FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

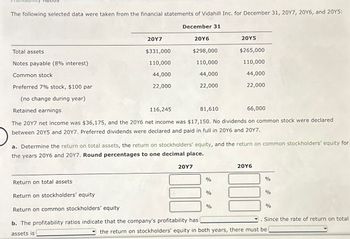

Transcribed Image Text:The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5:

December 31

20Y7

20Y6

20Y5

Total assets

$331,000

$298,000

$265,000

Notes payable (8% interest)

110,000

110,000

110,000

Common stock

44,000

44,000

44,000

Preferred 7% stock, $100 par

22,000

22,000

22,000

(no change during year)

Retained earnings

116,245

81,610

66,000

The 20Y7 net income was $36,175, and the 20Y6 net income was $17,150. No dividends on common stock were declared

between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7.

a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for

the years 20Y6 and 20Y7. Round percentages to one decimal place.

20Y7

20Y6

%

%

Return on total assets

Return on stockholders' equity

Return on common stockholders' equity

%

%

%

%

b. The profitability ratios indicate that the company's profitability has

assets is

the return on stockholders' equity in both years, there must be

Since the rate of return on total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- CHAPTER 11 NAME Shown below is information relating to the stockholders' equity of Revere Corporation at December 31, 2017. 8% cumulative preferred stock, $100 par, 50,000 shares authorized, 15,000 shares issued Common stock, $5 par, 1,500,000 shares authorized, 1,300,000 shares issued and outstanding. Additional paid-in capital: preferred stock Additional paid-in capital: common stock Retained earnings..... Each account needs a $ sign. $1,500,000 6,500,000 250,000 3,750,000 3,260,000arrow_forwardSolve this onearrow_forwardThe average stockholders’ equity for TWU Company for 2017 was $2,000,000. Included in this figure is $200,000 par value of 8% preferred stock, which remain unchanged during the year. The return on common shareholders’ equity was 12.5% during 2017. How much was the net income of the company in 2017?arrow_forward

- Phelps, Inc. had assets of $84,556, liabilities of $18,556, and 12,778 shares of outstanding common stock at December 31, 2017. Net income for 2017 was $9,456. The company had assets of $99,361, liabilities of $22,261, 11,401 shares of outstanding common stock, and its stock was trading at a price of $10 per share at December 31, 2018. Net income for 2018 was $10,598. Required: a. Calculate EPS for 2018. b. Calculate ROE for 2018. c. Calculate the Price/Earnings Ratio for 2018. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate EPS for 2018. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) EPSarrow_forwardBasic Earnings per Share Monona Company reported net income of $29,975 for 2016. During all of 2016, Monona had 1,000 shares of 10%, $100 par, nonconvertible preferred stock outstanding, on which the year's dividends had been paid. At the beginning of 2016, the company had 7,000 shares of common stock outstanding. On April 2, 2016, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2016. Common dividends of $17,000 had been paid during 2016. At the end of 2016, the market price per share of common stock was $17.50. Required: 1. Compute Monona's basic earnings per share for 2016. If required, round your answer to two decimal places. per share 2. Compute the price/earnings ratio for 2016. If required, round your answer to one decimal place. timesarrow_forwardOn December 31, 2016, Cullumber Company had 1,385,000 shares of $6 par common stock issued and outstanding. At December 31, 2016, stockholders’ equity had the amounts listed here. Common Stock $8,310,000 Additional Paid-in Capital 1,825,000 Retained Earnings 1,180,000 Transactions during 2017 and other information related to stockholders’ equity accounts were as follows. 1. On January 10, 2017, issued at $109 per share 124,000 shares of $104 par value, 9% cumulative preferred stock. 2. On February 8, 2017, reacquired 17,900 shares of its common stock for $11 per share. 3. On May 9, 2017, declared the yearly cash dividend on preferred stock, payable June 10, 2017, to stockholders of record on May 31, 2017. 4. On June 8, 2017, declared a cash dividend of $1.75 per share on the common stock outstanding, payable on July 10, 2017, to stockholders of record on July 1, 2017. 5. Net income for the year was $3,515,000. Prepare the stockholders’ equity…arrow_forward

