Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give true answer this general accounting

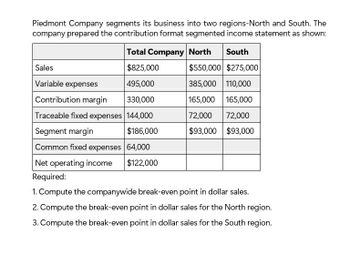

Transcribed Image Text:Piedmont Company segments its business into two regions-North and South. The

company prepared the contribution format segmented income statement as shown:

Total Company North South

Sales

$825,000

$550,000 $275,000

Variable expenses

495,000

385,000 110,000

Contribution margin

330,000

165,000 165,000

Traceable fixed expenses 144,000

72,000 72,000

Segment margin

$186,000

$93,000 $93,000

Common fixed expenses 64,000

Net operating income $122,000

Required:

1. Compute the companywide break-even point in dollar sales.

2. Compute the break-even point in dollar sales for the North region.

3. Compute the break-even point in dollar sales for the South region.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Piedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: Sales Variable expenses Contribution margin Traceable fixed expenses Segment margin Common fixed expenses Net operating income S Total Company $ 675,000 405,000 North $ 450,000 South $225,000 315,000 90,000 270,000 132,000 138,000 58,000 135,000 66,000 $ 69,000 135,000 66,000 $ 69,000 $ 80,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region. (For all requirements, round your intermediate calculations to 2 decimal places. Round your final answers to the nearest dollar.) 1. Dollar sales for company to break even 2. Dollar sales for North segment to break even 3. Dollar sales for South segment to break evenarrow_forwardPiedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: Total Company $ 675,000 North $ 450,000 South $ 225,000 Sales Variable expenses Contribution margin Traceable fixed expenses Segment margin Common fixed expenses 405,000 270,000 150,000 315,000 135,000 75,000 90,000 135,000 75,000 120,000 $ 60,000 $ 60,000 65,000 $ 55,000 Net operating income Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region. Note: For all requirements, round your intermediate calculations to 2 decimal places. Round your final answers to the nearest dollar. 1. Dollar sales for company to break even 2. Dollar sales for North segment to break even 3. Dollar sales for South segment to break evenarrow_forwardCrossfire Company segments its business into two regions-East and West. The company prepared a contribution format segmented income statement as shown below: Sales Variable expenses Contribution margin Traceable fixed expenses Total Company $1,035,000 828,000 207,000 136,000 East $ 690,000 579,600 110,400 59,000 $ 51,400 West $ 345,000 248,400 96,600 77,000 $ 19,600 Segment margin Common fixed expenses 71,000 60,000 Net operating income 11,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed ig requirements 2 and 3. Use the same format as shown above. What is Crossfire's net operating income (loss) in your new segmented income statement? 5. Do you think that Crossfire should allocate its common fixed expenses to the East and West…arrow_forward

- Need helparrow_forwardCrossfire Company segments its business into two regions—East and West. The company prepared a contribution format segmented income statement as shown below: Total Company East West Sales $ 915,000 $ 610,000 $ 305,000 Variable expenses 732,000 518,500 213,500 Contribution margin 183,000 91,500 91,500 Traceable fixed expenses 111,000 51,000 60,000 Segment margin 72,000 $ 40,500 $ 31,500 Common fixed expenses 60,000 Net operating income $ 12,000 Required: 1. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. What is Crossfire’s net operating income (loss) in your new segmented income statement? 2. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break-even points for each region?arrow_forwardPiedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: Total Company $ 600,000 360,000 240,000 132,000 North $ 400,000 280,000 120,000 66,000 South Sales Variable expenses Contribution margin Traceable fixed expenses $ 200,000 80,000 120,000 66,000 Segment margin 108,000 $ 54,000 $ 54,000 Common fixed expenses 56,000 Net operating income 2$ 52,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region. (For all requirements, round your intermediate calculations to 2 decimal places. Round your final answers to the nearest dollar.) 1. Dollar sales for company to break-even 2. Dollar sales for North segment to break-even 3. Dollar sales for South segment to break-evenarrow_forward

- Saved Piedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: Sales Variable expenses Contribution margin Traceable fixed expenses Total Company $ 750,000 450,000 300,000 144,000 North $ 500,000 350,000 150,000 72,000 South $ 250,000 100,000 150,000 72,000 $ 78,000 Segment margin 156,000 2$ 78,000 Common fixed expenses 59,000 Net operating income $ 97,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region. (For all requirements, round your intermediate calculations to 2 decimal places. Round your final answers to the nearest dollar.) 1 Dollar sales for company to break-even 2. Dollar sales for North segment to break-even 3. Dollar sales for South segment to break-even 2 of 4 Next > < Prevarrow_forwardPlease give me answer Accountingarrow_forwardCrossfire Company segments its business into two regions—East and West. The company prepared a contribution format segmented income statement as shown below: Total Company East West Sales $ 910,000 $ 650,000 $ 260,000 Variable expenses 637,000 468,000 169,000 Contribution margin 273,000 182,000 91,000 Traceable fixed expenses 133,000 70,000 63,000 Segment margin 140,000 $ 112,000 $ 28,000 Common fixed expenses 56,000 Net operating income $ 84,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. What is Crossfire’s net operating income (loss) in your new segmented income statement? 5. Do you think that…arrow_forward

- Vishnuarrow_forwardCrossfire Company segments its business into two regions—East and West. The company prepared a contribution format segmented income statement as shown below: Total Company East West Sales $ 900,000 $ 600,000 $ 300,000 Variable expenses 675,000 480,000 195,000 Contribution margin 225,000 120,000 105,000 Traceable fixed expenses 141,000 50,000 91,000 Segment margin 84,000 $ 70,000 $ 14,000 Common fixed expenses 59,000 Net operating income $ 25,000 Required: 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. Use the same format as shown above. What is Crossfire’s net operating income (loss) in your new segmented income statement? 5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break-even points for each region?arrow_forward1.Piedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: Total Company North South Sales $600,000 $ 400,000 $ 200,000 Variable expenses 360,000 280,000 80,000 Contribution margin 240,000 120,000 120,000 Traceable fixed expenses 120,000 60,000 60,000 120,000 $ 60,000 $ 60,000 Segment margi Common fixed expenses 50,000 Net operating income $70,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning