Financial & Managerial Accounting

13th Edition

ISBN: 9781285866307

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help

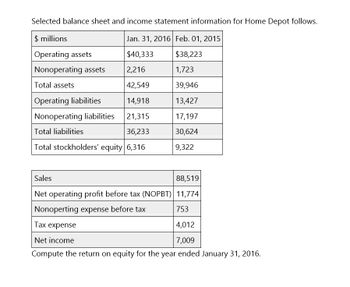

Transcribed Image Text:Selected balance sheet and income statement information for Home Depot follows.

$ millions

Jan. 31, 2016 Feb. 01, 2015

Operating assets

$40,333

$38,223

Nonoperating assets

2,216

1,723

Total assets

42,549

39,946

Operating liabilities

14,918

13,427

Nonoperating liabilities

21,315

17,197

Total liabilities

36,233

30,624

Total stockholders' equity 6,316

9,322

Sales

88,519

Net operating profit before tax (NOPBT) 11,774

Nonoperting expense before tax

Tax expense

Net income

753

4,012

7,009

Compute the return on equity for the year ended January 31, 2016.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pls answer with explanations return on common stockholders equity for 2016 and 2017 thxarrow_forwardFor years ended December 31 Equity Investee Financial Summary, $ millions 2018 2017 2016 Net sales... Gross margin Net income.. Cummins' share of net income. $7,352 $7,050 $5,654 1,373 1,422 1,182 647 680 499 $ 336 $ 308 $ 260 Royalty and interest income.. 58 49 41 Total equity, royalty and interest from investees... $ 394 $ 357 $ 301 Current assets $3,401 1,449 $3,416 1,379 Noncurrent assets Current liabilities.. Noncurrent liabilities.. Net assets... (2,669) (218) (2,567) (237) $1,963 $1,991 Cummins' share of net assets $1,144 $1,116 a. What assets and liabilities of unconsolidated affiliates are omitted from Cummins' balance sheet as a result of the equity method of accounting for those investments? b. Do the liabilities of the unconsolidated affiliates affect Cummins directly? Explain. c. How does the equity method impact Cummins' ROE and its RNOA components (net operating asset turnover and net operating profit margin)?arrow_forwardsaarrow_forward

- Selected balance sheet and income statement information for Home Depot follows. $ millions Operating assets Jan. 31, 2016 Feb. 01, 2015 $40,333 $38,223 Nonoperating assets 2,216 1,723 Total assets 42,549 39,946 Operating liabilities 14,918 13,427 Nonoperating liabilities 21,315 17,197 Total liabilities 36,233 30,624 Total stockholders' equity 6.316 9.322 Sales 88,519 Net operating profit before tax (NOPBT) 11,774 Non-operating expense before tax 753 Tax expense 4,012 Net income 7,009 Compute the return on equity for the year ended January 31, 2016. You want your all-equity (no debt) firm to provide a return on equity of 13.5%. If total assets are $375,000, how much must be generated in net income to make this target? a. $41,234 b. $43,405 c. $45,689 d. $48,094 e. $50,625 For the FY 2016, Alpha Company had net sales of $950,000 and a net income of $65,000, paid income taxes of $30,000, and had before-tax interest expense of $15,000. Use this information to determine the: 1. Times…arrow_forwardPrepare a pro forma balance sheetarrow_forwardNeed help with this Questionarrow_forward

- Please Solve thisarrow_forwardPlease help me with show all calculation thankuarrow_forwardHow do I determine the NNO for 2014? Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Operating Assets 1,447,869 1,513,139 Operating liabilities 1,094,173 1,158,007 Net operating assets (NOA) 353,696 355,132 $ 397,299.00 NNO $ 490,548 $ 473,323 Equity $ 844,244 $ 828,455 $ 726,328.00 NOA= NNO + Equity $ 1,334,792 $ 1,301,778arrow_forward

- Please fill out vertical analysis of this balance sheet to determine component percentage of assets liabilities and stockholders equity based on data. Round percentages to the nearest hundredths percentarrow_forwardPresented below are data for Caracas Corp. 2017 2018 Assets, January 1 $6,840 ? Liabilities, January 1 ? $4,104 Stockholders' Equity, Jan. 1 ? $4,125 Dividends 855 969 Common Stock 912 975 Stockholders' Equity, Dec. 31 ? 3,399 Net Income 1,026 ? Net income for 2018 is... $243 loss. $726 income. $180 income. $726 loss. Please show work.arrow_forwardCorrect answer please general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning