Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

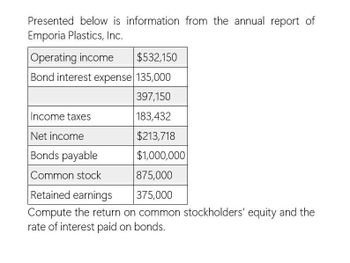

Accounting. Presented below is information from the annual report of emporia plastic, inc..

Transcribed Image Text:Presented below is information from the annual report of

Emporia Plastics, Inc.

Operating income

$532,150

Bond interest expense 135,000

397,150

Income taxes

183,432

Net income

$213,718

Bonds payable

$1,000,000

Common stock

875,000

375,000

Retained earnings

Compute the return on common stockholders' equity and the

rate of interest paid on bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the following balance sheet and income statement data, what is the debt to assets ratio? Current assets Net income 21600 44900 Stockholders' Current liabilities 9800 67000 equity Average assets 140000 Total liabilities 27600 Total assets 92600 Average common shares outstanding was 18000. O 40.7 percent O 32.2 percent O 19.7 percent O 29.8 percentarrow_forwardII. The following is a comparative balance sheet of ABC Co. for December 31, 2022 and 2021: Cash and cash equivalents Accounts receivable Inventories Investment in bonds at amortized cost Equipment Accumulated depreciation Total Assets Accounts payable Bonds payable, due 2025 Ordinary stock, P20 par Share premium Retained earnings Total Liabilities and Equity Additional information: . 2022 250,000 327,600 822,000 0 . 2,400,000 (700,000) 3,099,600 359,000 0 1,800,000 280,000 660,600 3,099,600 2021 220,000 356,000 780,000 200,000 2,040,000 (760,000) 2,836,000 • Net income for 2022, P545,600. Depreciation reported on income statement, P140,000. Fully depreciated equipment, no salvage value, was scrapped. Equipment was purchased for P560,000. Bonds of P400,000 were retired at their face value. 281,000 400,000 1,600,000 200,000 355,000 2,836,000 10,000 shares of ordinary stock were issued for cash of P28 per share. Cash dividends declared and paid, P240,000 Investment in bonds with carrying…arrow_forwardWhat is the debt to equity ratio for the general accounting question ?arrow_forward

- given the following data for the cheyenne company: current liabilities 602; long-term debt 630; common stock 858; retained earnings 1210; total liabilities & stockholders' equity 3300. how would common stock apprear on a common size balance sheet?arrow_forwardThe table below provides selected financial data for the Vogon Construction Co. in Years t and t-1. Interest Expense Short-Term Debt Long-Term Debt Total Liabilities Selected Financial Information Vogon Construction Co. Year t-1 Year t 32.4 12.6 61.0 67.1 140.0 461.0 35.3 388.4 What interest rate (on average) does the company pay on its borrowed funds? Express your answer in percentage form rounded to one decimal place.arrow_forward1. Find the Earnings Per share on common stock 2. Find the Price-earnings ratioarrow_forward

- Given the following data for the Novak Corp.: Current liabilities $560 Long-term debt 460 Common stock 780 Retained earnings 200 Total liabilities & stockholders’ equity $2000 How would common stock appear on a common size balance sheet?arrow_forwardNeed answerarrow_forwardSECOND BANK PROVIDES THE FOLLOWING EQUITY DATA: REGULATORY EQUITY RELATED ACCOUNTS COMMON STOCK 4,000.00 PREFERRED STOCKS 900.00 RETAINED EARNINGS 3,001.00 CAPITAL NOTES 1,000.00 SUBORDINATED DEBT 4,000.00 RESERVE FOR LOAN LOSSES 800.00 RISK WEIGHTED ASSETS 60,000.00 How much is Tier 2? Seleccione una: $7,901 $6,475 $6,038 $6,088 $13,701 $7,226 NOT ENOUGH DATA TO ANSWERarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning