FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

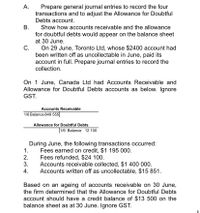

Transcribed Image Text:Prepare general journal entries to record the four

transactions and to adjust the Allowance for Doubtful

Debts account.

A.

В.

Show how accounts receivable and the allowance

for doubtful debts would appear on the balance sheet

at 30 June.

С.

On 29 June, Toronto Ltd, whose $2400 account had

been written off as uncollectable in June, paid its

account in full. Prepare journal entries to record the

collection.

On 1 June, Canada Ltd had Accounts Receivable and

Allowance for Doubtful Debts accounts as below. Ignore

GST.

Accounts Receivable

1/6 Balance 849 555

Allowance for Doubtful Debts

|1/6 Balance 12 100

During June, the following transactions occurred:

1.

Fees earned on credit, $1 195 000.

Fees refunded, $24 100.

Accounts receivable collected, $1 400 000.

Accounts written off as uncollectable, $15 851.

2.

3.

4.

Based on an ageing of accounts receivable on 30 June,

the firm determined that the Allowance for Doubtful Debts

account should have a credit balance of $13 500 on the

balance sheet as at 30 June. Ignore GST.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

In the

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

In the

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The company estimates future uncollectible accounts. The company determines $16,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 4% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.)arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardCan I please get help with this question along with a quick explaination to help me understand?arrow_forward

- Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for each of the following items:1. What is the balance sheet classification for a note payable due in six months that was used to purchase abuilding?arrow_forward6. Prepare general journal entries for the following transactions of Salvador Company. April 30 Received a $5,000, 6%, 30-day note receivable from Juan Co. as settlement for its $5,000 account receivable. May 30 The note received from Juan on April 30 was collected in full.arrow_forwardApr. 15. Received $1,800 from Joe Brown and wrote off the remainder owed of $2,700 as uncollectible. Aug. 7. Reinstated the account of Joe Brown and received $2,700 cash in full payment. Required: Journalize the above transactions, using the allowance method of accounting for uncollectible receivables. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Joe Brown 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment…arrow_forward

- Required information [The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $15,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 880,000 352,000 70, 400 35, 200 14, 080 Required: 1. Compute the required balance of the Allowance for Doubtful Accounts at December 31 using an aging of accounts receivable. Accounts Receivable Age of Accounts Receivable Not yet due 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due Not due: 1 to 30: 31 to 60: 61 to 90: Over 90: Estimated balance of allowance for uncollectibles Accounts Receivable $ 880,000 352,000 70, 400 35, 200 14, 080 View transaction list X X Date December 31 X Percent Uncollectible (#.##%) X Record entry Required information [The following information applies to the questions displayed below.] Note: Enter debits before credits. On…arrow_forwardThe following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $ 14,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable Age of Accounts Receivable Expected Percent Uncollectible $ 830,000 Not yet due 1.25 % 254,000 1 to 30 days past due 2.00 86,000 31 to 60 days past due 6.50 38,000 61 to 90 days past due 32.75 12,000 Over 90 days past due 68.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Record the estimated ba debts. Required information 1 Record the estimated bad debts. Note: Enter debits before credits. Date December 31 General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardOn 1 June, Mason and Boyce had Accounts Receivable and Allowance for Doubtful Debts accounts as below. Ignore GST.During June, the following transactions occurred:1. Revenue earned on credit, $1,195,000.2. Sales returns, $24,100.3. Accounts receivable collected, $1,400,000.4. Accounts written off as uncollectable, $15,851.Based on an ageing of accounts receivable on 30 June, the firm determined that the Allowance for Doubtful Debts account should have a credit balance of $13,500 on the balance sheet as at 30 June. Ignore GST. On 29 June, Kim Ltd, whose $2,400 account had been written off as uncollectable in June, paid its account in full. Prepare journal entries to record the collection.arrow_forward

- Jeter Company uses the allowance method to account for uncollectible receivables. On April 2, Jeter Company wrote off a $820 account receivable from customer J. Maters. On May 12, Jeter Company unexpectedly received full payment from Maters on the previously written off account. Jeter Company records an adjusting entry for bad debts expense of $14,100 on May 31. 9. Journalize Jeter Company's write-off of the uncollectible receivable. 10. Journalize Jeter Company's collection of the previously written off receivable. 11. Journalize Jeter Company's adjustment for bad debts expense. 9. Journalize Jeter Company's write-off of the uncollectible receivable. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Date Apr. 2 Accounts and Explanation Debit Creditarrow_forward3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $4,400 before adjustment on December 31. Journalize the adjusting entry for uncollectible accounts. Refer to the Chart of Accounts for exact wording of act titles.arrow_forwardRequired information. [The following information applies to the questions displayed below] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $15,000. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 840,000 336,000 67,200 33,600 13,440 Age of Accounts Receivable Not yet due 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due Expected Percent Uncollectible 1.15% 1.90 6.40 View transaction list View journal entry worksheet 32.25 67.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Note: Round percentage answers to nearest whole percent. Do not round intermediate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education