Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

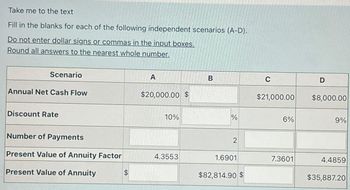

Transcribed Image Text:Take me to the text

Fill in the blanks for each of the following independent scenarios (A-D).

Do not enter dollar signs or commas in the input boxes.

Round all answers to the nearest whole number.

Scenario

Annual Net Cash Flow

Discount Rate

Number of Payments

Present Value of Annuity Factor

Present Value of Annuity

$

A

$20,000.00 $

10%

4.3553

B

%

2

1.6901

$82,814.90 $

C

$21,000.00

6%

7.3601

D

$8,000.00

9%

4.4859

$35,887.20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Question content area top Part 1 (Related to Checkpoint 6.4) (Present value of a perpetuity) What is the present value of a $350 perpetuity discounted back to the present at 16 percent? Question content area bottom Part 1 The present value of the perpetuity is $enter your response here. (Round to the nearest cent.)arrow_forwardMallings Review View Help e Search AaBbCcDd AaBbCcDd AaBbC AaBb AaBbCcD 三加三三、、田、 1 Normal 1 No Spac. Heading 1 Heading 2 Heading 3 Paragraph Styles 1) Find the amount accumulated FV in the given annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $2,800 is deposited quarterly for 20 years at 5% per year FV = $ 梦 0 93arrow_forwardanswer with working , explanation , formula answer in textarrow_forward

- Calculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase(Cash)Price DownPayment AmountFinanced Add-onInterest Number ofPayments FinanceCharge MonthlyPayment $6,000 15% $ 12 1 2 % 30 $ $arrow_forwardnnuity. Fill in the missing present values in the following table for an ordinary annuity: Future Value ate Data Table (Click on the following icon O in order to copy its contents into a spreadsheet) it Valuo $298 01 S3.396 92 S615 39 $2.459 07 6% 12% 2.5% 07% 18 0. 27 260 0. Print Done Check Aarrow_forwardWhat is the PV of an ordinary annuity with 10 payments of $6,600 if the appropriate interest rate is 5.5%? Select the correct answer. a. $49,766.03 b. $49,754.23 c. $49,771.93 d. $49,760.13 e. $49,748.33arrow_forward

- Future Value of an Annuity Find the future value of the following annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press FV, and find the FV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $600 per year for 10 years at 14%. $ $300 per year for 5 years at 7%. $ $600 per year for 5 years at 0%. $ Now rework parts a, b, and c…arrow_forwardNote: Round all answers to the nearest cent when necessary. Calculate the amount financed, the finance charge, and the total deferred payment price (in $) for the following installment loan. Purchase(Cash)Price DownPayment AmountFinanced MonthlyPayment Number ofPayments FinanceCharge TotalDeferredPaymentPrice $2,500 0 $ $186.69 18 $ $arrow_forwardAttempts Attempt 1 score is6.7This attempt is in progress. Keep the Highest 6.7 out of 106.7 / 10 5. Present value of annuities and annuity payments The present value of an annuity is the sum of the discounted value of all future cash flows. You have the opportunity to invest in several annuities. Which of the following 10-year annuities has the greatest present value (PV)? Assume that all annuities earn the same positive interest rate. An annuity that pays $500 at the end of every six months An annuity that pays $1,000 at the beginning of each year An annuity that pays $1,000 at the end of each year An annuity that pays $500 at the beginning of every six months You bought an annuity selling at $17,390.08 today that promises to make equal payments at the beginning of each year for the next eight years (N). If the annuity’s appropriate interest rate (I) remains at 5.00% during this time, then the value of the annual annuity payment…arrow_forward

- plz solve it within 30-40 mins I'll give you multiple upvotearrow_forwardDo not provide solution in imge format. and also do not provide plagarised content otherwise i dislikearrow_forwardHi, I am working on a regular payments savings plan spreadsheet assignment. I'm having trouble understanding what a compound is and how to find the interest.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education