Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

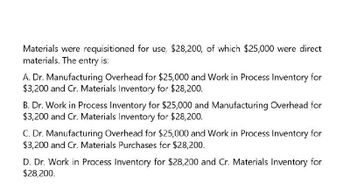

Transcribed Image Text:Materials were requisitioned for use, $28,200, of which $25,000 were direct

materials. The entry is:

A. Dr. Manufacturing Overhead for $25,000 and Work in Process Inventory for

$3,200 and Cr. Materials Inventory for $28,200.

B. Dr. Work in Process Inventory for $25,000 and Manufacturing Overhead for

$3,200 and Cr. Materials Inventory for $28,200.

C. Dr. Manufacturing Overhead for $25,000 and Work in Process Inventory for

$3,200 and Cr. Materials Purchases for $28,200.

D. Dr. Work in Process Inventory for $28,200 and Cr. Materials Inventory for

$28,200.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Selected information from Hernandez Corporation shows the following: Prepare journal entries to record the following: raw material purchased direct labor incurred depreciation expense (hint: this is part of manufacturing overhead) raw materials used overhead applied on the basis of $0.50 per machine hour the transfer from department 1 to department 2arrow_forwardMaterials were requisitioned for use, $28,200, of which $25,000 were direct materials. The entry is: A. Dr. Manufacturing Overhead for $25,000 and Work in Process Inventory for $3,200 and Cr. Materials Inventory for $28,200. B. Dr. Work in Process Inventory for $25,000 and Manufacturing Overhead for $3,200 and Cr. Materials Inventory for $28,200. C. Dr. Manufacturing Overhead for $25,000 and Work in Process Inventory for $3,200 and Cr. Materials Purchases for $28,200. D. Dr. Work in Process Inventory for $28,200 and Cr. Materials Inventory for $28,200.arrow_forwardManagerial accountingarrow_forward

- The cost of materials transferred into the Rolling Department of Keystone Steel Company is $590,700 from the Casting Department. The conversion cost for the period in the Rolling Department is $109,500 ($65,500 factory overhead applied and $44,000 direct labor). The total cost transferred to Finished Goods for the period was $687,200. The Rolling Department had a beginning inventory of $29,200. a1. Journalize the cost of transferred-in materials. a2. Journalize the conversion costs. If an amount box does not require an entry, leave it blank. a3. Journalize the costs transferred out to Finished Goods. b. Determine the balance of Work in Process—Rolling at the end of the period.arrow_forwardThe total cost of materials, labor, and overhead assigned to a job was $603. Company D transferred this job to its finished goods warehouse. Make the necessary journal entry to record this transaction.arrow_forwardSterling's records show the work in process inventory had a beginning balance of $3,000 and an ending balance of $4,000. How much direct labor was incurred if the records also show: Materials used $1,700 Overhead applied 500 Cost of goods manufactured 5,600arrow_forward

- Sterling's records show the work in process inventory had a beginning balance of $2,978 and an ending balance of $3,706. How much direct labor was incurred if the records also show: • Materials used $2,285 • Overhead applied $1,377 • Cost of goods manufactured $6,587 E noileeu PAntaubol medmuaarrow_forwardUhtred Manufacturing had the following transactions in October: 1. Purchased raw materials on account, $57,100. 2. Used materials in production: $18,500 in the Mixing Department; $5,100 in the packaging Department; $800 in indirect materials. 3. Incurred labor costs: $9,000 in the Mixing Department; $3,960 in the Packaging Department; $2,140 in indirect labor. 4. Incurred manufacturing overhead costs: $8,850 in machinery depreciation; paid $3,750 for rent and paid for utilities at a cost of $1,690. Prepare the journal entries for Uhtred Manufacturing. Date 1 2 3 4 Description O O O O O O O C O Debit Credit 000 Iarrow_forwardThe following costs relate to one month's activity in Martin Company: Indirect materials $ 300 Rent on factory building $ 500 Maintenance of equipment $ 50 Direct material used $1,200 Utilities on factory $ 250 Direct labour $1,500 Selling expense $ 500 Administrative expense $ 300 Work-in-process inventory, beginning $ 600 Work-in-process inventory, ending $ 800 Finished goods inventory, beginning $ 500 Finished goods inventory, ending $ 250 Required: (a.) Prepare a schedule of cost of goods manufactured in good form. (b.) Determine the cost of goods sold.arrow_forward

- The following data summarize the operations during the year. A. Purchase of raw materials on account. $3,100 B. Raw materials used by Job 1. $500 C. Raw materials used as indirect materials. $100 D. Direct labor for Job 1. $250 E. Indirect labor incurred. $40 F. Factory utilities incurred on account. $700 G. Adjusting entry for factory depreciation. $300 H. Manufacturing overhead applied as % of direct labor. 250% I. Job 1 is transferred to finished goods. J. Job 1 is sold. $2,900 K. Manufacturing overhead is overapplied. $80 Prepare a journal entry for each transaction. If an amount box does not require an entry, leave it blank.arrow_forwardThe following data summarize the operations during the year. A. Purchase of raw materials on account. $3,000 B. Raw materials used by Job 1. $500 C. Raw materials used as indirect materials. $100 D. Direct labor for Job 1. $300 E. Indirect labor incurred. $60 F. Factory utilities incurred on account. $750 G. Adjusting entry for factory depreciation. $200 H. Manufacturing overhead applied as % of direct labor. 200% I. Job 1 is transferred to finished goods. J. Job 1 is sold. $2,900 K. Manufacturing overhead is overapplied. $120 Prepare a journal entry for each transaction. If an amount box does not require an entry, leave it blank. A. Raw Materials Inventory 3,000 Accounts Payable 3,000 B. Work in Process Inventory 500 Raw Materials Inventory 500 C. Manufacturing Overhead 100 Raw Materials Inventory 100arrow_forwardCompany A transferred plastic costing $4,000 and sheet metal costing $22,000 to the factory floor to be used as direct materials in production. Make the necessary journal entry or entries to record these transactions.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning