FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

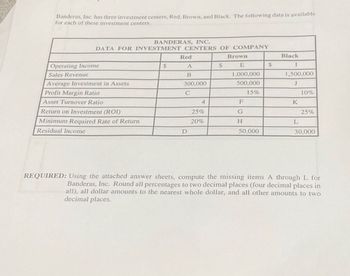

Transcribed Image Text:Banderas, Inc. has three investment centers, Red, Brown, and Black. The following data is available

for each of these investment centers.

BANDERAS, INC.

DATA FOR INVESTMENT CENTERS OF COMPANY

Red

Operating Income

$

A

$

Brown

E

$

Sales Revenue

B

1,000,000

Black

I

1,500,000

Average Investment in Assets

300,000

500,000

J

Profit Margin Ratio

C

15%

10%

Asset Turnover Ratio

4

F

K

Return on Investment (ROI)

25%

G

25%

Minimum Required Rate of Return

20%

H

L

Residual Income

D

50,000

30,000

REQUIRED: Using the attached answer sheets, compute the missing items A through L for

Banderas, Inc. Round all percentages to two decimal places (four decimal places in

all), all dollar amounts to the nearest whole dollar, and all other amounts to two

decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data are available for two divisions of Ryan Enterprises: Alpha Division Beta Division Division operating profit $ 7,360,000 $ 1,240,000 Division investment 32,160,000 3,160,000 The cost of capital for the company is 7 percent. Ignore taxes. Required: a-1. Calculate the ROI for both Alpha and Beta divisions. a-2. If Ryan measures performance using ROI, which division had the better performance? b-1. Calculate the EVA for both Alpha and Beta divisions. (The divisions have no current liabilities.) b-2. If Ryan measures performance using economic value added, which division had the better performance? c. Would your evaluation change if the company’s cost of capital was 10 percent, when evaluated by ROI? when evaluated by EVA?arrow_forwardUse the following information for the Problems below: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 8 percent. Division A Division B Division C $ Sales revenue ? ? 12,000,000 $ $ Income Average investment ? 450,000 2,190,000 $ ? ? 2,700,000 Sales margin 40% ? 45% Capital turnover 2 ? ? ROI ? ? 20% $ Residual income ? ? 133,000 PR 13-37 (Algo) ROI and Residual Income; Missing Data (LO 13-2) Required: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 6 percent. Note: Round "Capital turnover" answers to 2 decimal places. Division A Division B Division C Sales revenue $ 40,800,000 Income $ 1,710,000 $ 8,160,000 Average investment 10,200,000 Sales margin 18 % 1.00 % 20% Capital turnover ROI Residual income % % 18 % $ 501,000arrow_forwardA-1. Evaluate the performance of the two divisions assuming BMI users return on investment (ROI). A-2. Which division had the better performance?arrow_forward

- Selected financial data for the Photocopies Division of Elizabeth's Business Machines is as follows: Sales $8,200,000 Operating income $2,788,000 Total assets $3,280,000 Current liabilities $400,000 Required rate of return 14% Weighted average cost of capital 3% What is the Photocopier Division's residual income? Question 16 options: $459,200 $2,328,800 $3,247,200 $2,689,600arrow_forwardRequired information [The following information applies to the questions displayed below.] Megamart provides the following information on its two investment centers. Investment Center Electronics Income $ 3,114,000 2,261,000 Average Assets $ 17,300,000 13,300,000 Sporting goods Sales $ 41,520,000 18,088,000 1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? 2. Assume a target income of 11% of average assets. Compute residual income for each center. Which center generated the most residual income? 3. Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? The target return is 11%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute return on investment for each center. Using return on investment, which center is most efficient…arrow_forwardgo.4arrow_forward

- What is the investment turnover?arrow_forwardComparative data on three companies in the same service industry are given below: Required: 2. Fill in the missing information. (Round the "Turnover" and "ROI" answers to 2 decimal places.) A B C Sales $5,267,000 $1,630,000 Net Operaring Income $737,380 $260,800 Average operating assets $2,290,000 $2,570,000 Margin 6% Turnover 1.60 Return on Investment (ROI) 8%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education