FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

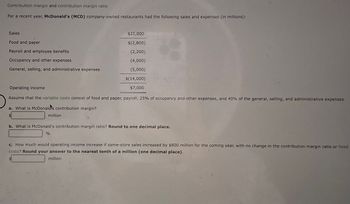

Transcribed Image Text:Contribution margin and contribution margin ratio

For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions):

Sales

Food and paper

Payroll and employee benefits

Occupancy and other expenses

General, selling, and administrative expenses

$21,000

$(2,800)

(2,200)

(4,000)

(5,000)

$(14,000)

$7,000

Operating income

Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses.

a. What is McDonald's contribution margin?

million

b. What is McDonald's contribution margin ratio? Round to one decimal place.

%

c. How much would operating income increase if same-store sales increased by $800 million for the coming year, with no change in the contribution margin ratio or fixed

costs? Round your answer to the nearest tenth of a million (one decimal place).

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hydra Company has two locations, downtown and at a surburban mall. During March, the company reported total net income of $337,000 and sales of $1.2 million. The contribution margin in the downtown store was $320,000 (40% of sales). The contribution margin in the mall store is $200,000. Total fixed costs are $90,000 in the downtown store and $93,000 in the mall location. How much are sales at the mall. Show the work. A. $400,000 B. $800,000 C. $666,667 D. Not enough information is provided to answer.arrow_forwardFor a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and paper Payroll and employee benefits Occupancy and other expenses $21,000 $(2,600) (2,000) (4,200) General, selling, and administrative expenses (3,200) $(12,000) $9,000 Operating income Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? X million b. What is McDonald's contribution margin ratio? Round to one decimal place. x % c. How much would operating income increase if same-store sales increased by $1,000 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the nearest tenth of a million (one decimal place). X millionarrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's Company-owned restaurants had the following sales and expenses (in millions): Sales $40,800 Food and packaging $11,004 Payroll 10,300 Occupancy (rent, depreciation, etc.) 12,376 General, selling, and administrative expenses 5,900 $39,580 Income from operations $1,220 Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.)$________ million b. What is McDonald's contribution margin ratio?________% c. How much would income from operations increase if same-store sales increased by $2,400 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million.$_________ millionarrow_forward

- Bhaduarrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Fixed expenses Contribution margin Net operating income (loss) 1,307,000 Department Total $ 4,210,000 Hardware $ 3,040,000 Linens $ 1,170,000 403,000 767,000 840,000 $ (73,000) 2,903,000 2,290,000 $ 613,000 904,000 2,136,000 1,450,000 $ 686,000 A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 15% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and packaging Payroll Occupancy (rent, depreciation, etc.) General, selling, and administrative expenses $18,700 $(7,497) (4,700) (3,243) (2,700) $(18,140) Operating income Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million b. What is McDonald's contribution margin ratio? % $560 c. How much would operating income increase if same-store sales increased by $1,100 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million. millionarrow_forward

- Contribution margin and contribution margin ratio For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and paper D Payroll and employee benefits Occupancy and other expenses General, selling, and administrative expenses million $19,207.8 $(2,564.2) (2,416.4) (4,357.6) (2,545.6) Operating income Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place). $(11,883.8) $7,324.0 b. What is McDonald's contribution margin ratio? Round to one decimal place. % million How much would operating income increase if same-store sales lecreased by $800 million for the coming year, with no change in the contribution margin ratio or fixed costs? Re decimal place).arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,310,000 1,313,000 2,997,000 2,200,000 $ 797,000 Department Hardware $ 3,130,000 901,000 2,229,000 1,360,000 $ 869,000 Linens $ 1,180,000 412,000 768,000 840,000 $ (72,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,130,000 1,223,000 2,907,000 2,160,000 $ 747,000 Department Hardware $ 3,060,000 814,000 2,246,000 1,310,000 $936,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage) Linens $ 1,070,000 409,000 661,000 850,000 $ (189,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 18% decrease in the sales of the Hardware Department.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education