FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

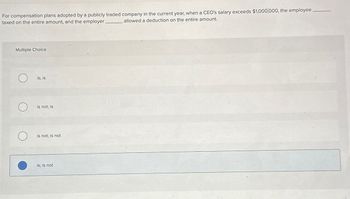

Transcribed Image Text:For compensation plans adopted by a publicly traded company in the current year, when a CEO's salary exceeds $1,000,000, the employee

taxed on the entire amount, and the employer

allowed a deduction on the entire amount.

Multiple Choice

О

is; is

is not; is

is not; is not

is; is not

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 32: What statement about Form l-9 is accurate? Answer: A. O The employee submits one or two documents to verify employment eligibility. В. O It was significantly revised and expanded in 2020. C. O A company submits this to request an EIN. D. O It is also referred to as Publication 15. Question 33: Match each incentive plan to its definition. Profit-sharing Employee receives a portion of the company's profits after exceeding a predetermined level DROP HERE Employee may purchase shares of the business after meeting predetermined goals Stock options DROP HERE Sabbaticals Paid leave after working a predetermined number of years DROP HERE Monies received for reaching a specific sales/production goal Cash incentives DROP HERE Question 34: Rachel is a server at a family restaurant in Omaha, NE. As a tipped employee, she receives an hourly wage that is less than the federal minimum wage. This week, her combined hourly wages and tips was less than the federal minimum wage. What happens…arrow_forwardNot a graded assignmentarrow_forwardFASB ASC 715–60: Compensation–Retirement Benefits–Defined Benefit Plans–Other Postretirement (previously Statement of Financial Accounting Standards No. 106) establishes accounting standards for postretirement benefits other than pensions, most notably postretirement health care benefits. Essentially, the standard requires companies to accrue compensation expense each year employees perform services, for the expected cost of providing future postretirement benefits that can be attributed to that service. Typically, companies do not prefund these costs for two reasons: (a) unlike pension liabilities, no federal law requires companies to fund nonpension postretirement benefits and (b) funding contributions, again unlike for pension liabilities, are not tax deductible. (The costs aren’t tax deductible until paid to, or on behalf of, employees.) Required: 1. As a result of being required to record the periodic postretirement expense and related liability, most companies now report lower…arrow_forward

- Indicate by letter whether each of the events listed below increases (I), decreases (D), or has no effect (N) on an employer's projected benefit obligation. Events 1. Interest cost. 2. Amortization of prior service cost. 3. A decrease in the average life expectancy of employees. 4. An increase in the average life expectancy of employees. 5. A plan amendment that increases benefits is made retroactive to prior years. 6. An increase in the actuary's assumed discount rate. 7. Cash contributions to the pension fund by the employer. 8. Benefits are paid to retired employees. 9. Service cost. 10. Return on plan assets during the year are lower than expected. 11. Return on plan assets during the year are higher than expected.arrow_forwardPuhlman Inc. provides a defined benefit pension plan to its employees. It smooths recognition of its gains and losses when computing its market-related value to compute expected return. Additional information follows: December 31, Description 20X1 20X0 ? $2,500,000 2,150,000 2,100,000 PBO АВО $2,335,000 Fair value of plan assets Market-related value of plan assets (smoothed recognition) Benefit payments made AOCI-net actuarial (gain) loss AOCI-prior service cost Balance sheet pension asset (liability) 2,342,800 272,000 114,000 2,100,000 231,000 -0- 400,000 (400,000) 214,000 321,000 129,000 Service cost Contribution Actual return Discount rate for PBO 9% 10% Expected rate of return Average remaining service life of employees 10% 10% 15 years 15 years During 20X1, the PBO increased by $33,000 due to a decrease in the discount rate from the previous year. The 20X0 discount rate assumption was used to compute 20X1 service cost and interest cost. Required: 1. Compute the fair value of plan…arrow_forwardIndicate by letter whether each of the events listed below increases (I), decreases (D), or has no effect (N) on an employer's periodic pension expense in the year the event occurs. Events 1. Interest cost. _____ 2. Amortization of prior service cost---AOCI. ______ 3.Excess of the expected return on plan assets over the actual return _____ 4. Expected return on plan assets. _____ 5. A plan amendment that increases benefits is made retroactive to prior years. ____ 6. Actuary's estimate of the PBO is increased.…arrow_forward

- Do not give image formatarrow_forwardDarrow_forwardA Defined Benefit Plan is a plan O A. In which employers agree to provide employees with a specific cash benefit upon retirement O B. Are funded 100% by the employees (you) O C. Are funded almost entirely by your employer O D. Both A & C O E. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education