EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

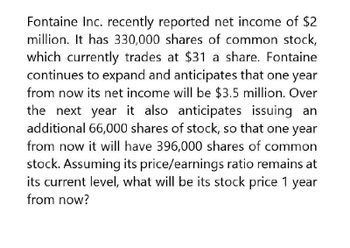

Transcribed Image Text:Fontaine Inc. recently reported net income of $2

million. It has 330,000 shares of common stock,

which currently trades at $31 a share. Fontaine

continues to expand and anticipates that one year

from now its net income will be $3.5 million. Over

the next year it also anticipates issuing an

additional 66,000 shares of stock, so that one year

from now it will have 396,000 shares of common

stock. Assuming its price/earnings ratio remains at

its current level, what will be its stock price 1 year

from now?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ferrell Inc. recently reported net income of $8 million. It has540,000 shares of common stock, which currently trades at $21 a share. Ferrell continuesto expand and anticipates that 1 year from now its net income will be $13.2million. Over the next year, it also anticipates issuing an additional 81,000 shares ofstock so that 1 year from now it will have 621,000 shares of common stock. AssumingFerrell’s price/earnings ratio remains at its current level, what will be its stock price1 year from now?arrow_forwardFerrell Inc. recently reported net income of $9 million. It has 470,000 shares of common stock, which currently trades at $47 a share. Ferrell continues to expand and anticipates that 1 year from now, its net income will be $12.15 million. Over the next year, it also anticipates issuing an additional 47,000 shares of stock so that 1 year from now it will have 517,000 shares of common stock. Assuming Ferrell's price/earnings ratio remains at its current level, what will be its stock price 1 year from now? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardI have just purchased 200 shares of LTC Limited preferred shares. It is currently selling for $40 per share. The annual dividend is $3.40 per share. At the same period, National System has just paid dividend of $1.00. It is estimated that the company's growth rate to be 5 percent p.a. for the next 2 years. After that, dividends are expected to grow at a rate of 10 percent p.a. indefinitely. a) What is the expected return on LTC shares? b) If my required rate of return is 8%, will you advise me to buy more shares of LTC shares or sell what I have under the market pricing? c) If I require a 12% rate of return on equity, what is my expected current price of the National System's share? d) Based on parts (b) and (c) above, explain why an investor would expect the different rate of return on the shares under consideration?arrow_forward

- Please can I get detailed step by step workings for this question?arrow_forwardLittle Oil has 1 million outstanding shares with a total market value of $20 million. The firm is expected to pay $1 million of dividends next year, and thereafter the amount paid out is expected to grow by 5 percent a year in perpetuity. Thus the expected dividend in year 2 is $1.05 million, and so on. However, the company has heard that the value of a share depends on the flow of dividends, and therefore it announces that next year’s dividend will be increased to $2 million and that the extra cash will be raised immediately by a simultaneous issue of new shares. After that, the total amount paid out each year will be as previously forecasted, i.e., $1.05 million in year 2 and increasing by 5 percent a year in each subsequent year. Capital markets are perfect. The discount rate for equity for this company is 10%. a) At what price will the new shares be issued in year 1? b) How many shares will the firm need to issue? c) What will be the expected payments on these new shares,…arrow_forwardAtlantic Northern Inc. just reported a net income of $10,000,000, and its current stock price is $31.25 per share. Atlantic Northern is forecasting an increase of 25% for its net income next year, but it also expects it will have to issue 1,800,000 new shares of stock (raising its shares outstanding from 5,500,000 shares to 7,300,000 shares). 1. If Atlantic Northern’s forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does management expect its stock price to be one year from now? $29.36 per share $31.25 per share $22.02 per share $36.70 per share 2. One year later, Atlantic Northern Inc.’s stock is trading at $38.00, and the company reports its common equity value as $42,865,600. What is Atlantic Northern Inc.’s market-to-book (M/B) ratio? 3. Is it possible for a company to have a negative EPS and thus a negative P/E ratio?arrow_forward

- P/E AND STOCK PRICE Ferrell Inc. recently reported net income of $10 million. It has 420,000 shares of common stock, which currently trades at $51 a share. Ferrell continues to expand and anticipates that 1 year from now, its net income will be $14.5 million. Over the next year, it also anticipates issuing an additional 63,000 shares of stock so that 1 year from now it will have 483,000 shares of common stock. Assuming Ferrell's price/earnings ratio remains at its current level, what will be its stock price 1 year from now? Do not round intermediate calculations. Round your answer to the nearest centarrow_forwardAtlantic Northern Inc. just reported a net income of $5,000,000, and its current stock price is $25.75 per share. Atlantic Northern is forecasting an increase of 25% for its net income next year, but it also expects it will have to issue 1,500,000 new shares of stock (raising its shares outstanding from 5,500,000 shares to 7,000,000 shares). If Atlantic Northern's forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does management expect its stock price to be one year from now? $25.18 per share O $25.75 per share O$18.88 per share $31.48 per share One year later, Atlantic Northern Inc.'s stock is trading at $43.50, and the company reports its common equity value as $35,252,000. What is Atlantic Northern Inc.'s market-to-book (M/B) ratio? 8.63x Is it possible for a company to have a negative EPS and thus a negative P/E ratio? Yes varrow_forwardTaggart Goods Corp. just reported a net income of $11,000,000, and its current stock price is $23.00 per share. Taggart is forecasting an increase of 25% for its net income next year, but it also expects it will have to issue 2,300,000 new shares of stock (raising its shares outstanding from 5,500,000 shares to 7,800,000 shares). If Taggart’s forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does management expect its stock price to be one year from now? $20.24 per share $23.00 per share $15.18 per share $25.30 per share One year later, Taggart Goods Corp.’s stock is trading at $38.00, and the company reports its common equity value as $31,574,400. What is Taggart Goods Corp.’s market-to-book (M/B) ratio? Is it possible for a company to have a negative EPS and thus a negative P/E ratio?.arrow_forward

- Tommy’s Automotive Group currently has 6,400,000 shares of stock outstanding and will report earnings of $10 million in the current year. The company is considering the issuance of 1,700,000 additional shares that will net $30 per share to the corporation. A. What is the immediate dilution potential for this new stock issue? B. Assume that Tommy’s Automotive Group can earn 9 percent on the proceeds of the stock issue in time to include them in the current year’s results. Calculate earnings per share. Should the new issue be undertaken based on earnings per share?arrow_forwardL. Sanders Manufacturing paid a dividend last year of $5 per share. The dividend is expected to grow at a constant rate of 8% per year. The price of L. Sanders Manufacturing's stock today is $29 per share. If L. Sandaers Manufacturing decides to issue new common stock, flotation costs will equal $2.50 per share. Based on the above information, the cost of new common stock is OA. 28.38%. OB. 31.40%. OC. 26.62%. OD. 24.12%. OE. None of the above.arrow_forwardb. How many shares will the firm need to issue? (Do not round intermediate calculations. Round your answer to the nearest whole number.) c. What will be the expected dividend payments on these new shares, and what, therefore, will be paid out to the old shareholders after year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. Recalculate the present value of the Price per share to current shareholders. (Do not round intermediate calculations. Round your answer to the nearest whole dollar.) X Answer is not complete. Price per share Number of shares $ 21.00 а. b. Dividend per share $ 1.04 X c. d. Present value %24 %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT