Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

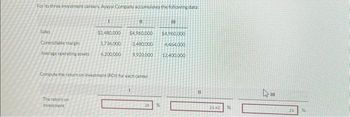

Transcribed Image Text:For its three investment centers, Ayayai Company accumulates the following data:

Sales

Controllable margin

Average operating assets

$2,480,000

1,736,000

6,200,000

The return on

investment

11

$4,960,000

2.480,000

9,920.000

Compute the return on investment (ROI) for each center.

25

%

111

$4,960,000

4,464,000

12.400.000

11

21.43

m

24

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Selected data from Chering Division's accounting records revealed the following: Sales $ 654,900 Average investment $ 301,300 Net operating income $ 55,500 Minimum rate of return (divisional cost of capital) 17 % Chering Division's return on sales (ROS) is:arrow_forwardAssume the Residential Division of Kappy Faucets had the following results last year. Net sales revenue $ 6,600,000 Operating income 990,000 Average total assets 5,500,000 Management's target rate of return 16% What is the division's profit margin ratio? O A 120% OB. 15% OC. 667% OD. 18%arrow_forwardGiven the following data: Average operating assets $ 1,116,000 Total liabilities $ 167,400 Sales $ 837,000 Contribution margin $ 502,200 Net operating income $ 167,400 Return on investment (ROI) is: Multiple Choice 20.0% 15.0% 60.0% 45.0%arrow_forward

- Division Y has generated sales revenue of $260,000 and achieved operating income of $18,500 using $20,000 of invested assets. If management desires a minimum rate of return of 10%, the profit margin would be _____. a.14.4% b.19.5% c.7.1% d.10.2%arrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given as follows: Division B $ 14,175,000 $ 7,087,500 $ 567,000 10% Division C $ 25,312,500 $ 5,062,500 $ 810,000 16% Sales Average operating assets Net operating income Minimum required rate of return Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 15% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Req 1 Division A $ 12,150,000 $ 3,037,500 $ 607,500 14% Req 2 Division A Division…arrow_forwardsolutionarrow_forward

- Megamart provides the following information on its two investment centers. Investment Center Electronics Sporting goods Sales $ 63,460,000 19,050,000 Income $ 3,173,000 2,286,000 Average Assets $ 16,700,000 12,700,000 Exercise 22-10 (Algo) Computing return on investment and residual income; investing decision LO A1 1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? 2. Assume a target income of 12% of average assets. Compute residual income for each center. Which center generated the most residual income? 3. Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? The target return is 12%.arrow_forwardDeuk Seon have the following investment centers. Several items are missing from the following table of rate of return on investment and residual income. Determine the missing items, identifying each item by the appropriate letter. Department Invested Assets Income from Operations Rate of Return on Investment Min. Rate of Return Min. Amt. of Income from Operations Residual Income Taek (a) (b) (c) 16% P128,000 P10,000 Jung Hwan P850,000 P153,000 (d) 12% (e) (f) Sun woo P825,000 (g) 20% (h) (i) P24,000 Dong Ryong (j) P129,000 24% (k) P60,000 (l) (a) Determine the missing items, identifying each by number. (b) Which division is most profitable in terms of income from operations? (c) Which division is most profitable in terms of rate of return on investment?arrow_forwardReturn on Investment and Residual IncomeJohnson Company has two sources of funds: long-term debt and equity capital. Johnson Company has profit centers in the following locations with the following net incomes and total assets: Net Income Assets Las Vegas $760,000 $4,000,000 Dallas 1,000,000 8,000,000 Tampa 1,840,000 12,000,000 a. Calculate ROI for each profit center and rank them from highest to lowest based on ROI. Round ROI to the nearest whole percentage. ROI Rank Las Vegas Answer Answer Dallas Answer Answer Tampa Answer Answer b. Calculate residual income for each profit center based on a desired ROI of 5% and rank them from highest to lowest based on residual income. ROI Rank Las Vegas Answer Answer Dallas Answer Answer Tampa Answer Answerarrow_forward

- The sales, operating income, and invested assets for each division of Salem Company are as follows: Sales OperatingIncome InvestedAssets Division C $4,000,000 $410,000 $3,500,000 Division D 3,500,000 600,000 4,000,000 Division E 2,250,000 780,000 7,000,000 Management has established a minimum rate of return for invested assets of 11%. a. Determine the residual income for each division. Residual Income Division C $fill in the blank 1 Division D $fill in the blank 2 Division E $fill in the blank 3 b. Based on residual income, which division is the most profitable?arrow_forwardSelected data from Division A of Green Company are as follows: Sales $ 630,000 Average investment $ 491,400 Operating income $ 81,900 Minimum rate of return 15% If the minimum rate of return was 11% (instead of the percentage shown above), Division A's residual income (RI) would be:arrow_forward4. Return on Investment, Residual Income & ROI Pricing For each of the following independent cases, the minimum desired Return on Investment (ROI) is 20%. Division LBM P 700,000 P 42,000 (5) (6) (7). (8) P 22,000 Sales Operating Income Operating Assets Margin Turnover Return on Investments Residual Income Division Lugaw P 400,000 (1). (2) 15% (3). 30% (4). Division Lugaw Unit selling price: P 20 Total fixed costs: P 100,000 Division LBM • Unit selling price: P 700 Total fixed costs: P 258,000 REQUIRED: 1. Compute for each division's missing items (1) to (8). 2. How many more units shall be sold by Lugaw to achieve a 40% ROI? 3. How much increase in selling price will allow LBM to reach 50% ROI from its current unit sales?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education