Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

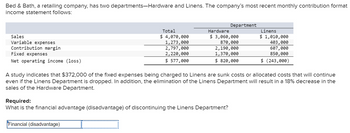

Transcribed Image Text:Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format

income statement follows:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income (loss)

Total

$ 4,070,000

1,273,000

2,797,000

2,220,000

$ 577,000

Financial (disadvantage) I

Department

Hardware

$ 3,060,000

870,000

2,190,000

1,370,000

$ 820,000

Required:

What is the financial advantage (disadvantage) of discontinuing the Linens Department?

A study indicates that $372,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue

even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 18% decrease in the

sales of the Hardware Department.

Linens

$ 1,010,000

403,000

607,000

850,000

$ (243,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,360,000 1,375,000 2,985,000 2,220,000 $ 765,000 Department Hardware $ 3,160,000 962,000 2,198,000 1,320,000 $ 878,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Linens $ 1,200,000 413,000 787,000 900,000 $ (113,000) A study indicates that $371,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 13% decrease in the sales of the Hardware Department.arrow_forwardCrane Trivia Co. manufactures and sells two trivia products, the Square Trivia Game and the Round Trivia Game. Last quarter's operating profits, by product, and for the company as a whole, were as follows: Square Round Total Sales revenue $11,000 $6,860 $17,860 Variable expenses 5,000 2,910 7,910 Contribution margin 6,000 3,950 9,950 Fixed expenses 2,750 4,200 6,950 Operating income $ 3,250 $(250) $ 3,000 Forty percent of the Round Game's fixed costs could have been avoided if the game had not been produced or sold. If the Round Game had been discontinued before the last quarter, what would operating income have been for the company as a whole? Operating income without round $arrow_forwardMaryland Novelties Company produces and sells souvenir products. Monthly income statements for two activity levels are provided below: Unit volumes Revenue Less cost of goods sold Gross margin Less operating expenses Salaries and commissions Advertising expenses Administrative expenses Total operating expenses Net income Required 22,000 units $ 165,000 66,000 $ 99,000 22,000 33,000 13,750 68,750 $ 30,250 Required A Required B Required C 33,000 units $ 247,500 99,000 $ 148,500 a. Identify each of the following expenses as fixed, variable, or mixed. b. Use the high-low method to separate the mixed costs into variable and fixed components. c. Prepare a contribution margin income statement at the 22,000-unit level. 27,500 33,000 13,750 74,250 $ 74,250 Complete this question by entering your answers in the tabs below.arrow_forward

- A company, has two departments—Hardware and Linens. The company’s most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $ 4,070,000 $ 3,000,000 $ 1,070,000 Variable expenses 1,350,000 950,000 400,000 Contribution margin 2,720,000 2,050,000 670,000 Fixed expenses 2,320,000 1,470,000 850,000 Net operating income (loss) $ 400,000 $ 580,000 $ (180,000) A study indicates $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 20% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department?arrow_forwardBuckley Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. BUCKLEY COMPANY Income Statements for Year 2 Segment A B C Sales $ 330,000 $ 480,000 $ 500,000 Cost of goods sold (242,000 ) (184,000 ) (190,000 ) Sales commissions (30,000 ) (44,000 ) (44,000 ) Contribution margin 58,000 252,000 266,000 General fixed operating expenses (allocation of president’s salary) (92,000 ) (92,000 ) (92,000 ) Advertising expense (specific to individual divisions) (6,000 ) (20,000 ) 0 Net income (loss) $ (40,000 ) $ 140,000 $ 174,000 Required Prepare a schedule of relevant sales and costs for Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Options for required A table are: Advertising…arrow_forwardThe income statement for the RUN-84979 company, an atletic shoe retailer, for the first quarter of the year is presented below: RUN-84979 Income Statement Sales $151,200 54,600 96,600 Cost of goods sold Gross margin Selling and administrative expenses Selling Administration $45,400 29,096 74,496 Net operating income $ 22,104 On average, an athletic shoe sells for $72. Variable selling expenses are $14 per athletic shoe, and the remaining selling expenses are fixed. The variable administrative expenses are 8% of sales with the remainder being fixed. How much is the total contribution margin for RUN-84979 for the first quarter?arrow_forward

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $4,200,000 $3,090,000 $1,110,000 Variable expenses 1,240,000 840,000 400,000 Contribution margin 2,960,000 2,250,000 710,000 Fixed expenses 2,300,000 1,470, 000 830,000 Net operating income (loss) $ 660,000 $ 780,000 $ (120,000) A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage ( disadvantage) of discontinuing the Linens Department?arrow_forwardSubmit A retailer has two departments-Home and Garden. The company's most recent contribution format income statement follows: Total Home Garden Sales $৪00, 000 $350,000 $450,000 Variable expenses 320,000 120,000 200,000 Contribution margin Fixed expenses 480,000 230,000 250,000 400,000 140,000 260,000 35:51 Net operating income (1loss) $ 80,000 $ 90,000 $(10,000) The retailer is considering whether It should close the Garden Department. Further analysis revealed that, of the fixed expenses being charged to the Garden Department, $140,000 are sunk costs or allocated costs that will continue If Garden is discontinued. In addition, If the Garden Department is discontinued, sales in the Home Department will drop by 5%. How much does the company's profit increase or decrease if the Garden Department is discontinued? (If a decrease, the dollar amount is indicated in parentheses, ie., $ (1,000).) Multiple Cholce $ (124,000) O Quiz $ (161,500) 1009arrow_forwardTike Industries is an apparel company that makes and sells both casual wear and sportswear. Here are data for the current year: Sales revenue Variable costs Contribution margin Traceable fixed costs Segment margin Common fixed costs Operating income Total $ 1,000,000 745,000 $255.000 (80,000) $175,000 (90,000) $85,000 Casual wear $ 450,000 388,000 $62,000 (25,000) $37,000 (42,000) S(5,000) Sportswear 5 pts $ 550,000 357,000 $193,000 (55,000) $138,000 (48,000) $90,000 Tike's accountant allocated the common fixed costs between the product lines based on sales revenue. Tike plans to discontinue the production of casual wear and use the freed-up capacity to triple the production and sale of sportswear. Although this will eliminate the traceable fixed costs for casual wear, the traceable fixed costs for sportswear will double. If Tike discontinues the casual wear product line, what would be the amount of the increase in Tike's operating income? Round to the nearest whole dollar and do not…arrow_forward

- Sandhill Electrical Products serves both residential and commercial clients. Annual financial information for Sandhill is as follows: Commercial Residential Total Sales Revenues $808,000 $508,000 $1,316,000 Variable Costs 202,000 127,000 329,000 Contribution Margin $606,000 $381,000 987,000 Fixed Costs 292,500 Operating Profit $694,500 Calculate the break-even point in sales revenue dollars for Sandhill Electrical Products. Break-even point in sales revenue $arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,130,000 1,223,000 2,907,000 2,160,000 $ 747,000 Department Hardware $ 3,060,000 814,000 2,246,000 1,310,000 $936,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage) Linens $ 1,070,000 409,000 661,000 850,000 $ (189,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 18% decrease in the sales of the Hardware Department.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education