FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

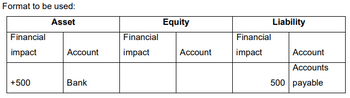

Transcribed Image Text:Format to be used:

Financial

impact

Asset

Equity

Financial

Account

impact

+500

Bank

Financial

Liability

Account

impact

Account

Accounts

500 payable

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Guys could you please help me: I'm attaching AT&T's Balance Sheet and Income Statement for the analysis.I'd really appreciate help with the following: Perform a vertical financial analysis incorporatingi. Debt ratioii. Debt to equity ratioiii. Return on assetsiv. Return on equityv. Current ratiovi. Quick ratiovii. Inventory turnoverviii. Days in inventoryix. Accounts receivable turnoverx. Accounts receivable cycle in daysxi. Accounts payable turnoverxii. Accounts payable cycle in daysxiii. Earnings per share (EPS)xiv. Price to earnings ratio (P/E)xv. Cash conversion cycle (CCC), andxvi. Working capitalxvii. Explain Dupont identity, apply it to your selected company, interpret thecomponents in Dupont identity.arrow_forwardIn the balance sheet, accounts Receivable, where did you get 489,555 from?arrow_forwardneed the calculation for debt to assets ratio, debt equity ratio, long-term debt to equity and times interest earned ratio. CURRENT ASSETS Cash and cash equivalents $ 5,910 $ 5,238 Marketable securities 406 503 Accounts receivable 10,888 9,645 Less: Allowance for credit losses (138) (93) Accounts receivable, net 10,750 9,552 Assets held for sale 1,197 0 Other current assets 1,953 1,810 Total Current Assets 20,216 17,103 Property, Plant and Equipment, Net 32,254 30,482 Operating Lease, Right-of-Use Asset 3,073 2,856 Goodwill 3,367 3,813 Intangible Assets, Net 2,274 2,167 Investments and Restricted Cash 25 24 Deferred Income Tax Assets 527 330 Other Non-Current Assets 672 1,082 Total Assets 62,408 57,857 Current Liabilities: Current maturities of long-term debt, commercial paper and finance leases 2,623 3,420 Operating Lease, Liability, Current 560 538 Accounts payable 6,455 5,555 Accrued wages and withholdings 3,569 2,552…arrow_forward

- A savings account that is insured by the FDIC/NCUA meansarrow_forwarduse the information to make a common size balance sheetarrow_forwardRATIO ANALYSIS. Debt Ratio Activity 6 · Understand the information provided by the debt ratio. · Identify the expected range and whether an increasing or decreasing trend is preferred. Purpose: The debt ratio compares total liabilities to total assets. This ratio measures the proportion of assets financed by debt. It is a measure of long-term solvency. Total liabilities DEBT RATI0 = Total assets JOHNSON & CITIGROUP 12/31/99 HEWLETT- PACKARD 10/3 1/99 JOHNSON 1/03/99 WAL-MART 1/31/99 ($ in 000s) Assets $716,937,000 $35,297,000 $26,211,000 $49,996,000 Liabilities 667,251,000 17,002,000 12,621.000 28,884,000 Stockholders' Equity $ 49,686,000 $18,295,000 $13,590,000 $21,112,000 Source: Disclosure, Inc, Compact D/SEC, 2000. 1. For each-company listed above, compute the debt ratio. Record your results below. Debt ratio: 0.93 2. The debt ratios computed above are primarily in the ranġe (less than 0,40 / 0.40 through 0.70 / over 0.70): 3. % of Wal-Mart's assets are financed by debt. 4.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education