Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Give me answer of this question

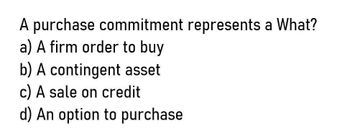

Transcribed Image Text:A purchase commitment represents a What?

a) A firm order to buy

b) A contingent asset

c) A sale on credit

d) An option to purchase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is an option? OA) A contract that is derived from some other underlying quantity, index, asset or event. B) A contract that gives the holder the right to buy or sell something at a specified price. C) A contract that gives the holder the right to sell an instrument at a pre- specified price. D) A contract that gives the holder the right to acquire an instrument at a pre- specified price.arrow_forwardwhich one is correct please confirm? Q4: Options are contracts that give the purchasers the option to buy or sell an underlying asset the obligation to buy or sell an underlying asset. the right to hold an underlying asset. the right to switch payment streams.arrow_forwardA contract requiring a specified future monetary payment at a specified future point in time in exchange for the delivery of a specific asset is called a: *A. nonconvertible option.B. hedge.C. long contract.D. swap.arrow_forward

- The seller of an option contract has the to buy or sell the underlying asset while the buyer of an option contract has the to buy or sell the underlying asset. O O O A right; obligation B с D obligation; right right; right obligation; obligationarrow_forwardWhich of the following gives the holder the right to buy the asset at a specified strike price? OA. A future contract OB. A put OC. An ETF OD. A stock OE. A callarrow_forwardWhich of the following gives the holder the right to sell the asset at a specified strike price? OA. A stock OB. A put OC. An ETF OD. A future contract OE. A callarrow_forward

- Explain the following concepts: (a) bargain purchase option and (b) bargain renewal option.arrow_forwardDistinguish between a conditional sale, on the one hand, and an absolute sale, on the other handarrow_forwardWhich of the following best describes an option contract? a. It gives the holder the obligation to buy or sell an underlying asset at a prespecified price for a specified time period. b. It gives the holder the right, but not the obligation, to buy or sell an underlying asset at a prespecified price for an unspecified time period. c. It gives the holder the right, but not the obligation, to buy or sell an underlying asset at a prespecified price for a specified time period. d. It gives the holder the right, but not the obligation, to buy or sell an underlying asset at an unspecified price for an unspecified time period.arrow_forward

- According to the fair value principle, assets and liabilities should be reported Select answer from the options below 1.at their fair market value. 2.at their historical cost. 3.at a value agreed upon by interested parties. 4.at cost plus inflation.arrow_forwardWhen does a buyer-lessor recognize a financial asset from a sale and leaseback transaction? Fair Value > Carrying Amount Fair Value < Carrying Amount Sale Price > Fair Value Sale Price < Fair Valuearrow_forwardexplain the main different between acquisition method, interest pooling g method and the purchase methodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning