Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

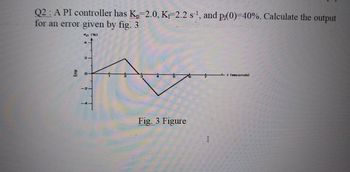

Transcribed Image Text:Q2: A PI controller has K, 2.0, K2.2 s¹, and pi(0)=40%. Calculate the output

for an error given by fig. 3

ep (%)

-2

Fig. 3 Figure

I

(seconds)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Suppose the following formula is inputted into Excel: =MROUND(1/4,100) The output in the cell will be: 0.2500 0.25 1 DOOarrow_forward8. Assume Model 2 with D₁ = $2 and r= 10%. Calculate different Po's with g = 0%, 1%, 2%, 3%, 4%, 5%, 6%, 7%, 8%, and 9%. Plot Po (= Y axis) against g in Excel. Comment. 6%, 7%, 9. Assume Model 2 with D₁ = $2 and g = 5%. Calculate different Po's with r = 8%, 9%, 10%, 11%, 12%, 13%, 14%, and 15%. Plot Po(= Y axis) against r in the same Excel file. Comment.arrow_forwardFind the APR using the formula APR= 2nr/n+1 when n= 36 and r= 8%arrow_forward

- Only typed solutionarrow_forwardI need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardRefer to the scattergram and the Ordinary Least Squares line of best fit, in Figure 1. T 10 8 6 4 2 0 0 2 4) Figure 1 y=-0.7941x10.515 R=0.9425 4 6 X 8 If x increases by 1 unit, y will 10 12 1) increases by 0.7941 units. 2) decreases by 0.7941 units. 3) increases by (0.7941 +10.515) units. decreases by (0.7941+ 10.515) units.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning