FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

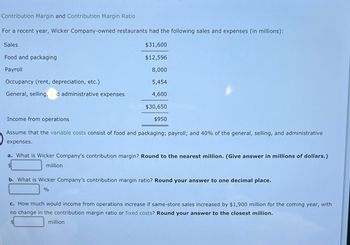

Transcribed Image Text:Contribution Margin and Contribution Margin Ratio

For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions):

$31,600

$12,596

8,000

5,454

4,600

$30,650

Sales

Food and packaging

Payroll

Occupancy (rent, depreciation, etc.)

General, selling, d administrative expenses

Income from operations

Assume that the variable costs consist of food and packaging; payroll; and 40% of the general, selling, and administrative

expenses.

a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.)

million

$950

b. What is Wicker Company's contribution margin ratio? Round your answer to one decimal place.

%

c. How much would income from operations increase if same-store sales increased by $1,900 million for the coming year, with

no change in the contribution margin ratio or fixed costs? Round your answer to the closest million.

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and paper Payroll and employee benefits Occupancy and other expenses $21,000 $(2,600) (2,000) (4,200) General, selling, and administrative expenses (3,200) $(12,000) $9,000 Operating income Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? X million b. What is McDonald's contribution margin ratio? Round to one decimal place. x % c. How much would operating income increase if same-store sales increased by $1,000 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the nearest tenth of a million (one decimal place). X millionarrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's Company-owned restaurants had the following sales and expenses (in millions): Sales $40,800 Food and packaging $11,004 Payroll 10,300 Occupancy (rent, depreciation, etc.) 12,376 General, selling, and administrative expenses 5,900 $39,580 Income from operations $1,220 Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.)$________ million b. What is McDonald's contribution margin ratio?________% c. How much would income from operations increase if same-store sales increased by $2,400 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million.$_________ millionarrow_forwardThe contribution format income statement for Huerra Company for last year is given below. Total $1,006,000 603,600 Unit $ 50.30 30.18 402,400 20.12 322,400 16.12 Sales Variable expenses Contribution margin Fixed expenses Net operating income Income taxes @ 40% Net income 80,000 32,000 $ 48,000 4.00 1.60 $2.40 The company had average operating assets of $502,000 during the year. Required: 1. Compute the company's margin, turnover, and return on investment (ROI) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $93,000. 3. The company achieves a cost savings of $7,000 per year by using less costly materials. 4. The company…arrow_forward

- Bhaduarrow_forwardFor a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): Sales $20,400 Food and packaging $5,940 Payroll 5,100 Occupancy (rent, depreciation, etc.) 5,750 General, selling, and administrative expenses 3,000 $19,790 Income from operations $610 Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.)$fill in the blank 1 million b. What is Wicker Company's contribution margin ratio? Round to one decimal place.fill in the blank 2 % c. How much would income from operations increase if same-store sales increased by $1,200 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million.$fill in the blank 3 millionarrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDugal's company-owned restaurants had the following sales and expenses (in millions): Sales Food and packaging Payroll Occupancy (rent, depreciation, etc.) General, selling, and admin. expenses Other expense Total expenses Operating income (loss) $4,310 3,800 4,190 2,200 290 % $14,500 (14,790) $(290) Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, a. What is McDonald's contribution margin? Enter your answer in million, rounded to one decimal place. million b. What is McDonald's contribution margin ratio? Round your percentage answer to one decimal place. and nistrative expenses. c. How much would operating income increase if same-store sales increased by $900 million for the coming year, with no change in the contribution margin ratio or fixed costs?arrow_forward

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Fixed expenses Contribution margin Net operating income (loss) 1,307,000 Department Total $ 4,210,000 Hardware $ 3,040,000 Linens $ 1,170,000 403,000 767,000 840,000 $ (73,000) 2,903,000 2,290,000 $ 613,000 904,000 2,136,000 1,450,000 $ 686,000 A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 15% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and packaging Payroll Occupancy (rent, depreciation, etc.) General, selling, and administrative expenses $18,700 $(7,497) (4,700) (3,243) (2,700) $(18,140) Operating income Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million b. What is McDonald's contribution margin ratio? % $560 c. How much would operating income increase if same-store sales increased by $1,100 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million. millionarrow_forwardHudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (11,300 units at $175 each) Variable costs (11,300 units at $140 each) Contribution margin Fixed costs Income 1. Compute break-even point in units. 2. Compute break-even point in sales dollars. 1. Break-even units 2. Break-even sales dollars units $ 1,977,500 1,582,000 395,500 315,000 $ 80,500arrow_forward

- Contribution margin and contribution margin ratio For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and paper D Payroll and employee benefits Occupancy and other expenses General, selling, and administrative expenses million $19,207.8 $(2,564.2) (2,416.4) (4,357.6) (2,545.6) Operating income Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place). $(11,883.8) $7,324.0 b. What is McDonald's contribution margin ratio? Round to one decimal place. % million How much would operating income increase if same-store sales lecreased by $800 million for the coming year, with no change in the contribution margin ratio or fixed costs? Re decimal place).arrow_forwardMarkson Company had the following results of operations for the past year: Contribution margin income statement Per Unit Annual Total Sales (9,000 units) $ 20.00 $ 180,000 Variable costs Direct materials 4.25 38,250 Direct labor 6.00 54,000 Overhead 2.00 18,000 Contribution margin 7.75 69,750 Fixed costs Fixed overhead 4.25 38,250 Income $ 3.50 $ 31,500 A foreign company offers to buy 2,500 units at $14 per unit. In addition to variable manufacturing and administrative costs, selling these units would increase fixed overhead by $2,000 for the purchase of special tools. Markson’s annual productive capacity is 13,500 units. If Markson accepts this additional business, its profits will:arrow_forwardFor a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): Sales $41,500 Food and packaging $11,585 Payroll 10,500 Occupancy (rent, depreciation, etc.) General, selling, and administrative expenses 12,175 6,000 $40,260 $1,240 Income from operations Assume that the variable costs consist of food and packaging; payroll; and 40% of the general, selling, and administrative expenses. a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) $ 24,485 x million b. What is Wicker Company's contribution margin ratio? Round your answer to one decimal place. 59 X % c. How much would income from operations increase if same-store sales increased by $2,500 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million. 1,475 X million.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education