Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

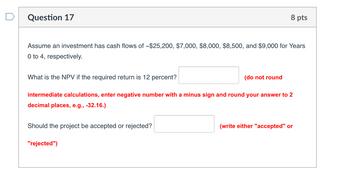

Assume an investment has cash flows of −$25,200, $7,000, $8,000, $8,500, and $9,000 for Years 0 to 4, respectively.

What is the NPV if the required return is 12 percent? (do not round intermediate calculations, enter negative number with a minus sign and round your answer to 2 decimal places, e.g., -32.16.)

Should the project be accepted or rejected?

Transcribed Image Text:Question 17

8 pts

Assume an investment has cash flows of -$25,200, $7,000, $8,000, $8,500, and $9,000 for Years

0 to 4, respectively.

What is the NPV if the required return is 12 percent?

(do not round

intermediate calculations, enter negative number with a minus sign and round your answer to 2

decimal places, e.g., -32.16.)

Should the project be accepted or rejected?

"rejected")

(write either "accepted" or

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the HPR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Period Cashflow 0 -14100 1 3300 2 3300 3 3100 4 2800arrow_forwardDamien offers you a sequence of end-of-year cash flows for an investment as follows: Year 1 2 3 4 4 What is the value of the cash flows if the opportunity cost is 6 percent? (Round to the nearest dollar). Please click on the following link to access a blank worksheet Click to open:: O $8.392 $8.598 Cash Flow $4,000 $3,000 $2,000 $1,000 $8.734 $8.915arrow_forwardCalculate the EAR of the following investment, entered as a percentage (Example: if your answer is 0.145, enter 14.5) Year Number Cashflow 0 -11400 1 3500 2 3000 3 3100 4 2800 Your Answer:arrow_forward

- Calculate the APR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Year Number Cashflow 0 -11000 1 3000 2 3500 3 2900 4 2800arrow_forwardA firm evaluates all of its projects by applying the IRR rule. Year Cash Flow 0 –$ 148,000 1 68,000 2 71,000 3 55,000 What is the project's IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) A. The Initial Rate on Returnarrow_forwardCalculate the internal rates of return of the following investment: Net investment -$1,000 Year 0 Net cash flows +6,000 Year 1 -11,000 Year 2 +6,000 Year 3 Round your answers to the nearest whole number and enter them in ascending order. IRR1: % IRR2: % IRR3: %arrow_forward

- ems with IRR Suppose you are offered a project with the following cash flows: Year Cash Flows 0 $ 8,900 1 -4,600 2 -3,300 3 -2,400 4 -1,700 a. What is the IRR of this offer? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR % b. If the appropriate discount rate is 11 percent, should you accept this offer? O Reject Accept c. If the appropriate discount rate is 23 Sercent, should you accept this offer? 3 Percent, should you accept this offer? O Accept O Reject d-1. What is the NPV of the offer if the appropriate discount rate is 11 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d-2. What is the NPV of the offer if the appropriate discount rate is 23 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardDetermine the future value of the following single amounts (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) (Round your final answers to nearest whole dollar amount.): Invested Amount Future Value 1. 14,000 7% 15 2. 21,000 6% 16 3. 33,000 12% 15 54,000 5% 11 4.arrow_forwardD-78 Which of the following equations can be used to find the internal rate of return (i) for a project that hun initial investment of P, net annual cash flows of A, and salvage value of S after n years? (a) 0 = -P + AP/A, i%,n) + SP/A, i%, n) | (b) (Р — А)P/А, 1%, п) — SPIF, 1%, n) (с) — А %3D — РАР, %, п) — S(AF, i1%, п — 1) (d) 0 = -PF/P, i%,n) + A(F/A, i%, n) + Sarrow_forward

- Average Rate of Return Method, Net Present Value Method, and Analysis for a service company The capital investment committee of Arches Landscaping Company is considering two capital investments. The estimated operating income and net cash flows from each investment are as follows: Front-End Loader Year 1 2 3 4 5 Total Year 1 2 3 4 5 6 7 Operating Income 8 9 10 $54,000 54,000 54,000 54,000 54,000 $270,000 0.943 Each project requires an investment of $600,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 10% for purposes of the net present value analysis. Present Value of $1 at Compound Interest 6% 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 10% Net Cash Flow 0.909 0.826 0.751 $172,000 172,000 172,000 172,000 172,000 $860,000 12% 0.893 0.797 0.756 0.712 0.658 0.683 0.636 0.572 0.621 0.567 0.497 0.564 0.507 0.513 0.467 0.424 0.386 0.452 0.404 15% 0.361 0.322 0.870 0.432 0.376 0.327 0.284 0.247 Operating Income…arrow_forwardDetermine the future value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Invested Amount i- n Future Value 1. $ 11,500 7% 15 23 $ 15,000 6% 14 $ 28,000 12% 14 4. S 48,000 8% 6arrow_forwardAssume an investment has cash flows of -$25,200, $7,000, $8,000, $8,500, and $9,000 for Years 0 to 4, respectively. What is the NPV if the required return is 11.1 percent? decimal places, e.g., -32.16.) Should the project be accepted or rejected? (do not round intermediate calculations, enter negative number with a minus sign and round your answer to 2 (write either "accepted" or "rejected")arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education