fixed expenses total $35,000 per period. By how much will net operating income change if sales are expected to increase by $40,000?arrow_forwardHow many units must company sell?arrow_forwardBlossom Footballs, Inc., management expects to sell 15,000 balls this year. The balls sell for $105 each and have a variable cost per unit of $71. Fixed costs, including depreciation and amortization, are currently $180,000 per year. How much can either the fixed costs or the variable cost per unit increase before the company has a negative EBIT. (Round increase in fixed cost to 0 decimal places, e.g. 5,275 and variable cost to 2 decimal places, e.g. 15.25.)Excel Template(Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you’ve been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Fixed costs could increase by $ and variable costs could increase by $ per unitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning