Players would draw a card from a standard 52 card deck. Whatever card they drew determined what they won. If they draw a face card (Jack, King, Queen) then they win $5. If they draw an Ace, they win $15. For all other cards, they win nothing.

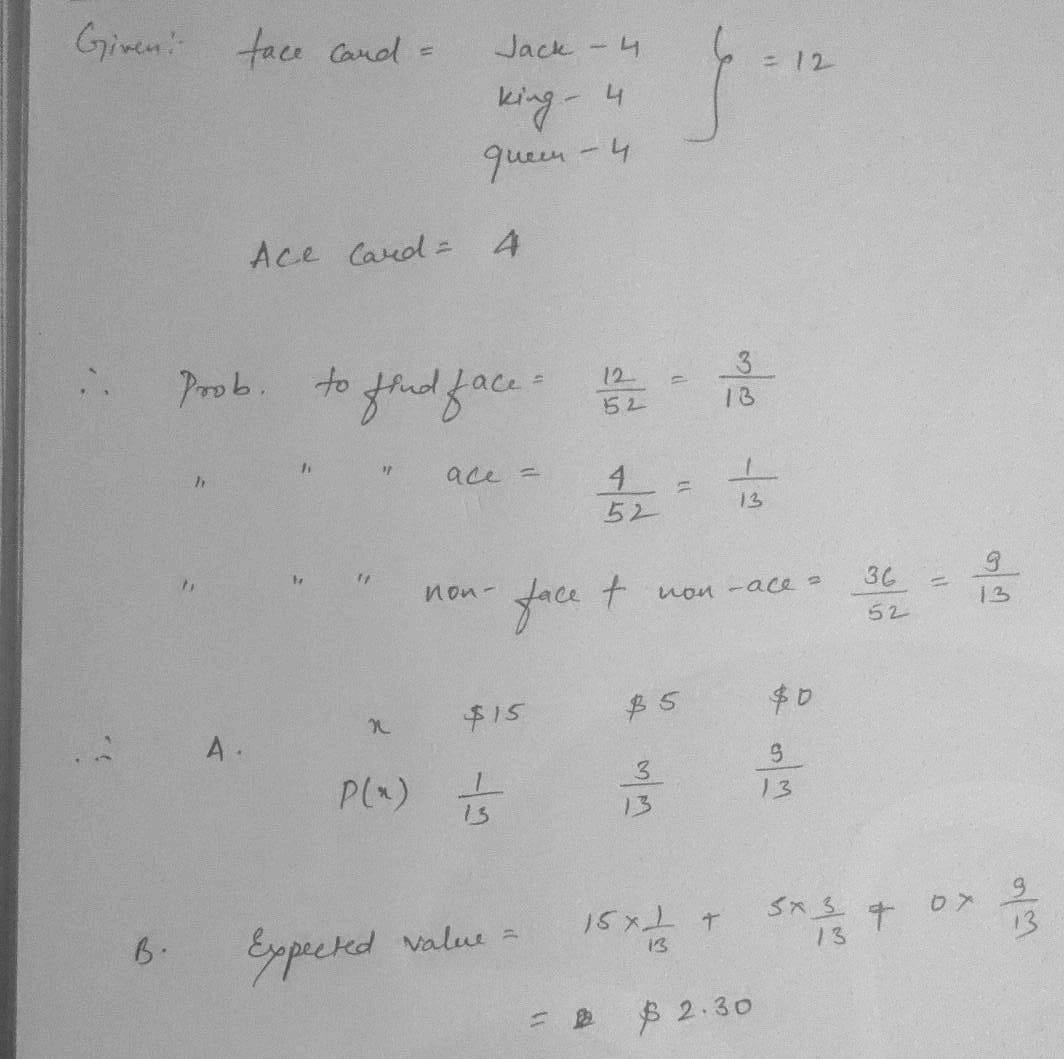

A. Fill out the probability distribution table with the probabilities of each possible outcome for this game. Round decimals to four places.

| x | $15 | $5 | $0 |

| P(x) |

B. What is the expected value of the distribution above? (Round to the nearest cent, two decimal places.)

C. If players were charged $2 per game, would they make and average profit on the games over time, or would they take an average loss over time?

D. If players were charged $3 per game, would they make and average profit on the games over time, or would they take an average loss over time?

Step by stepSolved in 2 steps with 2 images

- uestion Completion Status: Player 2 L R U 1,0 0,1 Player 1 D 0,1 1,0 Suppose Player 2 is using the following strategy: she plays L with probability 0.70 and she plays R with probability 0.30. In this case: a) If Player 1 plays U, then Player 1 attains an expected payoff of 0.70 b) If Player 1 plays D, then Player 1 attains an expected payoff of 0.30 c) Therefore, the best response of Player 1 is to play U with probability 1.00 and D with probability 0arrow_forwardIm confused on how to complete thisarrow_forwardQuestion is in attached image, Thank you!arrow_forward

- 21 Los Angeles averages 266.5 sunny days per year. What is probability that Boston has at least as many sunny days as Los Angeles? a 0.0020 b 0.0031 c 0.0047 d 0.0073arrow_forwardI need help solving problem 2 sections a-c. Please note that this is not graded work. I obtained this question from an old text book to help me practice problem sets. Do let me know if you have additional questions.arrow_forward3arrow_forward

- A salesperson is trying to sell cars. The number of cars that she will sell depends on her effort "e" and her luck. Given her effort e, with probability 4e she is able to sell four cars, and with probability (1 - 4e) she is able to sell only one car. Her personal cost of effort is 100e². The dealership pays her a bonus b for each car sold. The salesperson is risk-neutral, and wants to maximize her expected utility, which is her expected income minus her effort cost. a) Given the bonus b, the salesperson's best response function is b) Suppose the dealership pays b = 2. Then the expected number of cars sold will be E(Q)=arrow_forwardA construction company needs to move lumber onto the roof of a building. If the lumber falls and hits someone it will cause $1,200,000 in damage. Assume that company must choose between the following levels of precaution: Spend $500 and the probability of an accident is .05 Spend $5,000 and the probability of an accident is .01 Spend $8,000 and the probability of an accident is .008 Spend $10,000 and the probability of an accident is .003 If the construction company is strictly liable for the costs of the accident, how much would they spend on precaution? A. $500 B. $5,000 C. $8,000 D. $10,000arrow_forwardThe question is in the attached image. Thank you!arrow_forward

- Please do not give solution in image format thanku Two Manufacturers supply food to a large cafeteria. Manufacturer A supplies 40% of the soup served in the cafeteria, while Manufacturer B supplies 60% of the soup that is served. 3% of the soup cans provided by Manufacturer A are found to be dented, while 1% of the cans provided by Manufacturer B are found to be dented. Given that a can of soup is dented, find the probability that it came from Manufacturer B.arrow_forwardPls do both questionsarrow_forward1. Suppose the prices of used cars in the market are normally distributed with a mean of $15,000 and a standard deviation of $7,5000. What is the probability of selecting a car from this market and its priced above $20,000.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education