EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting

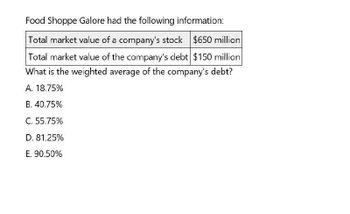

Transcribed Image Text:Food Shoppe Galore had the following information:

Total market value of a company's stock $650 million

Total market value of the company's debt $150 million

What is the weighted average of the company's debt?

A. 18.75%

B. 40.75%

C. 55.75%

D. 81.25%

E. 90.50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Do fast answer of this accounting questionsarrow_forwardAssume you are given the following relationships for the Orange Company: Sales/total assets 1.5X Return on assets (ROA) 3% Return on equity (ROE) 5% The Orange Company’s debt ratio is * a.40% b. 60% c. 35% d. 65%arrow_forward4. What is the debt to total assets ratio of the Company? a. 107% c. 35% b. 30%. d. 14% 5. What is the times interest earned ratio of the company?a. 5% c. 22% b. 2.5%. d. 2%arrow_forward

- Need help this question general accountingarrow_forwardCurrent assets Long-term assets Total Locust Farming Balance Sheet ($ in millions) $ 42,524 46,832 Current liabilities Long-term debt Other liabilities Equity $ 89,356 Total $ 29,755 27,752 14,317 17,532 $ 89,356 Locust has 657 million shares outstanding with a market price of $83 a share. a. Calculate the company's market value added. b. Calculate the market-to-book ratio. c. How much value has the company created for its shareholders as a percent of shareholders' equity, that is, as a percent of the net capital contributed by shareholders?arrow_forwardPlease provide general accounting question answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT