FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

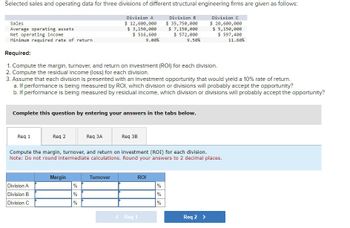

Transcribed Image Text:Selected sales and operating data for three divisions of different structural engineering firms are given as follows:

Division B

$ 35,750,000

$ 7,150,000

$ 572,000

9.50%

Division C

$ 20,600,000

$ 5,150,000

$ 597,400

11.60%

Sales

Average operating assets

Net operating income

Minimum required rate of return

Required:

1. Compute the margin, turnover, and return on investment (ROI) for each division.

2. Compute the residual income (loss) for each division.

3. Assume that each division is presented with an investment opportunity that would yield a 10% rate of return.

a. If performance is being measured by ROI, which division or divisions will obably accept the opportunity?

b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2

Division A

Division B

Division C

Req 3A

Compute the margin, turnover, and return on investment (ROI) for each division.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Margin

%

do do do

Division A

$ 12,600,000

$ 3,150,000

$ 516,600

9.00%

%

Turnover

Req 3B

ROI

< Req 1

%

%

Req 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 24arrow_forwardXYZ Company has two divisions, A and B. Information for each division is as follows: A B Net earnings for division P 40,000 P 260,000 Asset base for division P100,000 P1,200,000 Target rate of return 15% 18% Margin 10% 20% Weighted average cost of capital 12% 12% What is the operating asset turnover for A? 0.15 0.10 4.00 2.50 Group of answer choices 1 2 3 4arrow_forwardDetails explanationarrow_forward

- 10q-3arrow_forwardYear 1 Return on investment Net operating income Turnover Year 2 12% 36%8 $ 384,000 Margin Sales 3 $4,800,000 Del Luna Division's margin in Year 2 was 150% of the margin in Year 1. The turnover for Year 1 was: 1.2 O a. b. 1.5 Oc. 3.0 Od. 4.0arrow_forwardQUESTION 15 The following financial information is available for Beasties upper and lower divisions. Upper Lower Revenues $850,000 $700,000 Operating Expenses 470,000 460,000 Operating Income $380,000 $240,000 Assets Invested $2,000,000 $1,100,000 What is the ROI for the Upper Division? 21.8% 17.9% 19.0% 24.1%arrow_forward

- Residual Income The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Income from Operations Invested Assets Retail Division $102,900 Commercial Division 115,000 Internet Division 123,200 Assume that management has established a 8% minimum acceptable return for invested assets. a. Determine the residual income for each division. Income from operations Minimum acceptable of income from operations Residual income b. Which division has the most residual income? Commercial Division 490,000 500,000 770,000 Retail Division Commercial Division $102,900 $115,000 Internet Division $123,200arrow_forwardReturn on investment The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Income from Operations Invested Assets Retail Division $156,200 $710,000 Commercial Division 56,000 280,000 Internet Division 194,400 720,000 a. Compute the return on investment for each division. (Round to the nearest whole number.) Division Percent Retail Division fill in the blank 1 % Commercial Division fill in the blank 2 % Internet Division fill in the blank 3 % b. Which division is the most profitable per dollar invested?arrow_forwardQ35 Consider the following data for three divisions of a company, X, Y, and Z: Divisional: X Y Z Sales $ 1,483,000 $ 805,000 $ 5,005,000 Operating Income 216,100 59,700 263,800 Investment in assets 625,600 292,500 3,179,600 The return on sales (ROS) for Division Z is: (Round your percentages to one decimal place.) Multiple Choice 7.4%. 8.3%. 5.3%. 14.6%. 20.4%.arrow_forward

- Residual Income The Commercial Division of Galena Company has income from operations of $143,640 and assets of $399,000. The minimum acceptable return on assets is 10%. What is the residual income for the division?$fill in the blank 1arrow_forwardYear 1 Year 2 Return on investment Net operating income Turnover Margin Sales 128 368 $ 384,000 3 ? $4,800,000 Del Luna Division's margin in Year 2 was 150% of the margin in Year 1. The turnover for Year 1 was: Oa, 1.2 Ob, 1.5 c. 3.0 Od. 4.0arrow_forwardThe ABC Corporation reported the following information for its Toledo Division: Revenues Operating costs Beginning operating assets Ending operating assets P100,000,000 60,000,000 50,000,000 60,000,000 What is the Toledo Division's return on investment? 67% 73% 80% 109%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education