International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General Accounting Question Solution

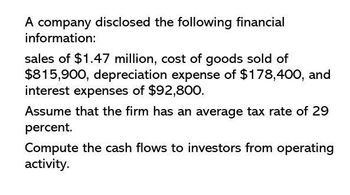

Transcribed Image Text:A company disclosed the following financial

information:

sales of $1.47 million, cost of goods sold of

$815,900, depreciation expense of $178,400, and

interest expenses of $92,800.

Assume that the firm has an average tax rate of 29

percent.

Compute the cash flows to investors from operating

activity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please Need Answer with calculationarrow_forwardAbcarrow_forwardThe Sandhill Mills Company has just disclosed the following financial information in its annual report: sales of $1.47 million, cost of goods sold of $815,300, depreciation expenses of $177,800, and interest expenses of $92,200. Assume that the firm has an average tax rate of 29 percent. Compute the cash flows to investors from operating activity. (Round intermediate calculations and final answer to 2 decimal places, e.g. 15.25.) Cash flow from operating activity +Aarrow_forward

- An analyst has collected the following information regarding National Co.:Earnings before interest and taxes (EBIT) = P730 million.Earnings before interest, taxes, depreciation and amortization (EBITDA) = P850 million.Interest expense = P100 million.The corporate tax rate is 25 percent.Depreciation is the company’s only non-cash expense or revenue.What is the company’s net cash flow?arrow_forwardJJ's has net sales of $48,920, depreciation of $711, cost of goods sold of $31,890, administrative costs of $11,210, interest expense of $680, dividends paid of $450, and taxes of $974. What is the cash flow from operating activities as it will appear on the accounting statement of cash flows if the firm spent $274 on net working capital?arrow_forwardNeed help with the questionsarrow_forward

- JJ's has net sales of $48,920, depreciation of $711, cost of goods sold of $31,890, administrative costs of $11,210, interest expense of $680, dividends paid of $450, and a tax rate of 20%. What is the net cash from operating activities as it will appear on the accounting statement of cash flows if the firm spent $274 on net working capital? $3,980 $3,056 $3,667 $4,066arrow_forwardCalculate the amount of the firm's after tax cash flow from operations? General accountingarrow_forwardWhat is the operating cash flow for this financial accounting question?arrow_forward

- What is the operating cash flow for this general accounting question?arrow_forwardThe Sunland Company has disclosed the following financial information in its annual reports for the period ending March 31, 2017: sales of $1.426 million, cost of goods sold of $815,000, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. Compute the cash flows to investors from operating activity. (Round answer to 2 decimal places, e.g. 15.25.) Cash flow from operating activity $arrow_forwardPlease Provide Answer in 2 decimal placesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub