FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

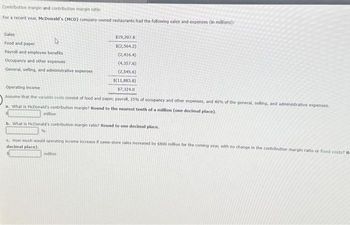

Transcribed Image Text:Contribution margin and contribution margin ratio

For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions):

Sales

Food and paper

D

Payroll and employee benefits

Occupancy and other expenses

General, selling, and administrative expenses

million

$19,207.8

$(2,564.2)

(2,416.4)

(4,357.6)

(2,545.6)

Operating income

Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses.

a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place).

$(11,883.8)

$7,324.0

b. What is McDonald's contribution margin ratio? Round to one decimal place.

%

million

How much would operating income increase if same-store sales lecreased by $800 million for the coming year, with no change in the contribution margin ratio or fixed costs? Re

decimal place).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- only need 4-7arrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and packaging Payroll Occupancy (rent, depreciation, etc.) General, selling, and administrative expenses $15,295.0 $(4,896.9) (4,134.2) (3,667.7) (2,384.5) $(15,083.3) $211.7 Operating income Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative exp a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place). $5,776.6 X million b. What is McDonald's contribution margin ratio? Round to one decimal place. 37.77 X % I. How much would operating income increase if same-store sales increased by $800 million for the coming year, with no ch= margin ratio or fixed costs? Round your answer to the nearest tenth of a million (one decimal place). 277.6 million Feedbackarrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's Company-owned restaurants had the following sales and expenses (in millions): Sales $41,400 Food and packaging $15,766 Payroll 10,400 Occupancy (rent, depreciation, etc.) 7,994 General, selling, and administrative expenses 6,000 $40,160 Income from operations $1,240 Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.)$ million b. What is McDonald's contribution margin ratio? % c. How much would income from operations increase if same-store sales increased by $2,500 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million.$ millionarrow_forward

- 7arrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's Company-owned restaurants had the following sales and expenses (in millions): Sales $40,800 Food and packaging $11,004 Payroll 10,300 Occupancy (rent, depreciation, etc.) 12,376 General, selling, and administrative expenses 5,900 $39,580 Income from operations $1,220 Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.)$________ million b. What is McDonald's contribution margin ratio?________% c. How much would income from operations increase if same-store sales increased by $2,400 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million.$_________ millionarrow_forwardBhaduarrow_forward

- Contribution Margin and Contribution Margin Ratio For a recent year, McDugal's company-owned restaurants had the following sales and expenses (in millions): Sales Food and packaging Payroll Occupancy (rent, depreciation, etc.) General, selling, and admin. expenses Other expense Total expenses Operating income (loss) $4,310 3,800 4,190 2,200 290 % $14,500 (14,790) $(290) Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, a. What is McDonald's contribution margin? Enter your answer in million, rounded to one decimal place. million b. What is McDonald's contribution margin ratio? Round your percentage answer to one decimal place. and nistrative expenses. c. How much would operating income increase if same-store sales increased by $900 million for the coming year, with no change in the contribution margin ratio or fixed costs?arrow_forwardFourth Street Lighting shows a net income of $224 000 for the previous year. If the contribution rate for the store was 40.3%, and the fixed cost was $315 000, what were last year’s sales?arrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and packaging Payroll Occupancy (rent, depreciation, etc.) General, selling, and administrative expenses $18,700 $(7,497) (4,700) (3,243) (2,700) $(18,140) Operating income Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million b. What is McDonald's contribution margin ratio? % $560 c. How much would operating income increase if same-store sales increased by $1,100 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million. millionarrow_forward

- Rogers Company reported net income of $43,319 for the year. During the year, accounts receivable increased by $7,282, accounts payable decreased by $3,300, and depreciation expense of $7,495 was recorded. Net cash provided by operating activities under the indirect method for the year is?arrow_forwardLaredo, Inc. has a contribution margin ratio of 55%. This month, sales revenue was $186,000, and profit was $28,000. If sales revenue increases by $45,000, by how much will profit increase? Multiple Choice $1,540 $5,500 $21,950 $24,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education