ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

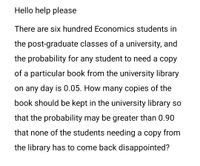

Transcribed Image Text:Hello help please

There are six hundred Economics students in

the post-graduate classes of a university, and

the probability for any student to need a copy

of a particular book from the university library

on any day is 0.05. How many copies of the

book should be kept in the university library so

that the probability may be greater than 0.90

that none of the students needing a copy from

the library has to come back disappointed?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- At races, your horse, White Rum, has a probability of 1/20 of coming 1st, 1/10 of coming 2nd and a probability of 1⁄4 in coming 3rd. First place pays $5,000 to the winner, second place $4,000 and third place $1,350.Hence, is it worth entering the race if it costs $1050? Your company plans to invest in a particular project. There is a 40% chance you will lose $3,000, a 45% chance you will break even, and a 15% chance you will make $5,500. Based solely on this information, what should you do? On 1st Jan 2006, a business had inventory of $19,000. During the month, sales totalled $32,500 and purchases $24,000. On 31st Jan 2006 a fire destroyed some of the inventory. The undamaged goods in inventory were valued at $11,000. The business operates with a standard gross profit margin of 30%. Based on this information, what is the cost of the inventory destroyed in the fire?arrow_forwardIf the farmer uses pesticides he expects a crop of 60,000 bushels; if he does not use pesticides he expects a crop of 50,000 bushels. The cost of pesticides is $30,000 and the other costs associated with planting and harvesting the crop total $450,000. The price of corn at harvest time will either be $9.00 with probability of 0.50 or it will be $11.00 with probability 0.50, so if the farmer decides to sell the crop at harvest, the expected price per bushel that he will receive is $10.00. If the farmer decides to sell the crop at harvest, then: a. He should not use pesticides because not using pesticides ensures greater expected profit. b. He should not use pesticides because not using pesticides ensures lower expected profit. c. He should use pesticides because using pesticides ensures greater expected profit. d. He should use pesticides because using pesticides ensures lower expected profit.arrow_forwardIf the farmer uses pesticides he expects a crop of 60,000 bushels; if he does not use pesticides he expects a crop of 55,000 bushels. The cost of pesticides is $20,000 and the other costs associated with planting and harvesting the crop total $450,000. The price of corn at harvest time will either be $10.00 with probability of 0.50 or it will be $12.00 with probability 0.50, so if the farmer decides to sell the crop at harvest, the expected price per bushel that he will receive is $11.00. If the farmer does not use pesticides and decides to sell the crop at harvest, what is his expected revenue? a. $550,000.00 b. $660,000.00 c. $600,000.00 d. $605,000.00arrow_forward

- Solve on paper ( economics)arrow_forwardConsider a worker who works for at most two periods (say, when young and when old) at a particular firm. Each period, the worker can choose between exerting high effort and exerting low effort. The worker's cost of exerting high effort are Cy when young and Co when old. The worker's cost of exerting low effort are zero. The effort of the worker is difficult to observe by the firm. With probability T, the firm observes the worker's effort at the end of a period. With the remaining probability, the firm does not observe the worker's effort. The firm can only fire the worker when it observed that the worker has shirked. In that case, the firm is also allowed to withhold the worker's wage for the period in which the worker was caught shirking. When exerting high effort, the worker's productivity is q, when young and q, when old. When exerting low effort, the worker's productivity is zero. The worker's value of alternative job opportunities is when young and v, when old. For simplicity, the…arrow_forwardTo go from Location 1 to Location 2, you can either take a car or take transit. Your utility function is: U= -1Xminutes -5Xdollars +0.13Xcar (i.e. 0.13 is the car constant) Car= 15 minutes and $8 Transit= 40 minutes and $4 What is your probability of taking transit given the conditions above? What is your probability of taking transit if the number of buses on the route were doubled, meaning the headways are halved? Remember to include units.arrow_forward

- Consider the following interaction between a student and a company. The student is either serious or lazy with probabilities 1/3 and 2/3 respectively. The student knows if they are serious or not, but the company does not. Initially, the student decides whether to revise for exams or not. Revising has a cost of 1 for a serious student and 3 for a lazy one. The company observes the student's exam result (that is, whether they have made the effort to revise), and based on this, offers a salary of 3 (for a serious student) or 1 (for a lazy student). The student learns of the proposed salary and can then either accept (and earn the salary) or refuse (and earn O). They also lose the revision effort if they worked. The company's gain is equal to the student's productivity (4 if they are serious, 2 if not) minus the salary if the student accepts the offer, and O otherwise. 1. Represent the game in extensive form. 2. Show that the game has a unique perfect Bayesian Equilibrium, and provide the…arrow_forwardIndustry standards suggest that 12 percent of new vehicles require warranty service within the first year. University Toyota in Morgantown, WV sold 10 Toyotas yesterday. What is the probability that exactly one of these vehicles will require warranty service?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education