FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

62.) Using Financial Statements for 2018-2019. The amount of shares of

TRUE OR FALSE?

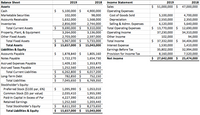

Transcribed Image Text:**Balance Sheet and Income Statement Overview (2018-2019)**

---

**Balance Sheet**

**Assets:**

1. **Current Assets:**

- Cash:

- 2019: $5,100,000

- 2018: $4,900,000

- Marketable Securities:

- 2019: $102,000

- 2018: $98,000

- Accounts Receivable:

- 2019: $1,632,000

- 2018: $1,568,000

- Inventories:

- 2019: $2,856,000

- 2018: $2,744,000

- **Total Current Assets:**

- 2019: $9,690,000

- 2018: $9,310,000

2. **Fixed Assets:**

- Property, Plant, & Equipment:

- 2019: $3,264,000

- 2018: $3,136,000

- Other Fixed Assets:

- 2019: $2,703,000

- 2018: $2,597,000

- **Total Fixed Assets:**

- 2019: $5,733,000

- 2018: $5,733,000

3. **Total Assets:**

- 2019: $15,657,000

- 2018: $15,043,000

**Liabilities and Equity:**

1. **Liabilities:**

- Current Liabilities:

- Accounts Payable:

- 2019: $1,878,840

- 2018: $1,805,160

- Notes Payable:

- 2019: $1,722,270

- 2018: $1,654,730

- Accrued Expenses Payable:

- 2019: $1,409,130

- 2018: $1,353,870

- Accrued Taxes Payable:

- 2019: $1,252,560

- 2018: $1,203,440

- **Total Current Liabilities:**

Expert Solution

arrow_forward

Step 1

The organization can raise their fund using different resources and preferred stock are one of them. Preferred stockholders are eligible to get a fixed percentage of dividends.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2018 2017 Net Income (in millions) ? ? Weighted Average Shares Outstanding (in millions) Basic Number Shares ? 59.2 Diluted Number of Shares 64.8 ? Earnings Per Share Basic 1.50 1.09 Diluted 1.43 1.02arrow_forward1. Using the data below, How many shares of preference share capital were issued during 2019? using data number 1, at what average price was the preference share capital issued during 2019? * using data number 1, assuming no other transactions affected the Retained Earnings except for the result of the corporation’s operations, how much is the 2019 profit (net loss)?arrow_forwardOn July 1, 2020. Rhod Corporation issued 1,000 P15 par ordinary shares at P19 and 2,000 P50 par redeemable preference shares at P60. Question: What is the amount debited to Cash?arrow_forward

- The equity section of a company for the last 2 years shows the following: - Share capital 885 M Euros in 2020 (777 M euros in 2019) - Share premium 3,555 M euros in 2020 (2,941 M euros in 2019) - Retained earnings 6,241 M euros in 2020 (5,293 M euros is 2019) - Treasury shares 82 M euros in 2020 (50 M euros in 2019) Assuming the par value of the company shares is 2 euros. Which of the following statement is correct regarding 2020? do calculation please The company has issued 54 million new shares The company has issued 108 million new shares The company has issued 722 million new shares The company has issued 361 million new sharesarrow_forwardDarrow_forwardBlossom Corporation issued $3 million of 10-year, 6% callable convertible subordinated debentures on January 2, 2023. The debentures have a face value of $1,000, with interest payable annually. The current conversion ratio is 13:1, and in two years it will increase to 16:1. At the date of issue, the bonds were sold at 100 to yield a 6% effective interest rate. The bond discount is amortized using the effective interest method. Blossom's effective tax rate was 30%. Net income in 2023 was $7.0 million, and the company had 2 million shares outstanding during the entire year. For simplicity, ignore the requirement to record the debentures' debt and equity components separately.arrow_forward

- 1. Spark has paid the following dividends during 2021-2022: Date 9 April 2021 1 October 2021 8 April 2022 7 October 2022 The price of Spark shares at the start of 2021, 2022, and 2023 are Date 5 January 2021 5 January 2022 4 January 2023 (a) What is the HPR for 2021? What is the HPR for 2022? Dividend 12.5c 12.5c 12.5c 12.5c Price 4.80 4.49 5.34arrow_forwardRakesharrow_forwardAssume that the following quote for the Walt Disney Company, a NYSE stock, appeared on some particular date of 2019 on Yahoo! Finance ( https://finance.yahoo.com/quote/DIS?p=DIS&.tsrc=fin-srch): The Walt Disney Company (DIS) - NYSE 136.55 +2.76 (+2.06%) Prev Close: 133.79 Day's Range: 135.63 - 138.47 Open: 140.22 52wk Range: 104.50 - 143.83 Bid: 136.55 x 800 Volume: 23,891,567 Ask: 137.00 x 1800 Avg Vol (3m): 7,947,016 1y Target Est: 151.04 Market Cap: 247.284B Analyst Recommendation Buy P/E (ttm) 21.01 Next Earnings Date: Feb. 3-7, 2020 EPS (ttm): 6.50 Div & Yield: 1.52 (1.14%) Given this information, answer the following questions. At what price did the stock sell at the time of the quote? $ What is the stock's price/earnings ratio? What does that indicate? Round your answers to the nearest whole number. This means that investors are willing to pay more than $ for every $1 of earnings per share that the company generated…arrow_forward

- The following financial information is available for Flintlock Corporation. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income BIU T₂ T² Ix !!! 111 2022 lil $2,532 298 40 504 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. Comment on your findings. W 2021 $2,591 144 611 40 555 트 M II á TT ¶ O Word(s)arrow_forwardWhat is the answer for these? and how do we find them k. Return on common stockholders' equity % %l. Price-earnings ratio, assuming that the market price was $72.12 per share on May 29, 2018, and $53.06 per share on May 30, 2017.arrow_forwardThe following data is available for Sheffield Service Corporation at December 31, 2020: Common stock, par $10 (authorized 100000 shares) Treasury Stock (at cost $15 per share) $413000 O 41300 O 50000 O 37700 O 48200 54000 Based on the data, how many shares of common stock are outstanding?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education