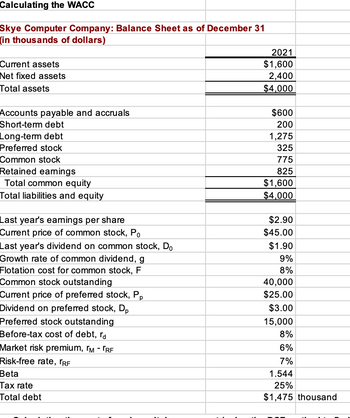

Here is the condensed 2021

| 2021 | ||||

| Current assets | $ | 1,600 | ||

| Net fixed assets | 2,400 | |||

| Total assets | $ | 4,000 | ||

| Accounts payable and accruals | $ | 600 | ||

| Short-term debt | 200 | |||

| Long-term debt | 1,275 | |||

| 325 | ||||

| Common stock (40,000 shares) | 775 | |||

| 825 | ||||

| Total common equity | $ | 1,600 | ||

| Total liabilities and equity | $ | 4,000 |

Skye's earnings per share last year were $2.90. The common stock sells for $45.00, last year's dividend (D0) was $1.90, and a flotation cost of 8% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skye's preferred stock pays a dividend of $3.00 per share, and its preferred stock sells for $25.00 per share. The firm's before-tax cost of debt is 8%, and its marginal tax rate is 25%. The firm's currently outstanding 8% annual coupon rate, long-term debt sells at par value. The market risk premium is 6%, the risk-free rate is 7%, and Skye's beta is 1.544. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1.475 million.

Do not round intermediate calculations. Round your answers to two decimal places.

-

Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the

cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity.After-tax cost of debt: fill in the blank 2 %

Cost of preferred stock: fill in the blank 3 %

Cost of retained earnings: fill in the blank 4 %

Cost of new common stock: fill in the blank 5 %

Now calculate the cost of common equity from retained earnings, using the

CAPM method. -

If Skye continues to use the same market-value capital structure, what is the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock? (Hint: Use the market value capital structure excluding current liabilities to determine the weights. Also, use the simple average of the required values obtained under the two methods in calculating WACC.)

WACC1:

WACC2:

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Property, plant, and equipment (net) $1,212,000 Liabilities: Current liabilities $120,000 Note payable, 6%, due in 15 years 606,000 Total liabilities $726,000 Stockholders' equity: Preferred $4 stock, $100 par (no change during year) $544,500 Common stock, $10 par (no change during year) 544,500 Retained earnings: Balance, beginning of year $580,000 Net income 226,000 $806,000 Preferred dividends $21,780 Common dividends 58,220 80,000 Balance, end of year 726,000 Total stockholders' equity $1,815,000 Sales $16,351,500 Interest expense $36,360 Assuming that total assets were $2,414,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal…arrow_forwardThe following financial information is available for Sunland Corporation. 2022 2021 Average common stockholders' equity $1,100,000 $877,000 Dividends paid to common stockholders 45,000 25,500 Dividends paid to preferred stockholders 18,500 18,500 Net income 285,000 190,000 Market price of common stock 18 13 The weighted-average number of shares of common stock outstanding was 76,000 for 2021 and 103,000 for 2022. Calculate earnings per share and return on common stockholders' equity for 2022 and 2021 (Round answers to 2 decimal places, e.g. 10.50% or 10.50.) Earnings per share Return on common stockholders' equity $ 2022 % $ 2021 %arrow_forward62.) Using Financial Statements for 2018-2019. The amount of shares of preferred stock for 2019 is 10,959.90. TRUE OR FALSE?arrow_forward

