FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

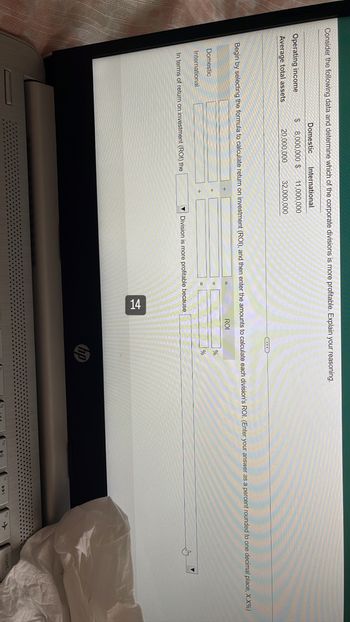

Transcribed Image Text:Consider the following data and determine which of the corporate divisions is more profitable. Explain your reasoning.

Domestic

International

Operating income

$8,000,000 $

11,000,000

Average total assets

20,000,000

32,000,000

C

Begin by selecting the formula to calcula return on investment (ROI), and then enter the amounts to calculate each division's ROI. (Enter your answer as a percent rounded to one decimal place, X.X%)

ROI

%

Domestic

%

International

In terms of return on investment (ROI) the

Division is more profitable because

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The lable shows some of the hems in an economy's National Income and Product Accounts Calculate net domestic product at factor cost using the income approach What is the statistical discrepancy? Arseto 1 decimal place Amount Wage Government exper Interest, rent, and pra Consumption expend 6.0 2.0 24 74 1.6 00 Indirect as less subsidies 07 Retired prof 16 1.3 1.1 10.5 1.3 Using the income approach, nel domestic product al factor con The statistical discrepancy is Transf Personal Income GNP Depreciationarrow_forwardDetermining missing items in return and residual income computations Data for Uberto Company are presented in the following table of returns on investment and residual incomes: Invested Assets Income from Operations Return on Investment Minimum Return Minimum Acceptable Income from Operations Residual Income $890,000 $231,400 (a) 15% (b) (c) $460,000 (d) (e) (f) $50,600 $23,000 $310,000 (g) 14% (h) $31,000 (i) $230,000 $48,300 (j) 12% (k) (l) Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number. a. % b. c. d. e. % f. % g. h. % i. j. % k. l.arrow_forwardDengararrow_forward

- For its three investment centers, Ayayai Company accumulates the following data: Sales Controllable margin Average operating assets $2,480,000 1,736,000 6,200,000 The return on investment 11 $4,960,000 2.480,000 9,920.000 Compute the return on investment (ROI) for each center. 25 % 111 $4,960,000 4,464,000 12.400.000 11 21.43 m 24 96arrow_forward10q-2arrow_forwardeBook Determining missing items in return on investment and residual income computations The following table presents various rates of return on investment and residual incomes: InvestedAssets OperatingIncome Return onInvestment MinimumRate ofReturn MinimumAcceptableOperatingIncome ResidualIncome $980,000 $215,600 (a) 12% (b) (c) 520,000 (d) (e) (f) $62,400 $20,800 320,000 (g) 14% (h) 35,200 (i) 240,000 50,400 (j) 12% (k) (l) Determine the missing items, identifying each item by the appropriate letter. Round dollar amounts to the nearest whole number. Answer a. fill in the blank 1 % b. $fill in the blank 2 c. $fill in the blank 3 d. $fill in the blank 4 e. fill in the blank 5 % f. fill in the blank 6 % g. $fill in the blank 7 h. fill in the blank 8 % i. $fill in the blank 9 j. fill in the blank 10 % k. $fill in the blank 11 l. $fill in the blank 12arrow_forward

- Determining missing items in return and residual income computations Data for Uberto Company are presented in the following table 'of returns on investment and residual incomes: Invested Income from Return on Minimum Minimum Acceptable Residual Operations Investment Return Income from Operations Income Assets $925,000 $185,000 (a) 15% (b) (c) $775,000 (d) (e) (f) $93,000 $23,250 $450,000 (g) 18% (h) $58,500 (i) $610,000 $97,600 (j) 12% (k) (1) Determine the missing values, identifying each item by the appropriate letter.arrow_forwardFirm K has a margin of 9%, turnover of 1.4, and sales of $1,610,000. Required: Calculate Firm K's net Income, average total assets, and return on Investment (ROI). Choose Factors: Choose Numerator: Net Income * Choose Factors: X Average Total Assets /Choose Denominator: = 1 Return on Investment Choose Numerator: /Choose Denominator: 1 1 Net Income Net Income Average Total Assets Average Total Assets 0 Return on Investment Return on Investment 0arrow_forwardA company has following details for this yearDetails Total sales($) Total cost($) Details Total sales($) Total cost($)Year ended 31/12/2018 35,78,998 25,89,709Year ended 31/12/2019 48,90,742 31,67,984 Calculate P/V ratio, Fixed cost, break even sales, Margin of safety 2018/2019, Variable cost 2018/2019and percent of fixed cost 2018/2019arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education