FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

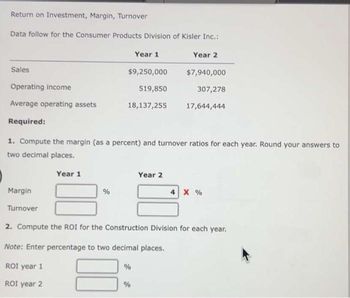

Transcribed Image Text:Return on Investment, Margin, Turnover

Data follow for the Consumer Products Division of Kisler Inc.:

Sales

Operating income

Average operating assets

Required:

Margin

Turnover

%

$9,250,000

Year 1

18,137,255

1. Compute the margin (as a percent) and turnover ratios for each year. Round your answers to

two decimal places.

Year 1

519,850

%

%

Year 2

$7,940,000

307,278

17,644,444

Year 2

2. Compute the ROI for the Construction Division for each year.

Note: Enter percentage to two decimal places.

ROI year 1

ROI year 2

4 X %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the Residential Division of Kipper Faucets had the following results last year: What is the division’s RI? a. $(140,000) b. $104,000 c. $140,000 d. $(104,000)arrow_forwardFinancial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity Joel de Paris, Incorporated Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 121,000 207,000 $4,416,000 3,665,280 750,720 328,000 $ 422,720 Beginning Balance $ 136,000 339,000 568,000 857,000 395,000 251,000 $ 2,546,000 Ending Balance $ 131,000 479,000 488,000 842,000 435,000 253,000 $ 2,628,000 $ 349,000 $ 374,000 983,000 1,189,000 983,000 1,296,000 $ 2,546,000 $ 2,628,000 The company paid dividends of $315,720 last year. The “Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The…arrow_forwardROI and Margin Arbus Company provided the following information: Turnover 1.3 Operating assets $106,000 Operating income 6,620 Required: 1. What is ROI? (Round your answer to three decimals.) 0.062 ✓ 2. What is margin? (Round your answer to two decimals.) X Feedbackarrow_forward

- The Millard Division's operating data for the past two years are provided below: Year 1 Return on investment Net operating income Turnover Margin Sales 10% ? ? ? Year 2 24% $ 380,000 4 ? $ 3,210,000 Millard Division's margin in Year 2 was 120% of the margin in Year 1. The net operating income for Year 1 was: Note: Round your intermediate percentage calculations to the nearest whole percent. ?arrow_forwardSupply the missing data for three service companies shown in the table below: Note: Loss amounts should be indicated by a minus sign. Round your percentage answers to nearest whole percent. Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income A Company B C $ 9,450,000 $ $ 7,750,000 329,000 $ 5,175,000 $ 3,150,000 $ 2,070,000 11 % 14 % % 9% $ 376,000 % 14 % $ 103,500arrow_forwardLast year's contribution format income statement for Huerra Company is given below: Unit $ 49.60 29.76 19.84 15.74 Sales Variable expenses Contribution margin Fixed expenses Net operating income Income taxes @ 40% Net income The company had average operating assets of $496,000 during the year. Required: 1. Compute last year's margin, turnover, and return on investment (ROI). For each of the following questions, indicate whether last year's margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI. Consider each question separately. 2. Using Lean Production, the company is able to reduce the average level of inventory by $95,000. 3. The company achieves a cost savings of $11,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increase average operating assets by $124,000. Sales remain unchanged. The new, more efficient equipment reduces production costs by $7,000 per…arrow_forward

- Kyle Corporation provides the following information for the Product Division and Service Division for the year. Product Division Service Division 420,000 $ 650,000 195,000 245,000 640,000 610,000 14.0% 14.0% Net sales Operating income Average total assets Target rate of return $ Requirement 1. Calculate the return on investment for each division. (Enter answers as a percent rounded to the nearest hundredth percent, X.XX%) The return on investment for the Product Division is The return on investment for the Service Division is Requirement 2. Which division has the highest ROI? % % Requirement 3. Calculate the residual income for each division. (Round answers to the nearest whole dollar.) The residual income for the Product Division is The residual income for the Service Division is Requirement 4. Which division has the highest residual income?arrow_forwardThe Dry Wall Division reports the following operating data for the past two years: Profit margin ratio Asset turnover Divisional assets After-tax income Stockholders' equity Sales Multiple Choice 18%. Year 1 70% 20% 3.5 ? Year 2 ? 2 The return on investment at the Dry Wall Division was exactly the same in Year 1 and Year 2. The profit margin ratio in Year 2 was: 4 $ 159,000 $ 41,800 ? $ 83,600 $ 134,000 ? Yaarrow_forwardComparative data on three companies in the same service industry are given below: Required: 2. Fill in the missing information. (Round the "Turnover" and "ROI" answers to 2 decimal places.) A B C Sales $5,267,000 $1,630,000 Net Operaring Income $737,380 $260,800 Average operating assets $2,290,000 $2,570,000 Margin 6% Turnover 1.60 Return on Investment (ROI) 8%arrow_forward

- Eacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales Net operating income Average operating assets The company's minimum required rate of return $14,720,000 $1,000,960 $4,000,000 14% Required: a. What is the division's margin? b. What is the division's turnover? c. What is the division's return on investment (ROI)? d. What is the division's residual income?arrow_forwardwant correct answer for this questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education