- Here is financial information for Windsor, Inc. December 31, 2022 December 31, 2021 Current assets $104,753 $ 89,000 Plant assets (net) 367,169 319,000 Current liabilities 108,936 72,000 Long-term liabilities 109,986 83,000 Common stock, $1 par 120,946 106,000 Retained earnings 132,054 147,000 Prepare a schedule showing a horizontal analysis for 2022, using 2021 as the base year. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) WINDSOR, INC. Assets Current Assets Condensed Balance Sheet December 31 2022 2021 $104,753 $89,000 Plant assets (net) 367,169 319,000 Total assets Liabilities Current Liabilities $471,922 $408,000 $108,936 $72,000 Long-term liabilities 109,986 83,000 +A +A Increase or (Decrease) Amount Percentage % de % % do % % de Total liabilities $218,922 $155,000 do % Stockholders' Equity Common stock, $1 par 120,946 106,000 % Retained earnings 132,054 147,000 %…arrow_forwardAs of December 31, 2021, Halaga Corporation reported the following items in its balance sheet: Cash- P520,000 Receivables- P240,000 Inventory- P350,000 Equipment- P850,000 Accounts payable- P325,650 Short-term notes payable- P524,500 Long-term debt- P1,049,850 Weighted average of outstanding shares in 2021- P250,000 Halaga Corporation contracted a third-party appraiser which has determined that the replacement value of its assets. This resulted to P14.22 calculation as its replacement value per share of the company.Based on the report of the appraiser, the property and plant have replacement cost of 125% of its reported value. On the other hand, the equipment only commands replacement cost of 70% of its value. According to the appraiser, the equipment was designed using an old technology, thus, the lower replacement cost. Other assets and liabilities are valued fairly.How much is the book value per share of Halaga Corporation as of December 31, 2021? a. Php 0.24 b. Php 14.22 c.…arrow_forwardIncome Statement Bullseye, Incorporated's 2021 income statement lists the following income and expenses: EBIT = $701,000, Interest expense = has no preferred stock outstanding and 310, 000 shares of common stock outstanding. What are the 2021 earnings per share? $51, 500, and Taxes = $218,000. Bullseye'sarrow_forward

- The balance sheet for Campbell Corporation follows: Current assets $233,000 763,000 $996, 000 $141,000 456,000 597,000 399,000 $996,000 Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings Total liabilities and stockholders' equityarrow_forwardhe financial statements of Friendly Fashions include the following selected data (in millions): ($ in millions except share data) 2021 2020 Sales $ 9,343 $ 10,434 Net income $ 230 $ 748 Stockholders' equity $ 1,760 $ 2,240 Average Shares outstanding (in millions) 640 - Dividends per share $ 0.33 - Stock price $ 8.10 - Required:Calculate the following ratios for Friendly Fashions in 2021. (Enter your Dividend yield and Price-earning ratio values to 2 decimal places. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).)arrow_forwardWD Corporation reports the following year-end balance sheet data. The company's debt-to-equity ratio equals: Cash $ 42,000 Current liabilities $ 77,000 Accounts receivable 57,000 Long-term liabilities 28,000 Inventory 62,000 Common stock 102,000 Equipment 147,000 Retained earnings 101,000 Total assets $ 308,000 Total liabilities and equity $ 308,000arrow_forward

- SW Company provides the Equity & Liability information below for analysis. SW Company had net income of $365, 700 in 2023 and $335,800 in 2022. Equity and Liabilities 2023 2022 Share capital-common (137,700 shares issued) $ 1,417,500 $ 1,417,500 Retained earnings (Note 1) 417,700 311, 300 Accrued liabilities 10,300 6,500 Notes payable (current) 82,700 65,500 Accounts payable 59,500 179,000 Total equity and liabilities $1,987,700 $ 1,979,800 Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023. Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,454,000 at December 31, 2021.) (Round your answers to 1 decimal place.) 2. Calculate the book value per shares for 2022 and 2023. (Round your answers to 2 decimal places.)arrow_forwardA public company has the following balance sheet ($000’s) Cash $540 Accounts Receivable $4,580 Inventories $7,400 Long Term Debt $12,590 Net Fixed Assets $18,955 Common Equity $18,885 Total Assets $31,475 Total debt & Equity $31,475 At present, the firm’s common stock is selling for a price equal to its book value, and the form’s bonds are selling at par. The market requires a 15% return on the common stock, the firm’s bond’s command a yield to maturity of 8% and firm faces a tax rate of 34%. What is the firm’s weighted average cost of capital?arrow_forwardBill Inc.'s last year financial statements are shown below: Bill Inc. Balance Sheet as of December 31 Cash $ 90,000 Accounts payable $ 180,000 Receivables 180,000 Notes payable 78,000 Inventory 360,000 Accruals 90,000 Total current assets $630,000 Total current liabilities $ 348,000 Common stock 900,000 Net fixed assets 720,000 Retained earnings 102,000 Total assets $1,350,000 Total liabilities and equity $1,350,000 Bill Inc. Income Statement for December 31 Sales $1,800,000 Operating costs 1,639,860 EBIT $ 160,140 Interest 10,140 EBT $ 150,000 Taxes (40%) 60,000 Net income $90,000 Dividends (60%) $ 54,000 Addition to retained earnings $ 36,000 Suppose that next year's sales will increase by 20 percent over last year's sales. Construct the pro forma financial statements using the percent of sales method. Assume the firm…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education