Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

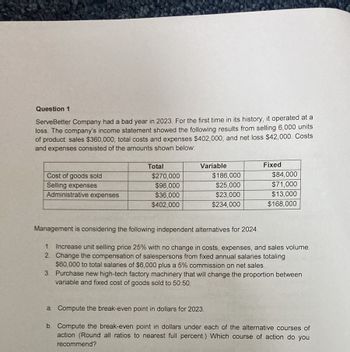

Transcribed Image Text:Question 1

Serve Better Company had a bad year in 2023. For the first time in its history, it operated at a

loss. The company's income statement showed the following results from selling 6,000 units

of product: sales $360,000; total costs and expenses $402,000; and net loss $42,000. Costs

and expenses consisted of the amounts shown below:

Cost of goods sold

Selling expenses

Administrative expenses

Total

$270,000

Variable

Fixed

$186,000

$84,000

$96,000

$25,000

$71,000

$36,000

$23,000

$13,000

$402,000

$234,000

$168,000

Management is considering the following independent alternatives for 2024.

1. Increase unit selling price 25% with no change in costs, expenses, and sales volume.

2. Change the compensation of salespersons from fixed annual salaries totaling

$60,000 to total salaries of $6,000 plus a 5% commission on net sales.

3. Purchase new high-tech factory machinery that will change the proportion between

variable and fixed cost of goods sold to 50:50.

a. Compute the break-even point in dollars for 2023.

b. Compute the break-even point in dollars under each of the alternative courses of

action (Round all ratios to nearest full percent.) Which course of action do you

recommend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 3: Keppel Manufacturing had a bad year in 2012, operating at a loss for the first time in its history. The company’s income statement showed the following results from selling 200,000 units of product: net sales Br.2,000,000; total costs and expenses Br.2,120,000; and net loss Br.120,000. Costs and expenses consisted of the following. Total Variable Fixed Cost of goods sold Br.1,295,000 Br. 975,000 Br.320,000 Selling expenses 575,000 325,000 250,000 Administrative expenses 250,000 Br.2,120,000 100,000 Br.1,400,000 150,000 Br.720,000 Management is considering the following independent alternatives for 2013. Increase unit selling price 30% with no change in costs and Change the compensation of salespersons from fixed annual salaries totaling 170,000 to total salaries of Br.50,000 plus a 6% commission on net sales. Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold…arrow_forwardPlease do not give solution in image format thankuarrow_forwardde bne In previous year, Seventy Up, Inc. operated at 250,000 units. The following income ement was provided for you to plan your next year's operation: Sales Cost of goods sold Gross profit Operating expenses, variable costs is P125,000 Net income before income tax eleo P2,000,000d 1,500,000 it P 500,000 ns mh 225,000 P 275,000 29 adeo baud The fixed manufacturing cost in the cost of goods sold is P3.00 Instructions: Revise the income statement to reflect a variable costing method. ladarrow_forward

- Question 3:Keppel Manufacturing had a bad year in 2012, operating at a loss for the first time in its history. The company’s income statement showed the following results from selling 200,000 units of product: net sales Br.2,000,000; total costs and expenses Br.2,120,000; and net loss Br.120,000. Costs and expenses consisted of the following. Total Variable FixedCost of goods sold Br.1,295,000 Br. 975,000 Br.320,000Selling expenses 575,000 325,000 250,000Administrative expenses 250,000 100,000 150,000 Br.2,120,000 Br.1,400,000 Br 720,000 Management is considering the following independent alternatives for 2013.1. Increase unit…arrow_forwardSolve this question financial accountingarrow_forwardak.3arrow_forward

- Question 4: Gorham Manufacturing’s sales slumped badly in 2010. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 600,000 units of product: Net sales $2,390,000; total costs and expenses 2,540,000; and net loss $150,000. Costs and expenses consisted of the amounts shown below. Total Variable Cost of goods sold $2,100,000 $1,440,000 Selling expenses 240,000 72,000 Administrative expenses 200,000 48,000 $2,540,000 $1,560,000 Management is considering the following independent alternatives for 2011. Increase unit selling price 25% with no change in costs, expenses, and sales volume. Change the compensation of salespersons from fixed annual salaries totaling $150,000 to total salaries of $60,000 plus a 3% commission on net sales. Purchase new…arrow_forwardprovide answer please give the correct answerarrow_forwardSolve this accounting problemarrow_forward

- Indarrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Celestial Beverage Inc. indicated the following for Star Cola for the past year: Sales $390,000 Cost of goods sold 184,000 Gross profit $206,000 Operating expenses 255,000 Loss from operations $(49,000) It is estimated that 20% of the cost of goods sold represents fixed factory overhead costs and that 30% of the operating expenses are fixed. Because Star Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated January 21 to determine whether Star Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential Analysis Continue Star Cola (Alt. 1) or Discontinue Star Cola (Alt. 2) January 21 Continue StarCola (Alternative 1) Discontinue StarCola (Alternative 2)…arrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Celestial Beverage Inc. indicated the following for Star Cola for the past year: Sales $390,000 Cost of goods sold 184,000 Gross profit $206,000 Operating expenses 255,000 Loss from operations $(49,000) It is estimated that 20% of the cost of goods sold represents fixed factory overhead costs and that 30% of the operating expenses are fixed. Because Star Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated January 21 to determine whether to Continue Star Cola (Alternative 1) or Discontinue Star Cola (Alternative 2). If an amount is zero, enter zero "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Continue Star Cola (Alt. 1) or Discontinue Star Cola (Alt. 2) January 21 Continue Star…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning