Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

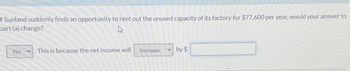

Transcribed Image Text:f Sunland suddenly finds an opportunity to rent out the unused capacity of its factory for $77,600 per year, would your answer to

bart (a) change?

Yes

.This is because the net income will

Increase

V

by $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your business partner has just presented to you a summary of projected costs and annual receipts for a new product line. He asks you to calculate the before-tax IRR & ERR for the investment opportunity. The company’s MARR = 15% quarterly. Is this investment justified?arrow_forwardYou are analyzing a property that popped up on CREXI. Real estate taxes and management services cost 42,362 and 31,563, respectfully. Other expenses are 15,369. If your company’s required return is 10%, what must the average annual rent be over the next five years for you to purchase the property at $400,000 and obtain that 10%? Expenses grow at 2.5% per year. A. 189,500 B. 198,400 C. 201,300 D. 192,700 E. 209,500arrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $78,000 immediately. If your cost of capital is 7.4%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $_________________________(Round to the nearest dollar.)arrow_forward

- Hello,the answer is incorrectarrow_forwardDetermine the time value of money. Formula: FV = PV(1 + i)N or PV = FV × (1 + i)-N 1. 1. Assume you have just been hired with an annual salary of P300,000. Ifyou expect annual raises of 5%, what will your salary be for thefollowing? a. 5 years?b. 10 years?c. 15 years?d. 30 years? 2. A farmland is currently selling for P200,000 per hectare. If the rate ofincrease has been 2% annually, what was the price of the land 10 yearsago?arrow_forwardb. eBook The Lesseig Company has an opportunity to invest in one of two mutually exclusive machines that will produce a product the company will need for the next a years, Machine A has an after-tax Jost of $8.7 million but will provide after-tax inflows of $4.9 million per year for 4 years. If Machine A were replaced, es after-tax cost would be $9.9 million due to inflation and its after-tax cash inflows would increase to $5.4 million due to production efficiencies Machine has an after-tax cost of $13 million and will provide after-tax inflows of $4.2 million per year for 8 years. If the WACC is 8%, which machine should be acquired? Explain, Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. is the better project and will increase the company's value by $ Machine A Machine B V millions, rather than the s 11.14 millions created byarrow_forward

- You are preparing to produce some goods for sale You will sel them in one year and you will incur costs of $74,000 immediately. If your cost of capital is 7 3%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? elarrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $89,000 immediately. If your cost of capital is 6.9%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? $______________ (Round to the nearest dollar.)arrow_forwardSuppose you wish to purchase a factory that will yield an annual return of $12,000 for 12 years, after which the factory will have no value. You want to earn 8.25% annually on your investment and also set up a sinking fund to replace the purchase price. If money is placed in the fund at the end of each year and earns 4.2% compounded annually, how much should you pay for the factory? a) $81,921 b) $81,487 C)O $80,487 $80,921 e) O $82,487 Boş bırak Cevap Listesi KÖnceki 2/12 Sonraki> Карatarrow_forward

- H1.arrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $79,000 immediately. If your cost of capital is 7.2%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $ (Round to the nearest dollar) COOarrow_forwardou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $ 76,000 immediately. If your cost of capital is 7%. What is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? Question content area bottom Part 1 The minimum dollar amount is $XXX enter your response here .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College