Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Accounting problem with help

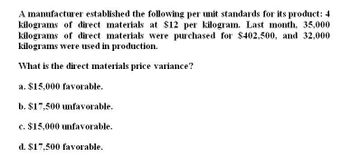

Transcribed Image Text:A manufacturer established the following per unit standards for its product: 4

kilograms of direct materials at $12 per kilogram. Last month, 35,000

kilograms of direct materials were purchased for $402,500, and 32,000

kilograms were used in production.

What is the direct materials price variance?

a. $15,000 favorable.

b. $17,500 unfavorable.

c. $15,000 unfavorable.

d. $17,500 favorable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kavallia Company set a standard cost for one item at 328,000; allowable deviation is 14,500. Actual costs for the past six months are as follows: Required: 1. Calculate the variance from standard for each month. Which months should be investigated? 2. What if the company uses a two-part rule for investigating variances? The allowable deviation is the lesser of 4 percent of the standard amount or 14,500. Now which months should be investigated?arrow_forwardLowell Manufacturing Inc. has a normal selling price of 20 per unit and has been selling 125,000 units per month. In November, Lowell Manufacturing decided to lower its price to 19 per unit expecting it can increase the units sold by 16%. a. Compute the normal revenue with a 20 selling price. b. Compute the planned revenue with a 19 selling price. c. Compute the actual revenue for November, assuming 135,000 units were sold in November at 19 per unit. d. Compute the revenue price variance, assuming 135,000 units were sold in November at 19 per unit. e. Compute the revenue volume variance, assuming 135,000 units were sold in November at 19 per unit. f. Analyze and interpret the lowering of the price to 19.arrow_forwardSitka Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for one ladder (unit): Sitka Industries made 3,000 ladders in July and used 8,800 pounds of material to make these units. Smith Industries bought 15,500 pounds of material in the current period. There was a $250 unfavorable direct materials price variance. A. How much in total did Sitka pay for the 15,500 pounds? B. What is the direct materials quantity variance? C. What is the total direct material cost variance? D. What ii 9,500 pounds were used to make these ladders, what would be the direct materials quantity variance? E. It there was a $340 favorable direct materials price variance, how much did Sitka pay for the 15,500 pounds of material?arrow_forward

- Marymount Company makes one product. In the month of April, it made 3,500 units. Workers were paid $32 per hour for labor, for a total of $718,848. The standard hours per unit are 6.4, and the standard labor wage rate is $38.40 per hour. A. What are the actual hours worked? B. What are the standard hours for the units made? C. What is the direct labor rate variance for April? D. What Is the direct labor time variance for April? E. What is the total direct labor variance for April?arrow_forwardThe production cost for a waterproof phone case is $7 per unit and fixed costs are $23,000 per month. How much is the favorable or unfavorable variance If 5,500 units were produced for a total of $61,000?arrow_forwardAt the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forward

- Case made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. A. Compute the direct labor rate and time variances for the month of June, and also calculate the total direct labor variance. B. If the standard rate per hour was $16.00, what would change?arrow_forwardSmith Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for the cost of one basket (unit): Smith Industries made 3,000 baskets in July and used 15,500 pounds of material to make these units. Smith Industries paid $39,370 for the 15,500 pounds of material. A. What was the direct materials price variance for July? B. What was the direct materials quantity variance for July? C. What is the total direct materials cost variance? D. If Smith Industries used 15,750 pounds to make the baskets, what would be the direct materials quantity variance?arrow_forwardWhat is the direct materials price variance of this general accounting question?arrow_forward

- A company purchases 48000 pounds of materials. The materials price variance is $12000 favorable. What is the difference between the standard price and the actual price paid for the materials? $1.00 $4.00 $0.25 Cannot be determined from the data provided.arrow_forwardhelparrow_forwardA company developed the following per-unit standards for its product: 2 pounds of direct materials at $10 per pound. Last month, 3500 pounds of direct materials were purchased for $13300. The direct materials price variance for last month was O $13300 favorable. O $21700 favorable. O $21700 unfavorable. O $10850 favorable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning