College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

What is Cc?

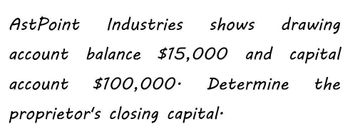

Transcribed Image Text:AstPoint Industries shows drawing

account balance $15,000 and capital

account

$100,000. Determine the

proprietor's closing capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- XYZ Co. has current assets of OR 75000 and total assets of OR 210000. It has current liabilities of OR 45000 and total liabilities of OR 110000. If during the year he had drawings OR 7500, retained earnings OR 34000 & Net Profit for the year OR 12500. What will be the amount of XYZ's Opening Capital?arrow_forwardThe following information is available for a FVTOCI investment: Purchase price $400,000; Unrealized holding gain at the end of year 1 $5,000; Unrealized holding gain at the end of year 2 $6,000. Calculate the balance in the AOCI equity holding (loss) or gain account at the end of year 2 for reporting purposes. O Gain of $6,000 O Gain of $411,000 O Gain of $5,000 O Gain of $11,000arrow_forwarda. Prepare a profit distribution account for the year ended 31 October 2021. b. Prepare the partners' current accounts (in columnar form) for the year to 31 October 2021. c. (Note: All the figures must be rounded up to the nearest RM) note i need the answer in full format thank youarrow_forward

- What is the amount of ending capital shown on the balance sheet for Floress Catering? a. 22,000 b. 20,000 c. 45,500 d. 32,800arrow_forwardPartners Biore and Selisana each have a P450, 000 capital balance andshare profits and losses in a 3:2 ratio, respectively. Cash equals P150, 000,non-cash assets equal P1, 500, 000, and liabilities equal P750, 000.7. If the non-cash assets are sold for P1, 000, 000, the change in Selisana’scapital account will bea. an increase of P500, 000b. a decrease of P250, 000c. a decrease of P200, 000d. an increase of P400, 000 8. If the non-cash assets are sold for P700, 000 and each partner ispersonally insolvent, upon liquidation Selisana will receive a cash distributionofa. P100, 000b. P50, 000c. P130, 000d. P0arrow_forwardThe following historical information is from Assisi Community Markets. Calculate the working capital and current ratio for each year. What observations do you make, and what actions might the owner consider taking?arrow_forward

- Assume Avaya contracted to provide a customer with Internet infrastructure for $2,050,000. The project began in 2024 and was completed in 2025. Data relating to the contract are summarized below: Costs incurred during the year Estimated costs to complete as of 12/31 Billings during the year Cash collections during the year Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required: 1. Compute the amount of revenue and gross profit or loss to be recognized in 2024 and 2025, assuming Avaya recognizes revenue over time according to percentage of completion. 2. Compute the amount of revenue and gross profit or loss to be recognized in 2024 and 2025, assuming this project does not qualify for revenue recognition over time. 3. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2024, assuming Avaya recognizes revenue over time according to percentage of completion. 4. Prepare a…arrow_forwardJohnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $23,000 on the purchase date and the balance in five annual installments of $6,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment?2. Johnstone needs to accumulate sufficient funds to pay a $530,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 5% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021.3. On January 1, 2021,…arrow_forwardJohnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, FVAD of $1 and PVAD of$1) (Use appropriate factor(s) from the tables provided.) 1.On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $20,000 on the purchase date and the balance in five annual installments of $8,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment? 2.Johnstone needs to accumulate sufficient funds to pay a $5000,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 9% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021. 3.On January 1, 2021, Johnstone leased…arrow_forward

- Pacquired a 70% of S on January 1, 2020, for S380,000. During 2020 S had a net income of $30,000 and paid a cash dividend of $10,000. Applying the cost method would give a balance in the Investment account at the end of 2020 of: Select one: $394,000 $400,000 O $380,000 $373,000arrow_forwardJohnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, FVAD of $1 and PVAD of$1) (Use appropriate factor(s) from the tables provided.) 1.On June 30, 2021, the Johnstone Company purchased equipment form Genovese Corp. Johnstone agreed to pay Genovese $20,000 on the purchase date and the balance in five annual installments of $8,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment? 2.Johnstone needs to accumulate sufficient funds to pay a $5000,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 9% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021. 3.On January 1, 2021, Johnstone leased…arrow_forwardJohnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, FVAD of $1 and PVAD of$1) (Use appropriate factor(s) from the tables provided.) 1.On June 30, 2021, the Johnstone Company purchased equipment form Genovese Corp. Johnstone agreed to pay Genovese $20,000 on the purchase date and the balance in five annual installments of $8,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment? 2.Johnstone needs to accumulate sufficient funds to pay a $5000,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 9% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021. 3.On January 1, 2021, Johnstone leased…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning