Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

account questions.

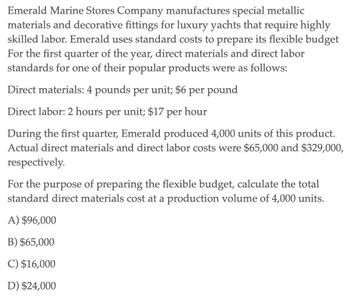

Transcribed Image Text:Emerald Marine Stores Company manufactures special metallic

materials and decorative fittings for luxury yachts that require highly

skilled labor. Emerald uses standard costs to prepare its flexible budget

For the first quarter of the year, direct materials and direct labor

standards for one of their popular products were as follows:

Direct materials: 4 pounds per unit; $6 per pound

Direct labor: 2 hours per unit; $17 per hour

During the first quarter, Emerald produced 4,000 units of this product.

Actual direct materials and direct labor costs were $65,000 and $329,000,

respectively.

For the purpose of preparing the flexible budget, calculate the total

standard direct materials cost at a production volume of 4,000 units.

A) $96,000

B) $65,000

C) $16,000

D) $24,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: At the beginning of March, Salisburys management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. b. Prepare a budget performance report for manufacturing costs, showing the total cost variances for direct materials, direct labor, and factory overhead for March. c. Interpret the budget performance report.arrow_forwardCloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardLean accounting Dashboard Inc. manufactures and assembles automobile instrument panels for both eCar Motors and Greenville Motors. The process consists of a lean product cell for each customers instrument assembly. The data that follow concern only the eCar lean cell. For the year, Dashboard Inc. budgeted the following costs for the eCar production cell: Dashboard Inc. plans 2,000 hours of production for the eCar cell for the year. The materials cost is 240 per instrument assembly. Each assembly requires 24 minutes of cell assembly time. There was no April 1 inventory for either Raw and In Process Inventory or Finished Goods Inventory. The following summary events took place in the eCar cell during April: A. Electronic parts and wiring were purchased to produce 450 instrument assemblies in April. B. Conversion costs were applied for the production of 400 units in April. C. 380 units were started, completed, and transferred to finished goods in April. D. 350 units were shipped to customers at a price of 800 per unit. Instructions 1. Determine the budgeted cell conversion cost per hour. 2. Determine the budgeted cell conversion cost per unit. 3. Journalize the summary transactions (a) through (d). 4. Determine the ending balance in Raw and In Process Inventory and Finished Goods Inventory. 5. How does the accounting in a lean environment differ from traditional accounting?arrow_forward

- JoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT estimated variable factory overhead of 600,000 and fixed factory overhead of 400,000. JoyT uses a standard costing system, and factory overhead is allocated to units produced using standard direct labor hours. The level of activity budgeted for this year was 10,000 direct labor hours, and JoyT used 10,300 actual direct labor hours. Based on the output accomplished during this year, 9,900 standard direct labor hours should have been used. Actual variable factory overhead was 596,000, and actual fixed factory overhead was 410,000 for the year. Based on this information, the variable factory overhead controllable variance for JoyT for this year was: a. 24,000 unfavorable. b. 2,000 unfavorable. c. 4,000 favorable. d. 22,000 favorable.arrow_forwardJillian Manufacturing Inc. manufactures a single product and uses a standard cost system. The factory overhead is applied on the basis of direct labor hours. A condensed version of the company’s flexible budget follows: The product requires 3 lb of materials at a standard cost of $5 per pound and 2 hours of direct labor at a standard cost of $10 per hour. For the current year, the company planned to operate at the level of 6,250 direct labor hours and to produce 3,125 units of product. Actual production and costs for the year follow: Required: For the current year, compute the factory overhead rate that will be used for production. Show the variable and fixed components that make up the total predetermined rate to be used. Prepare a standard cost card for the product. Show the individual elements of the overhead rate as well as the total rate. Compute (a) standard hours allowed for production and (b) under- or overapplied factory overhead for the year. Determine the reason for any under- or overapplied factory overhead for the year by computing all variances, using each of the following methods: Two-variance method Three-variance method (appendix) Four-variance method (appendix)arrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 4,000 units in March and 3,700 in April. Each pole requires a half pound of material, which costs $1.20 per pound. The companys policy is to have enough material on hand to equal 10% of the next months production needs and to maintain a finished goods inventory equal to 25% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forward

- TIB makes custom guitars and prepared the following sales budget for the second quarter It also has this additional information related to its expenses: Direct material per unit $55, Direct labor per hour 20, Variable manufacturing overhead per hour 3.50, Fixed manufacturing overhead per month 3,000, Sales commissions per unit 20, Sales salaries per month 5,000, Delivery expense per unit 0.50, Utilities per month 4,000. Administrative salaries per month 20,000, Marketing expenses per month 8,000, Insurance expense per month 11,000, Depreciation expense per month 9,000. Prepare a sales and administrative expense budget for each month in the quarter ended June 30. 2018.arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forwardJacson Company produces two brands of a popular pain medication: regular strength and extra strength. Regular strength is produced in tablet form, and extra strength is produced in capsule form. All direct materials needed for each batch are requisitioned at the start. The work orders for two batches of the products are shown below, along with some associated cost information: In the Mixing Department, conversion costs are applied on the basis of direct labor hours. Budgeted conversion costs for the department for the year were 60,000 for direct labor and 190,000 for overhead. Budgeted direct labor hours were 5,000. It takes one minute of labor time to mix the ingredients needed for a 100-unit bottle (for either product). In the Bottling Department, conversion costs are applied on the basis of machine hours. Budgeted conversion costs for the department for the year were 400,000. Budgeted machine hours were 20,000. It takes one-half minute of machine time to fill a bottle of 100 units. Required: 1. What are the conversion costs applied in the Mixing Department for each batch? The Bottling Department? 2. Calculate the cost per bottle for the regular and extra strength pain medications. 3. Prepare the journal entries that record the costs of the 12,000 regular strength batch as it moves through the various operations. 4. Suppose that the direct materials are requisitioned by each department as needed for a batch. For the 12,000 regular strength batch, direct materials are requisitioned for the Mixing and Bottling departments. Assume that the amount of cost is split evenly between the two departments. How will this change the journal entries made in Requirement 3?arrow_forward

- Lens & Shades sells sunglasses for $37 each and is estimating sales of 21,000 units in January and 19,000 in February. Each lens consist of 2.00 mm of plastic costing $2.50 per mm, 1.7 oz of dye costing $2.80 per ounce. and 0.50 hours direct labor at a labor rate of $18 per unit. Desired inventory levels are: Prepare a sales budget, production budget, direct materials budget for silicon and solution, and a direct labor budget.arrow_forwardThe Calhoun Textile Mill is in the process of deciding on a production schedule. It wishes to know how to weave the various fabrics it will produce during the coming quarter. The sales department has continued orders for each of the 15 fabrics produced by Calhoun. These demands are given in the following table. Also given in this table is the variable cost for each fabric. The mill operates continuously during the quarter: 13 weeks, 7 days a week, and 24 hours a day. There are two types of looms: dobbie and regular. Dobbie looms can be used to make all fabrics and are the only looms that can weave certain fabrics, such as plaids. The rate of production for each fabric on each type of loom is also given in the table. Note that if the production rate is zero, the fabric cannot be woven on that type of loom. Also, if a fabric can be woven on each type of loom, then the production rates are equal. Calhoun has 90 regular looms and 15 dobbie looms. For this problem, assume that the time requirement to change over a loom from one fabric to another is negligible. Management would like to know how to allocate the looms to the fabrics and which fabrics to buy on the market so as to minimize the cost of meeting demand.arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning