Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please Give Stap by Stap Answer

I Give like

Transcribed Image Text:5:56

More Details

Retake

Attempts Remaining: Infinity

#2

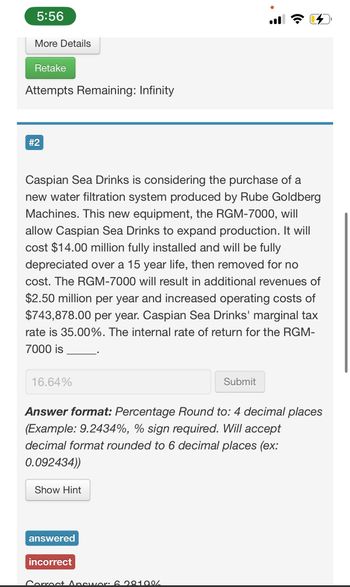

Caspian Sea Drinks is considering the purchase of a

new water filtration system produced by Rube Goldberg

Machines. This new equipment, the RGM-7000, will

allow Caspian Sea Drinks to expand production. It will

cost $14.00 million fully installed and will be fully

depreciated over a 15 year life, then removed for no

cost. The RGM-7000 will result in additional revenues of

$2.50 million per year and increased operating costs of

$743,878.00 per year. Caspian Sea Drinks' marginal tax

rate is 35.00%. The internal rate of return for the RGM-

7000 is

16.64%

Submit

Answer format: Percentage Round to: 4 decimal places

(Example: 9.2434%, % sign required. Will accept

decimal format rounded to 6 decimal places (ex:

0.092434))

Show Hint

answered

incorrect

Correct Answer: 6.28100/

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- #2 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 15 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.92 million per year and increased operating costs of $644,639.00 per year. Caspian Sea Drinks' marginal tax rate is 33.00%. The internal rate of return for the RGM-7000 is _____. Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))arrow_forward#3 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.37 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.24 million per year and cost $2.26 million per year over the 10-year life of the project. Marketing estimates 20.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 33.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward#3 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by $1.08 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.64 million per year and cost $1.58 million per year over the 10-year life of the project. Marketing estimates 17.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 21.00%. The WACC is 10.00%. Find the NPV (net present value). Answer format: Currency: Round to: 2 decimal places.arrow_forward

- #3 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.01 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.59 million per year and cost $1.52 million per year over the 10-year life of the project. Marketing estimates 13.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 27.00%. The WACC is 13.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places. #4 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet…arrow_forward#4 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.11 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.81 million per year and cost $2.04 million per year over the 10-year life of the project. Marketing estimates 18.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 31.00%. The WACC is 11.00%. Find the IRR (internal rate of return). Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))arrow_forward#4 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $2.00 million, and sold for that amount in year 10. Net working capital will increase by $1.23 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.78 million per year and cost $2.27 million per year over the 10-year life of the project. Marketing estimates 17.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 34.00%. The WACC is 15.00%. Find the IRR (internal rate of return). Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))arrow_forward

- 7arrow_forward6. Problem 12.11 (Replacement Analysis) eBook St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will increase earnings before depreciation from $30,000 to $54,000 per year. The new machine will cost $85,000, and it will have an estimated life of 8 years and no salvage value. The new riveting machine is eligible for 100% bonus depreciation at the time of purchase. The applicable corporate tax rate is 25%, and the firm's WACC is 12%. The old machine has been fully depreciated and has no salvage value. What is the NPV of the project? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. $ Should the old riveting machine be replaced by the new one? -Select- ↑arrow_forwardall parts of the question pleasearrow_forward

- Exercise 14-6 (Algo) Simple Rate of Return Method [LO14-6] The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $57,000. The machine would replace an old piece of equipment that costs $15,000 per year to operate. The new machine would cost $7,000 per year to operate. The old machine currently in use is fully depreciated and could be sold now for a salvage value of $24,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%.)arrow_forwardProblem 9 A contractor is considering the following three alternatives: a. Purchase a new microcomputer system for $15,000. The system is expected to last 6 years with salvage value of $1,000. b. Lease a new microcomputer system for $3,000 per year, payable in advance. The system should last 6 years. c. Purchase a used microcomputer system for $8,200. It is expected to last 3 with no salvage value. Use a common-multiple-of-lives approach. If MARR of 8% is used, which alternative should be selected using a discounted present worth analysis? If the MARR is 12%, which alternate should be selected? yearsarrow_forward6:05 IMG_0742.jpg X Wildhorse Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.80 million. This investment will consist of $2.30 million for land and $9.50millian for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.30 million, which is $2.15 million above book value. The farm is expected to produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.80 million. The marginal tax rate is 35 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.s. 15.25.) NPV $ The project should bearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education