Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide answer to the required

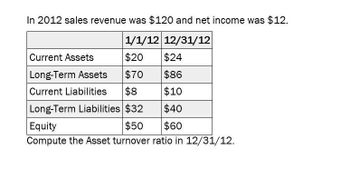

Transcribed Image Text:In 2012 sales revenue was $120 and net income was $12.

1/1/12 12/31/12

Current Assets

$20

$24

Long-Term Assets

$70

$86

Current Liabilities

$8

$10

Long-Term Liabilities $32

$40

Equity

$50

$60

Compute the Asset turnover ratio in 12/31/12.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Right Company reported beginning and ending total assets of $36,000 and $30,000, respectively. Its net sales revenue for the year were $26,070. What was Right's asset turnover ratio? A. 0.87 OB. 1.27 OC. 0.79 OD. 0.72arrow_forwardYour company has net sales revenue of $43 million during the year. At the beginning of the year, fixed assets are $15 million. At the end of the year, fixed assets are $17 million. What the fixed asset turnover ratio? Multiple Choice 2.87 1.34 2.53 269arrow_forwardNet Sales = $88,122 Total Assets = $189,100 Calculate Asset Turnover ( Round to nearest hundredth of a cent)arrow_forward

- Independence Company reported beginning and ending total assets of $38,000 and $42,000, respectively. Its net sales revenue for the year were $34,000. What was Independence's asset turnover ratio? OA. 0.80 ОВ. 0.85 OC. 1.18 OD. 0.81 pe here to search Pi 50 G This question:arrow_forwardWhat is the asset turnover ratio on these general accounting question?arrow_forwardSE9-10 Return on Assets and Asset Turnover Last Year, the Miller Company reported on assets of 15 percent and an asset turnover of 1.6. In the current year, the company reported a return on assets of 19 percent but an asset turnover of only 1.2. If sales revenue remained unchanged from last year to the current year, what would explain the ratio results?arrow_forward

- Company A has sales of $830, costs of $290 (not including depreciation), depreciation expense of $40, interest expense of $40, and a tax rate of 21 percent, current assets of $260, net fixed assets of $1850, current liabilities of $240, and long-term debt of $700. What is the total asset turnover? (keep two decimal places) Your Answer: 0.39arrow_forwardA company reports the following: Sales $8,296,860 Average total assets (excluding long-term investments) 1,063,700 Determine the asset turnover ratio. Round your answer to one decimal place.fill in the blank 1arrow_forwardGiven the following data:arrow_forward

- Please provide answer the general accounting questionarrow_forwardWhere would you find the financial statements for Costco? https://motley.com https://wallstreet.com https://investor.costco.com https://sec.gov Endotherm Company produced revenue of $120,000. Beginning Assets for the period were $200,000 and Ending Assets were $250,000. What is the Total Asset Turnover Ratio for this period? .53 1.87 .48 .26 What is the Total Asset Turnover Ratio for a company with $120,000 in annual sales, beginning Assets of $250,000 and ending Assets of $200,000? .48 1.34 .26 .53 The efficiency ratio that shows how efficiently a company uses its cash to generate revenue is: Accounts Receivable Turnover Ratio. Total Asset Receivable Turnover Ratio. Cash Turnover Ratio. Inventory Turnover Ratio. please answer all questions. explainte answwer provide me with correct optionarrow_forwardH6. BDU Company has net income of $500,000 and average assets of $2,000,000 for the current year. If its asset turnover is 1.25 times, what is its profit margin? Show proper step by step calculationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT