EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General Accounting Question Solve Please

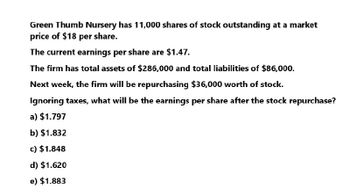

Transcribed Image Text:Green Thumb Nursery has 11,000 shares of stock outstanding at a market

price of $18 per share.

The current earnings per share are $1.47.

The firm has total assets of $286,000 and total liabilities of $86,000.

Next week, the firm will be repurchasing $36,000 worth of stock.

Ignoring taxes, what will be the earnings per share after the stock repurchase?

a) $1.797

b) $1.832

c) $1.848

d) $1.620

e) $1.883

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Green Thumb Nursery has 11,000 shares of stock outstanding at a market price of $18 per share. The current earnings per share are $1.47. The firm has total assets of $286,000 and total liabilities of $86,000. Next week, the firm will be repurchasing $36,000 worth of stock. Ignoring taxes, what will be the earnings per share after the stock repurchase? a) $1.797 b) $1.832 c) $1.848 d) $1.620 e) $1.883arrow_forwardGreen Thumb Nursery has 11,000 shares of stock outstanding at a market price of $18 per share. The current earnings per share are $1.47. The firm has total assets of $286,000 and total liabilities of $86,000. Next week, the firm will be repurchasing $36,000 worth of stock. Ignoring taxes, what will be the earnings per share after the stock repurchase? a) $1.797 b) $1.832 c) $1.848 d) $1.620 e) $1.883 On Jan. 1, XYZ started a new business. The shareholders made an initial cash investment of $1,000,000. During the year, the company provided $10,500,000 of services to customers. On December 31, XYZ had a balance in Accounts Receivable of $1,200,000. Also, during the year, the company incurred expenses of $8,800,000 and ended the year with a balance in Accounts Payable of $920,000. What is XYZ's income before income taxes for the year, under the Cash and Accrual basis? A. Cash Basis: $9,300,000 Accrual Basis: $10,500,000 B. Cash Basis: $1,700,000 Accrual Basis: $1,420,000 C. Cash Basis:…arrow_forwardBob’s Standard Station has 15,000 shares of stock outstanding at a market price of $15 a share. The current earnings per share are $1.26. The firm has total assets of $312,000 and total liabilities of $97,500. Next week, the firm will be repurchasing $37,500 worth of stock. Ignore taxes. What will be the earnings per share after the stock repurchase?arrow_forward

- Question: Financial accountingarrow_forwardprovide answer correctlyarrow_forwardThe market value balance sheet for Apple Pie Corp. reflects cash of $42,000, fixed assets of $319,000, and equity of $237,000. There are 7,500 shares of stock outstanding with a par value of $1 per share. The company has declared a dividend of $1.03 per share. The stock goes ex dividend tomorrow. Ignore any tax effects. What will be the price of the stock tomorrow morning?arrow_forward

- At year end, Sampson Company's balance sheet showed total assets of $80 million, total liabilities of $50 million, and 1,000,000 shares of common stock outstanding. Next year, Malta is projecting that it will have net income of $2.9 million. If the average P/E multiple in Malta's industry is 16, (and this is an average stock) what should be the price of Sampson's stock? O $50.43 O $46.40 O $44.57 O $41.60arrow_forwardneed help with questionarrow_forwardBreakaway wealth had net earnings of $336,000 this past year. dividends were paid of $77,280 on the company's book equity of $2,800,000. if Safeway has 175,000 shares outstanding with a current market price of $21 per share, what is the required rate of return?arrow_forward

- Botanical Gardens Nursery has 7, 500 shares of stock outstanding at a market price of $18 a share. The earnings per share are $1.23. The firm has total assets of $384, 000 and total liabilities of $ 146,000. Today, the firm is paying a quarterly cash dividend of $.22 a share. What will be the earnings per share after the dividend is paid if the tax rate on dividends is 15 percent?arrow_forwardFondren Machine Tools has total assets of $3,180,000 and current assets of $882,000. It turns over Its fixed assets 1.8 times per year. Its return on sales is 5.5 percent. It has $1,410,000 of debt. What is its return on stockholders' equlty? (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return on stockholders' equityarrow_forwardes Fondren Machine Tools has total assets of $3,420,000 and current assets of $803,000. It turns over its fixed assets 1.4 times per year. Its return on sales is 5.4 percent. It has $1,630,000 of debt. What is its return on stockholders' equity? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return on stockholders' equity %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning