ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

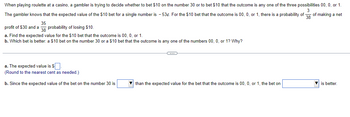

Transcribed Image Text:When playing roulette at a casino, a gambler is trying to decide whether to bet $10 on the number 30 or to bet $10 that the outcome is any one of the three possibilities 00, 0, or 1.

3

The gambler knows that the expected value of the $10 bet for a single number is - 53¢. For the $10 bet that the outcome is 00, 0, or 1, there is a probability of 38 of making a net

profit of $30 and a probability of losing $10.

35

38

a. Find the expected value for the $10 bet that the outcome is 00, 0, or 1.

b. Which bet is better: a $10 bet on the number 30 or a $10 bet that the outcome is any one of the numbers 00, 0, or 1? Why?

a. The expected value is $.

(Round to the nearest cent as needed.)

b. Since the expected value of the bet on the number 30 is

C

than the expected value for the bet that the outcome is 00, 0, or 1, the bet on

is better.

Expert Solution

arrow_forward

Given

The probability for net profit of 30 is 3/38

The probability for lossing of 10 is 35/38

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3arrow_forwardA salesperson is trying to sell cars. The number of cars that she will sell depends on her effort "e" and her luck. Given her effort e, with probability 4e she is able to sell four cars, and with probability (1 - 4e) she is able to sell only one car. Her personal cost of effort is 100e². The dealership pays her a bonus b for each car sold. The salesperson is risk-neutral, and wants to maximize her expected utility, which is her expected income minus her effort cost. a) Given the bonus b, the salesperson's best response function is b) Suppose the dealership pays b = 2. Then the expected number of cars sold will be E(Q)=arrow_forward5. A shipment of 24 electric stoves is rejected if three 3 are checked for defects and at least one 1 is found ton be defective. Find the probability that the shipment will be returned if there are actually six stoves that are defectives.arrow_forward

- 19arrow_forwardAt races, your horse, White Rum, has a probability of 1/20 of coming 1st, 1/10 of coming 2nd and a probability of 1⁄4 in coming 3rd. First place pays $5,000 to the winner, second place $4,000 and third place $1,350.Hence, is it worth entering the race if it costs $1050? Your company plans to invest in a particular project. There is a 40% chance you will lose $3,000, a 45% chance you will break even, and a 15% chance you will make $5,500. Based solely on this information, what should you do? On 1st Jan 2006, a business had inventory of $19,000. During the month, sales totalled $32,500 and purchases $24,000. On 31st Jan 2006 a fire destroyed some of the inventory. The undamaged goods in inventory were valued at $11,000. The business operates with a standard gross profit margin of 30%. Based on this information, what is the cost of the inventory destroyed in the fire?arrow_forwardIf the farmer uses pesticides he expects a crop of 60,000 bushels; if he does not use pesticides he expects a crop of 50,000 bushels. The cost of pesticides is $30,000 and the other costs associated with planting and harvesting the crop total $450,000. The price of corn at harvest time will either be $9.00 with probability of 0.50 or it will be $11.00 with probability 0.50, so if the farmer decides to sell the crop at harvest, the expected price per bushel that he will receive is $10.00. If the farmer decides to sell the crop at harvest, then: a. He should not use pesticides because not using pesticides ensures greater expected profit. b. He should not use pesticides because not using pesticides ensures lower expected profit. c. He should use pesticides because using pesticides ensures greater expected profit. d. He should use pesticides because using pesticides ensures lower expected profit.arrow_forward

- Question 21 On the average, the amount of money that a customer spends in the store is $40 with a standard deviation $1O. The probability that the total spending of 4 customers in the store is over $170 is closest to 0.1543 0.3085 0.2376 O 0.4013 not able to calculatearrow_forwardIn a large casino, the house wins on its blackjack tables with a probability of 50.9%. All bets at blackjack are 1 to 1, which means that if you win, you gain the amount you bet, and if you lose, you lose the amount you bet. a. If you bet $1 on each hand, what is the expected value to you of a single game? What is the house edge? b. If you played 150 games of blackjack in an evening, betting $1 on each hand, how much should you expect to win or lose? c. If you played 150 games of blackjack in an evening, betting $3 on each hand, how much should you expect to win or lose? d. If patrons bet $7,000,000 on blackjack in one evening, how much should the casino expect to earn? a. The expected value to you of a single game is $ (Type an integer or a decimal.)arrow_forwardOn Monday's there are eight classes taught in the business building. The probability that any of those classes starts late is 0.3. What is the probability that at least one these classes will start late on Monday?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education