- Wilco Corporation has the following account balances at December 31, 2017. Common stock, $5 par value $510,000. Treasury stock 90,000. Retained earnings 2,340,000. Paid-in capital in excess of par-common stock 1,320,000. Prepare Wilco’s December 31, 2017, stockholders’ equity section.arrow_forwardFollowing are the Balance Sheets of X Ltd. for the year 2014 and 2015. 2014 2015 sin '000 sin '00 L Equity and Liabilities (1) Shareholders' Funds (a) Share Capital : Equity Share Capital 8% Redeemable Preference Share Capital (b) Reserves and Surplus : General Reserve Surplus Account (2) Non-current Liabilities 200 320 150 90 40 70 15 38 Debentures 100 90 (3) Current Liabilities Creditors 55 83 Bills Payable Proposed Dividend (Treating it as non-current liability) Provision for Tax (NCL) 20 16 42 50 40 50 Total Equity and Liabilities 662 807 II. Assets (1) Non-current Assets Fixed Assets: Land & Building Plant & Machinery Intangible Asset : Goodwill 200 80 170 200 80 100 (2) Current Assets Stock Debtors B/R Cash & Bank Balances 59 250 30 18 87 150 20 25 Total Assets 662 807 Additional Information: (1) (1) (I) (IV) An interim dividend of $ 20,000 has been paid in 2015. $ 35,000 income tax was paid during the year 2015. Dividend of $ 28,000 was paid during the year 2015. During the year…arrow_forwardNonearrow_forward

- Divac Company has developed a statement of stockholders' equity for the year 2017 as follows: Preferred Stock Paid-InCapital—Preferred Common Stock Paid-InCapital—Common Retained Earnings Balance, Jan. 1 $100,000 $50,000 $400,000 $40,000 $200,000 Stock issued 100,000 10,000 Net income 87,000 Cash dividend -45,000 Stock dividend 10,000 5,000 -15,000 Balance, Dec. 31 $110,000 $55,000 $500,000 $50,000 $227,000 Divac’s preferred stock is $100 par, 8% stock. If the stock is liquidated or redeemed, stockholders are entitled to $120 per share. There are no dividends in arrears on the stock. The common stock has a par value of $5 per share. Assume that the common stockholders have a right to the total net income of $87,000. Determine the book value per share of Divac’s common stock. Round the book value per share to two decimals.$fill in the blank_____ per sharearrow_forwardBalance Sheet of Do Well Ltd. As on 31st March, 2016 was as follows: 1. Equity and Liabilities (1) Shareholders' Funds (a) Share Capital: Equity Shares @ $10 each 2,00,000 (Ь) Reserves and Surplus : Surplus Account 1,20,000 (2) Non-current Liabilities 6% Debentures 1,20,000 (2) Current Liabilities Creditors 60,000 Proposed Dividend 20,000 Total Equity and Liabilities 5,20,000 II. Assets (1) Non-current Assets Fixed Assets : Freehold Property 1,00,000 (2) Current Assets Stock 1,20,000 Debtors 80,000 Balance at Bank 2,20,000 Total Assets 5,20,000 At the annual general meeting held on 18th April, 2016 it was resolved: (i) To declare dividend of 10% for the accounting year ended on 31st March, 2016. (ii) To issue one bonus share for every 4 shares held out of Surplus Account. (iii) To give existing shareholders the option to purchase for cash one share for $15 for every 4 shares held prior to the bonus distribution. This option was accepted by all the shareholders. (On this no bonus share…arrow_forwardStatement of stockholders' equityScott Lockhart owns and operates AAA Delivery Services. On January 1,20Y7, Common Stock had a balance of $40,000, and Retained Earningshad a balance of $815,500. During the year, no additional common stock was issued, and $10,000 of dividends were paid. For the year endedDecember 31, 2017, AAA Delivery reported a net income of $67,250.Prepare a statement of stockholders' equity for the year endedDecember 31, 20Y7.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education