FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

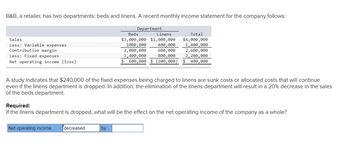

Transcribed Image Text:B&B, a retailer, has two departments: beds and linens. A recent monthly income statement for the company follows:

Sales

Less: Variable expenses

Contribution margin

Less: Fixed expenses

Net operating income (loss)

Department

Net operating income decreased

Beds

Linens

$3,000,000 $1,000,000

1000,000

by

400,000

600,000

800,000

$ 600,000 $ (200,000)

2,000,000

1,400,000

Total

$4,000,000

1,400,000

A study indicates that $240,000 of the fixed expenses being charged to linens are sunk costs or allocated costs that will continue

even if the linens department is dropped. In addition, the elimination of the linens department will result in a 20% decrease in the sales

of the beds department.

2,600,000

2,200,000

400,000

Required:

If the linens department is dropped, what will be the effect on the net operating income of the company as a whole?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses as shown by its most recent monthly contribution format income statement: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) $ 1,591, 000 706, 760 884, 240 973,000 $ (88,760) In an effort to resolve the problem, the company wants to prepare an income statement segmented by division. Accordingly, the Accounting Department provided the following information: Sales Variable expenses as a percentage of sales Traceable fixed expenses East $ 351,000 $262,000 56% Division Central $ 660,000 36% $ 335,000 West $ 580,000 47% $206,000 Required: 1. Prepare a contribution format income statement segmented by divisions. 2-a. The Marketing Department believes increasing the West Division's monthly advertising by $25,000 will increase that division's sales by 18%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease)…arrow_forwardFollowing is the revenue and cost data for Metlock Ltd. in the manufacturing of luxury shower curtains for the year ended December 31, 2022: NewsVariable manufacturing costs $34 per curtainVariable selling and administrative expenses $8 per curtain Fixed manufacturing overhead $53,900Fixed selling and administrative expenses $184,800 Units produced and sold 7, 700Selling price $84 per curtain. Prepare an income statement using absorption costing. Prepare an income statement using variable costing.arrow_forwardThe accounting firm of JN Corporation has been studying the sales requirements of the Shayan Bottling Company. In the course of the study, the managing partner submits the following estimated data: Sales Rs. 900,000 Fixed marketing expenses Rs. 71,000 Direct materials 206,200 Variable marketing expenses 80,000 Direct Labor 165,200 Fixed administrative expenses 9,500 FOH 171,896 Variable administrative expenses 4,000 Variable FOH 102,600 Calculate Break-Even Point in amount for JN Corporation.arrow_forward

- Bolka Corporation, a merchandising company, reported the following results for October: Sales $ 418,000 Cost of goods sold (all variable) $ 175,500 Total variable selling expense $ 23,700 Total fixed selling expense $ 21,800 Total variable administrative expense $ 16,200 Total fixed administrative expense $ 34,300 The contribution margin for October is: Multiple Choice $146,500 $361,900 $202,600 $242,500arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $4,200,000 $3,090,000 $1,110,000 Variable expenses 1,240,000 840,000 400,000 Contribution margin 2,960,000 2,250,000 710,000 Fixed expenses 2,300,000 1,470, 000 830,000 Net operating income (loss) $ 660,000 $ 780,000 $ (120,000) A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage ( disadvantage) of discontinuing the Linens Department?arrow_forwardIn the last reporting period, Harold's Hat Company recorded 100,000 units sold for the first time in the history of the company. The price per unit was $89.99 and variable costs per unit was $36.39. Compute the fixed costs if the operating income is $4,020,000. Do not use units in your final answer (i.e. $ or commas). Answer:arrow_forward

- Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format Income statement: sales variable expenses Contribution margin Fixed expenses $ 1,610,000 551,400 Net operating income (loss) 1,058,600 1,164,000 $ (105,400) In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the Accounting Department has developed the following Information: Sales East $410,000 Division Central $ 670,000 West $530,000 Variable expenses as a percentage of sales Traceable fixed expenses 52% 22% 36% $ 278,000 $ 326,000 $ 200,000 Required: 1. Prepare a contribution format Income statement segmented by divisions. 2-8. The Marketing Department has proposed increasing the West Division's monthly advertising by $27,000 based on the belief that it would increase that division's sales by 13%. Assuming these estimates are accurate, how much…arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Fixed expenses Contribution margin Net operating income (loss) 1,307,000 Department Total $ 4,210,000 Hardware $ 3,040,000 Linens $ 1,170,000 403,000 767,000 840,000 $ (73,000) 2,903,000 2,290,000 $ 613,000 904,000 2,136,000 1,450,000 $ 686,000 A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 15% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardThe following income statements illustrate different cost structures for two competing companies: Number of customers (a) Sales revenue (a x $230) Variable cost (a x $185) Contribution margin Fixed cost Net income Required Income Statements Required A Required B a. Reconstruct Gibson's income statement, assuming that it serves 178 customers when it lures 89 customers away from Franklin by lowering the sales price to $130 per customer. b. Reconstruct Franklin's income statement, assuming that it serves 178 customers when it lures 89 customers away from Gibson by lowering the sales price to $130 per customer. Complete this question by entering your answers in the tabs below. GIBSON COMPANY Income Statement Sales revenue Variable cost Contribution margin Fixed cost Net income (loss) Reconstruct Gibson's income statement, assuming that it serves 178 customers when it lures 89 customers away from Franklin by lowering the sales price to $130 per customer. $ Company Name Franklin 89 $ Gibson…arrow_forward

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,310,000 1,313,000 2,997,000 2,200,000 $ 797,000 Department Hardware $ 3,130,000 901,000 2,229,000 1,360,000 $ 869,000 Linens $ 1,180,000 412,000 768,000 840,000 $ (72,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,130,000 1,223,000 2,907,000 2,160,000 $ 747,000 Department Hardware $ 3,060,000 814,000 2,246,000 1,310,000 $936,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage) Linens $ 1,070,000 409,000 661,000 850,000 $ (189,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 18% decrease in the sales of the Hardware Department.arrow_forwardsolve this Question as per fast to posiblearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education